In the world of Forex trading, price action remains one of the most powerful and reliable ways to analyze the market. Among all technical tools, candlestick patterns play a vital role in helping traders understand market psychology and predict future price movement. One of the most effective bullish reversal patterns every trader should master is the Morning Star candlestick pattern.

The Morning Star pattern is widely used by professional traders to identify potential trend reversals and find high-probability entry points. When used correctly, it can significantly improve your trading accuracy and help you capture profitable opportunities in the Forex market.

In this comprehensive guide, you will learn everything about the Morning Star candlestick pattern — its meaning, structure, psychology, variations, and proven strategies to trade it successfully.

What Is a Morning Star Candlestick Pattern?

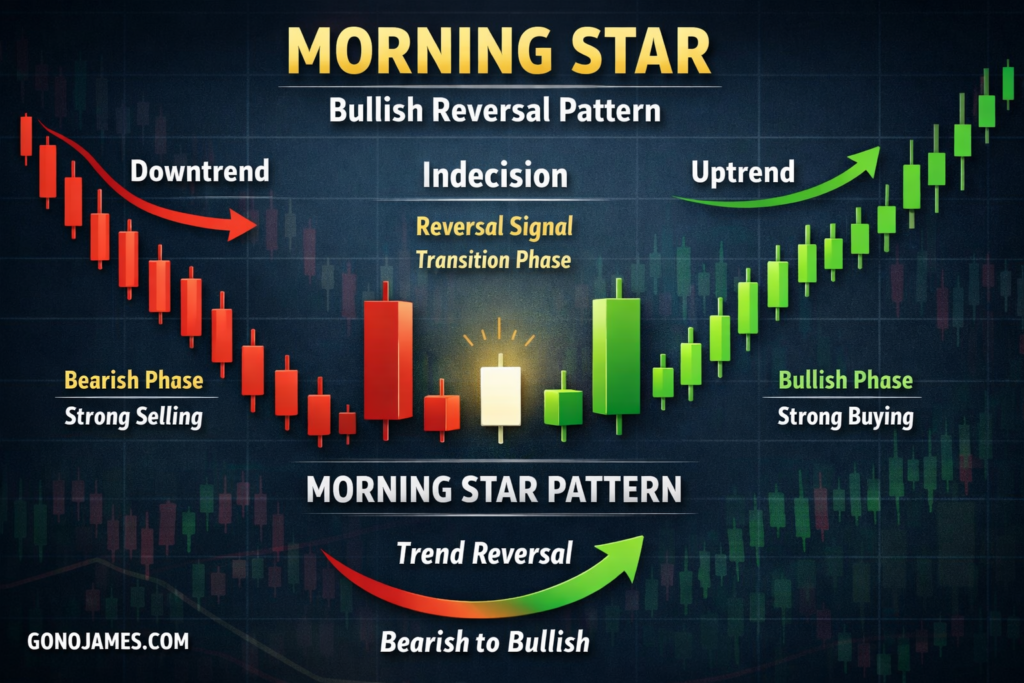

The Morning Star is a bullish reversal candlestick pattern that usually appears at the end of a downtrend. It signals that selling pressure is weakening and buyers are beginning to take control of the market.

This pattern marks the transition from a bearish market to a bullish market. When it forms, traders interpret it as a sign that price may soon reverse upward and start a new uptrend.

The Morning Star is one of the most reliable candlestick patterns because it reflects a clear shift in market sentiment. Sellers dominate the first phase, indecision appears in the second phase, and buyers take over in the final phase.

For Forex traders, mastering the Morning Star pattern can provide high-probability trading opportunities with excellent risk-to-reward ratios.

Structure and Characteristics of the Morning Star Pattern

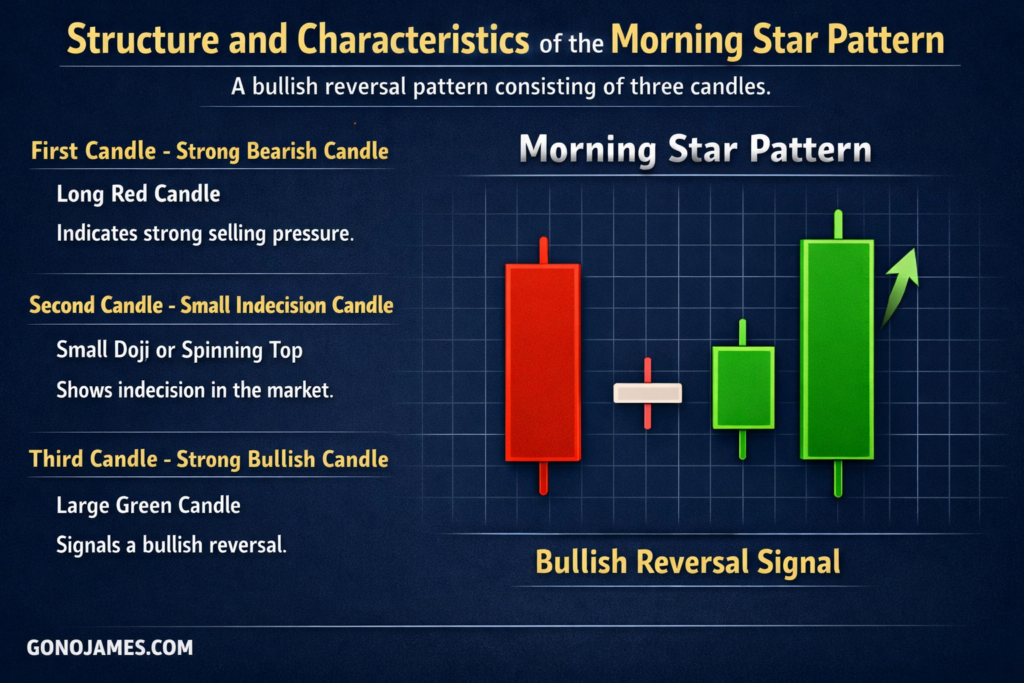

A standard Morning Star candlestick pattern consists of three candles that form a specific structure.

First Candle – Strong Bearish Candle

The first candle is a long bearish candle (red).

It represents strong selling pressure and confirms that the market is currently in a downtrend.

This candle shows that sellers are still in control and pushing the price lower.

Second Candle – Small Indecision Candle

The second candle is usually small and can be a spinning top, doji, or small-bodied candle.

It represents market indecision and a slowdown in selling pressure.

This candle shows that the market is losing momentum and neither buyers nor sellers have full control.

Third Candle – Strong Bullish Candle

The third candle is a strong bullish candle (green).

It must close at least halfway into the body of the first bearish candle.

This candle confirms that buyers have taken control and the market may reverse upward.

When these three candles form together, they create the Morning Star pattern — a strong bullish reversal signal.

Market Psychology Behind the Morning Star

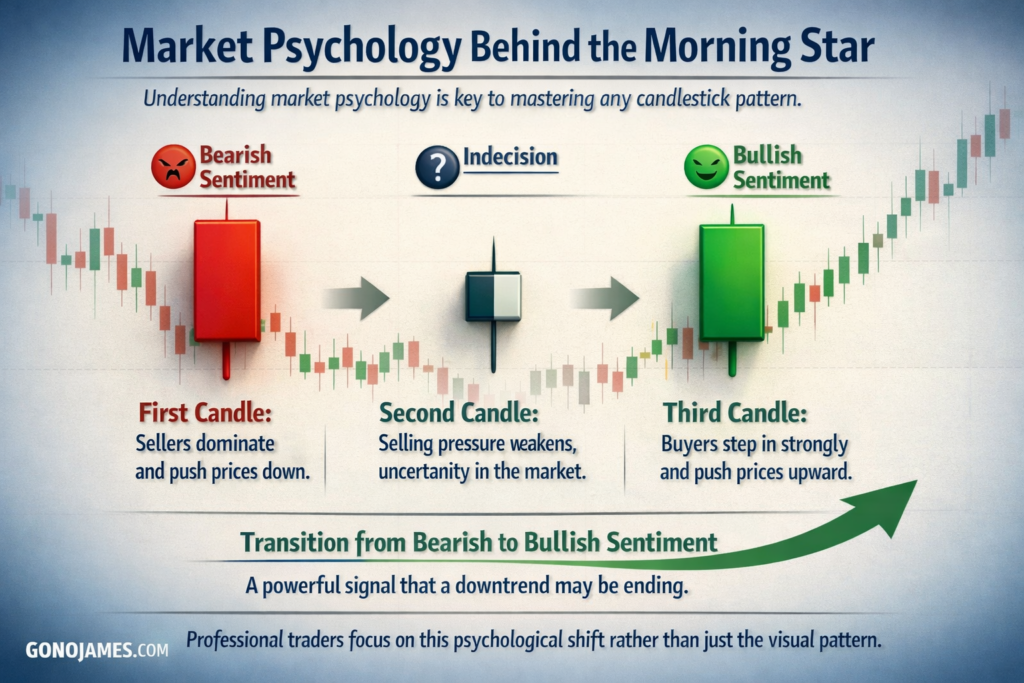

Understanding market psychology is key to mastering any candlestick pattern.

The Morning Star pattern reflects a shift in market sentiment:

- First Candle: Sellers dominate and push prices down.

- Second Candle: Selling pressure weakens and the market becomes uncertain.

- Third Candle: Buyers step in strongly and push prices upward.

This transition from bearish to bullish sentiment makes the Morning Star a powerful signal that a downtrend may be ending.

Professional traders focus on this psychological shift rather than just the visual pattern.

Where the Morning Star Pattern Appears

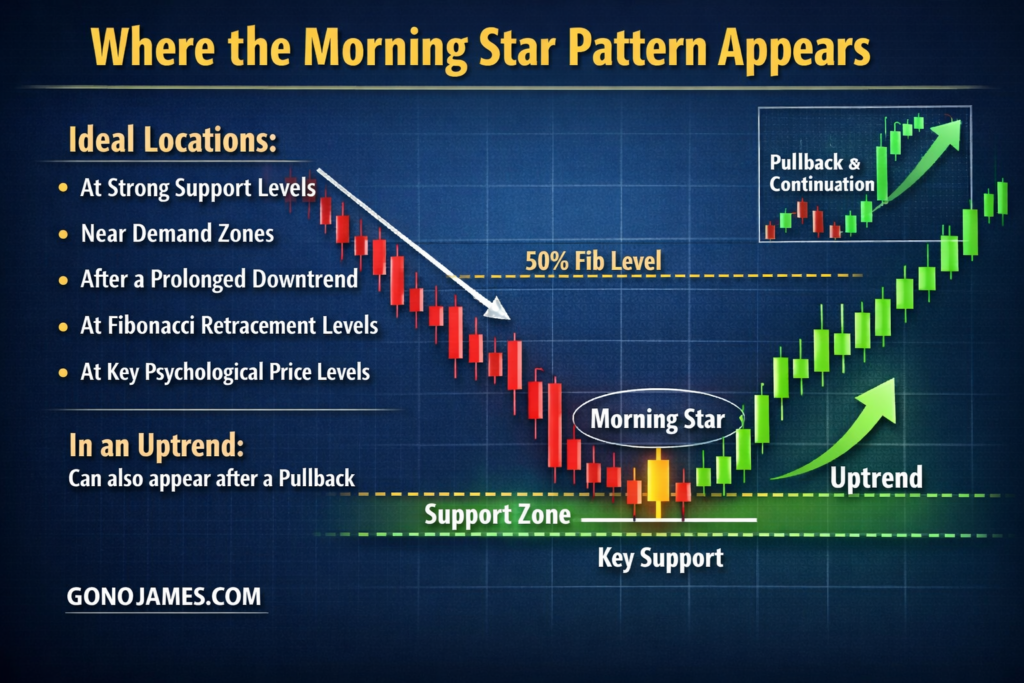

The Morning Star pattern is most effective when it appears at the end of a downtrend. This is where it has the highest probability of signaling a bullish reversal.

Ideal Locations

- At strong support levels

- Near demand zones

- After a prolonged downtrend

- At Fibonacci retracement levels

- At key psychological price levels

When the Morning Star forms at these important levels, the probability of a successful trade increases significantly.

Sometimes, the pattern can also appear in an uptrend and signal continuation after a temporary pullback.

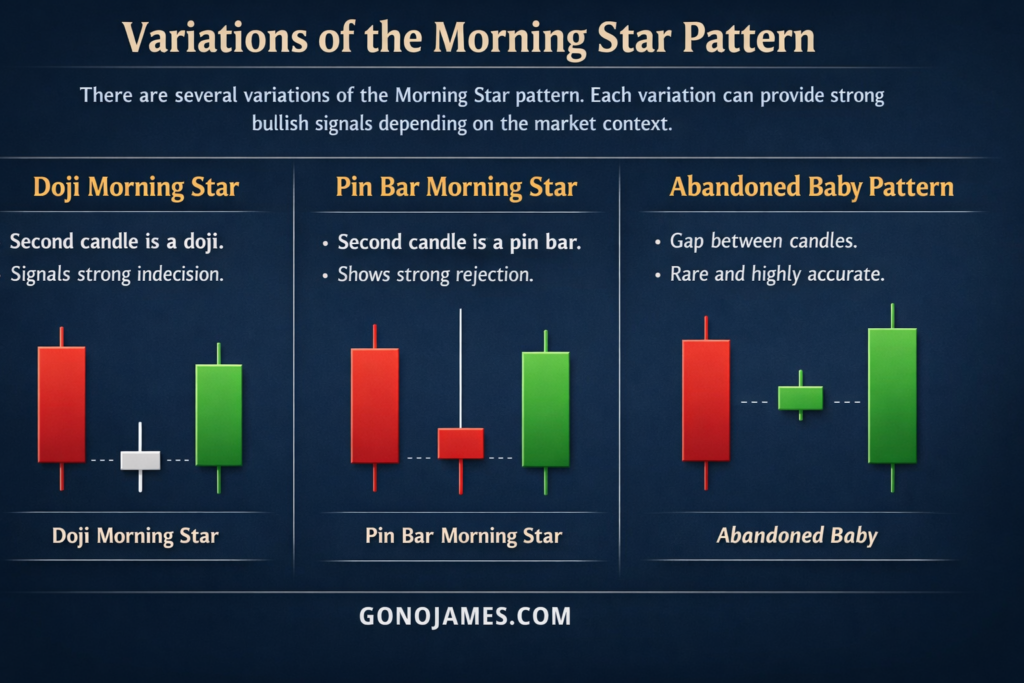

Variations of the Morning Star Pattern

There are several variations of the Morning Star pattern. Each variation can provide strong bullish signals depending on the market context.

1. Doji Morning Star

In this variation, the second candle is a doji.

A doji represents strong indecision and increases the likelihood of a trend reversal.

This is considered one of the strongest Morning Star patterns.

2. Pin Bar Morning Star

Here, the second candle is a pin bar with a long wick.

It shows rejection of lower prices and indicates buyers are entering the market.

This variation often leads to strong bullish moves.

3. Abandoned Baby Pattern

This rare variation occurs when there is a gap between candles.

It has very high accuracy but appears less frequently in Forex markets.

When it appears, it often signals a strong and fast reversal.

Why Traders Love the Morning Star Pattern

There are many reasons why the Morning Star pattern is popular among traders:

- Easy to identify

- High accuracy

- Works on all timeframes

- Suitable for Forex, crypto, and stocks

- Provides clear entry and exit signals

- Works well with other indicators

It is especially powerful when combined with support and resistance levels or technical indicators.

How To Trade and Win Forex With the Morning Star Pattern

To trade successfully using the Morning Star pattern, you must follow a structured approach. Below are two proven trading strategies.

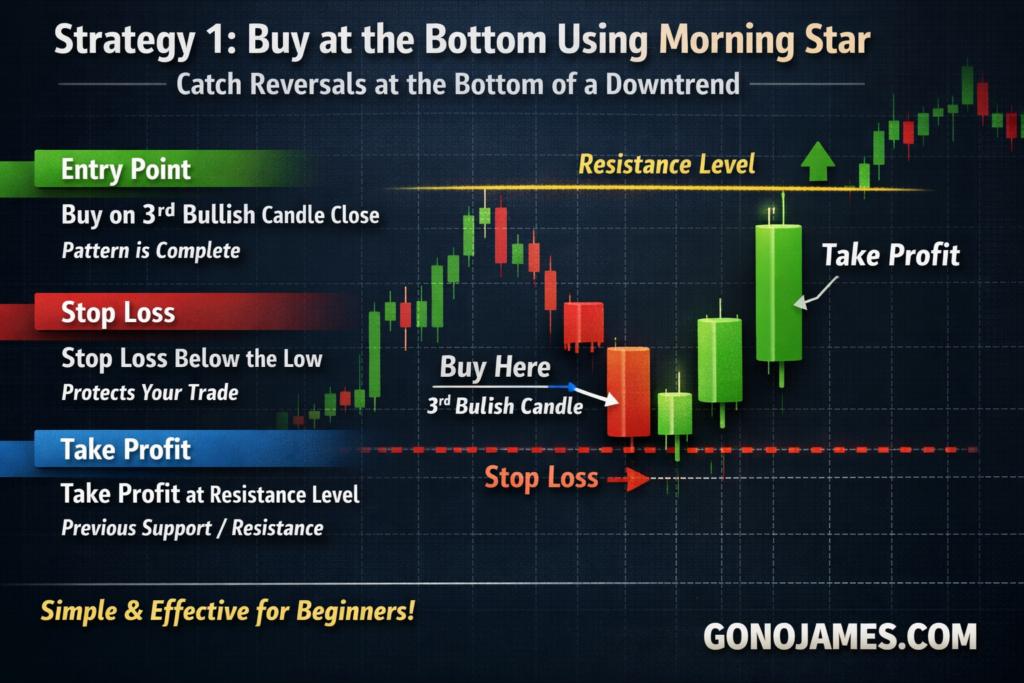

Strategy 1: Buy at the Bottom Using Morning Star

This strategy focuses on catching reversals at the bottom of a downtrend.

Entry Point

Open a BUY trade immediately after the third bullish candle closes.

This confirms the pattern is complete.

Stop Loss

Place stop-loss below the lowest point of the pattern.

This protects your trade if the reversal fails.

Take Profit

Set take-profit at the nearest resistance level or previous support turned resistance.

This strategy is simple and effective for beginners.

Strategy 2: Trend Continuation with Morning Star

This strategy uses the Morning Star as a continuation signal in an uptrend.

Entry Point

Enter a BUY trade after the pattern forms during a pullback in an uptrend.

Stop Loss

Place stop-loss below the lowest wick of the pattern.

Take Profit

Set take-profit at the next resistance level or use risk-to-reward ratio of 1:2 or higher.

This method increases accuracy by trading in the direction of the overall trend.

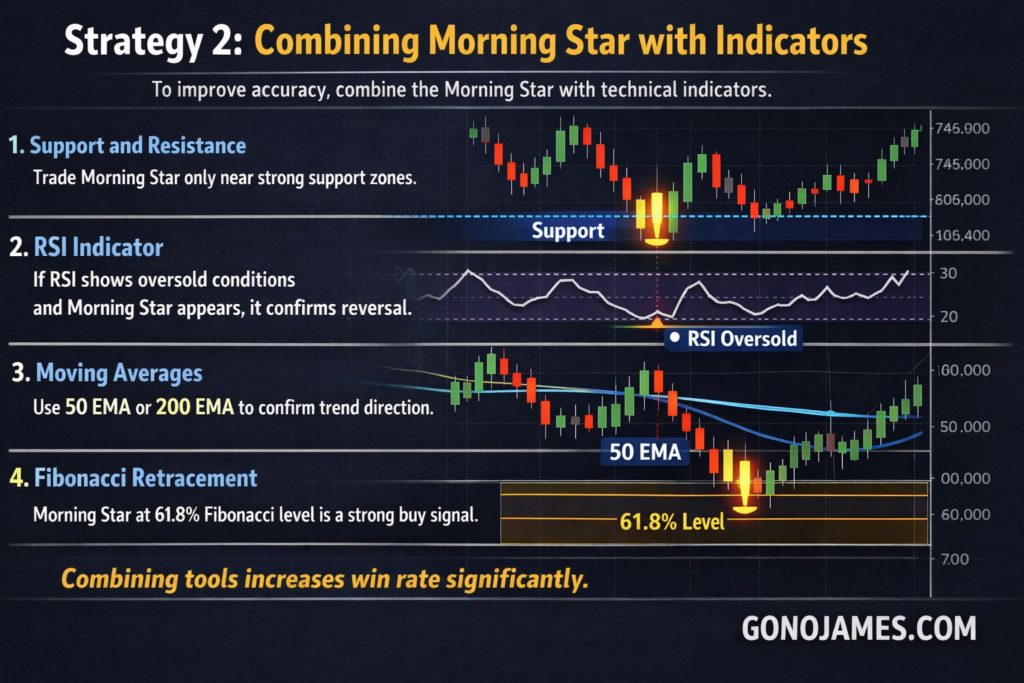

Combining Morning Star with Indicators

To improve accuracy, combine the Morning Star with technical indicators.

1. Support and Resistance

Trade Morning Star only near strong support zones.

2. RSI Indicator

If RSI shows oversold conditions and Morning Star appears, it confirms reversal.

3. Moving Averages

Use 50 EMA or 200 EMA to confirm trend direction.

4. Fibonacci Retracement

Morning Star at 61.8% Fibonacci level is a strong buy signal.

Combining tools increases win rate significantly.

Common Mistakes to Avoid

Many traders misuse the Morning Star pattern. Avoid these mistakes:

- Trading without confirmation

- Ignoring trend direction

- Entering before pattern completes

- Not using stop-loss

- Trading in weak market conditions

Always wait for confirmation before entering a trade.

Best Timeframes for Trading Morning Star

The pattern works on all timeframes, but some are more reliable:

- 5M & 15M: Scalping

- 1H: Intraday trading

- 4H: Swing trading

- Daily: Long-term trading

Higher timeframes usually provide stronger signals.

Risk Management Tips

Even strong patterns can fail. Always manage risk.

- Risk only 1–2% per trade

- Use stop-loss always

- Avoid overtrading

- Follow trading plan

- Practice on demo account first

Consistency is key to long-term success.

Conclusion

The Morning Star candlestick pattern is one of the most powerful bullish reversal signals in Forex trading. It provides clear entry points, strong confirmation, and high probability setups when used correctly.

By understanding its structure, psychology, and strategies, traders can significantly improve their trading performance. However, like all trading methods, it should be combined with proper risk management and confirmation tools.

Practice identifying and trading the Morning Star pattern on a demo account first. With time and experience, you will be able to spot profitable opportunities and trade with confidence.

Master this pattern, stay disciplined, and you will increase your chances of winning in the Forex market.