In the world of Forex trading, mastering price action is one of the most effective ways to achieve consistent results. Among all candlestick patterns used by professional traders, the Pin Bar candlestick stands out as one of the most powerful and reliable signals. It is simple, highly accurate, and widely used by both beginners and experienced traders.

If you are looking for a clear and practical way to understand the Pin Bar pattern, this guide will help you learn everything you need to know. By the end of this article, you will understand what a Pin Bar candlestick is, how it works, and how to trade Forex successfully using this powerful price action signal.

What is a Pin Bar Candlestick in Forex?

When you enter the Forex market, the first chart you encounter is usually the Japanese candlestick chart. These candlesticks reflect market psychology and price movement in real time. Each candlestick tells a story about the battle between buyers and sellers.

Among all candlestick patterns, the Pin Bar candlestick is one of the most distinctive and meaningful. It is called a “Pin Bar” because it resembles a pin shape, featuring a long wick and a small body.

A Pin Bar represents strong price rejection in the market. It signals that the price tried to move in one direction but was quickly rejected and pushed back by strong buying or selling pressure. This rejection often leads to a reversal or continuation in the opposite direction.

The Pin Bar is widely respected in price action trading because it provides clear and reliable information about market sentiment and potential future price movement.

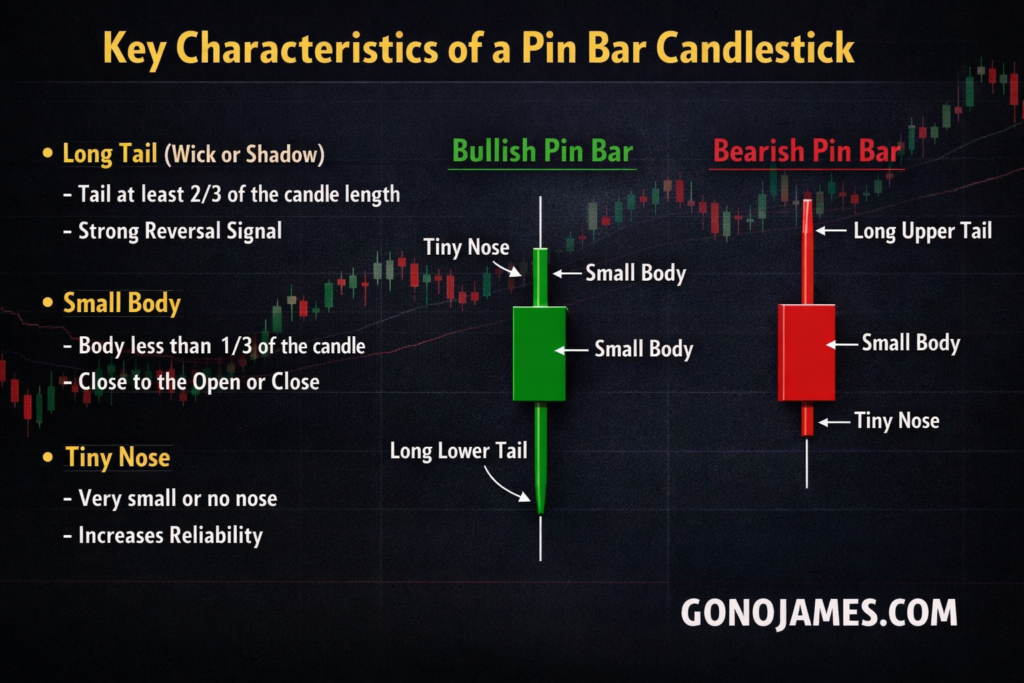

Key Characteristics of a Pin Bar Candlestick

To correctly identify a Pin Bar candlestick on a Forex chart, it must meet specific characteristics. Understanding these features will help you avoid false signals and improve your trading accuracy.

1. Long Tail (Wick or Shadow)

The most important feature of a Pin Bar is its long tail. This tail shows strong rejection of price from a certain level.

The tail should be at least two-thirds of the entire candlestick length. The longer the tail, the stronger the rejection and the more reliable the signal. A long tail indicates that the market attempted to move in one direction but failed and reversed sharply.

For example:

- A long lower tail indicates rejection of lower prices and potential upward movement.

- A long upper tail indicates rejection of higher prices and potential downward movement.

2. Small Body

The body of a Pin Bar represents the difference between the opening and closing prices. In a true Pin Bar, the body must be small and should not exceed one-third of the total candle length.

The opening and closing prices are usually very close to each other, and sometimes they can even be equal. A small body shows that price movement during the candle period was dominated by rejection rather than continuation.

3. The Nose (Opposite of the Tail)

The nose is the small wick on the opposite side of the tail. A Pin Bar may or may not have a nose, but if it exists, it should be very small.

A smaller nose increases the reliability of the Pin Bar because it shows stronger rejection in one direction. The ideal Pin Bar has a long tail, small body, and very small or no nose.

Overall, a Pin Bar clearly indicates price rejection and suggests a high probability of a reversal or continuation in the direction of the candle body.

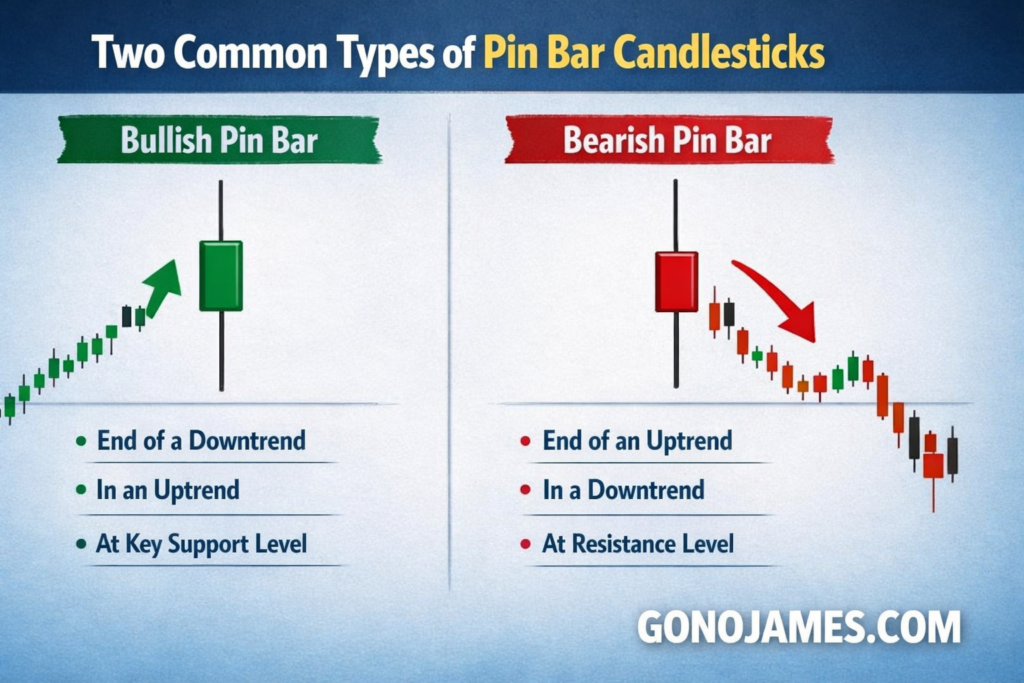

Two Common Types of Pin Bar Candlesticks

There are two main types of Pin Bar patterns that traders should watch carefully: Bullish Pin Bar and Bearish Pin Bar. Each provides valuable insight into potential market direction.

Bullish Pin Bar

A Bullish Pin Bar has a long lower tail and a small body located near the top of the candle. This pattern shows that sellers pushed the price down strongly, but buyers stepped in and pushed it back up before the candle closed.

This strong rejection of lower prices signals that buyers are gaining control of the market.

Bullish Pin Bars typically appear:

- At the end of a downtrend, signaling a potential reversal upward

- During an uptrend, indicating continuation of the bullish trend

When a Bullish Pin Bar forms at a key support level, it becomes an even stronger signal that the price may rise significantly.

Bearish Pin Bar

A Bearish Pin Bar has a long upper tail and a small body near the bottom of the candle. This pattern shows that buyers tried to push the price higher, but sellers rejected those higher prices and forced the market down.

This rejection of higher prices indicates strong selling pressure.

Bearish Pin Bars usually appear:

- At the end of an uptrend, signaling a potential downward reversal

- During a downtrend, confirming continuation of the bearish trend

When this pattern appears near a resistance level, it often signals a strong opportunity for a sell trade.

How to Trade Forex Using the Pin Bar Strategy

The Pin Bar itself is a powerful price action signal. When used correctly, it can provide highly accurate entry points in Forex trading. Below are simple and effective strategies to help you trade using Pin Bar candlesticks.

Trading with a Bullish Pin Bar

When a Bullish Pin Bar appears, traders should focus on buying opportunities.

Entry Point:

Enter a BUY trade immediately after the Bullish Pin Bar candle closes. This confirms the pattern and the price rejection.

Stop-Loss:

Place the stop-loss below the tail of the Bullish Pin Bar. This level represents the strongest rejection zone, and if the price breaks it, the signal becomes invalid.

Take-Profit:

Set your take-profit at the nearest resistance level or previous price high. These levels often act as barriers where price may reverse or slow down.

Trading with a Bearish Pin Bar

When a Bearish Pin Bar forms, traders should focus on selling opportunities.

Entry Point:

Enter a SELL trade immediately after the Bearish Pin Bar closes.

Stop-Loss:

Place the stop-loss above the tail of the Bearish Pin Bar. If the price moves beyond this level, the rejection signal is no longer valid.

Take-Profit:

Set the take-profit at the nearest support level or previous price low. These levels often serve as natural targets for price movement.

Important Tips for Trading Pin Bar Successfully

To increase your accuracy and profitability when trading with Pin Bars, keep the following tips in mind:

Use Higher Time Frames

Pin Bars on higher time frames such as H1, H4, and Daily charts are more reliable than those on lower time frames. The longer the timeframe, the stronger the signal.

Look for Strong Support and Resistance

Pin Bars that form at key support or resistance levels are much more powerful. These levels act as decision points where major reversals often occur.

Follow the Trend

Trading in the direction of the overall trend increases the probability of success. For example, Bullish Pin Bars are more reliable in an uptrend, while Bearish Pin Bars work best in a downtrend.

Combine with Indicators

Although the Pin Bar is powerful on its own, combining it with indicators like RSI, moving averages, or trendlines can help filter false signals and improve accuracy.

Practice on a Demo Account

Before trading with real money, practice identifying and trading Pin Bars on a demo account. This helps build confidence and improves your understanding of market behavior.

Conclusion

The Pin Bar candlestick is one of the most powerful and reliable patterns in Forex trading. Its ability to show clear price rejection makes it an essential tool for any trader who wants to master price action.

By understanding its structure, recognizing its signals, and applying proper risk management, you can use the Pin Bar to identify high-probability trading opportunities. Whether you are a beginner or an experienced trader, mastering the Pin Bar strategy can significantly improve your trading performance.

Start practicing with this classic candlestick pattern today, and you will soon discover why it remains a favorite among professional Forex traders worldwide.