In the world of Forex trading, understanding price action is one of the most powerful ways to identify high-probability trading opportunities. Professional traders often rely on candlestick patterns to read market sentiment and predict future price movement. Among the most reliable bullish reversal signals is the Three White Soldiers candlestick pattern.

This powerful pattern frequently appears at the beginning of a strong uptrend and signals that buyers have taken control of the market. Because of its reliability and clarity, traders closely watch for this formation whenever it appears on a price chart.

In this comprehensive guide, you will learn everything you need to know about the Three White Soldiers pattern, including its structure, meaning, and how to trade it effectively in Forex markets.

What Is the Three White Soldiers Candlestick Pattern?

The Three White Soldiers is a well-known Japanese candlestick pattern that signals a strong reversal from a downtrend to an uptrend. It represents a shift in market sentiment where sellers lose control and buyers step in with strong momentum.

This pattern typically appears at the bottom of a downtrend and indicates that the market is preparing for a sustained bullish move. It shows a clear transition from bearish dominance to bullish strength.

When this pattern forms correctly, it often marks the beginning of a new upward trend or the continuation of an existing bullish movement.

Traders consider the Three White Soldiers one of the most reliable bullish signals in technical analysis because it reflects strong and consistent buying pressure over multiple trading sessions.

Structure of the Three White Soldiers Pattern

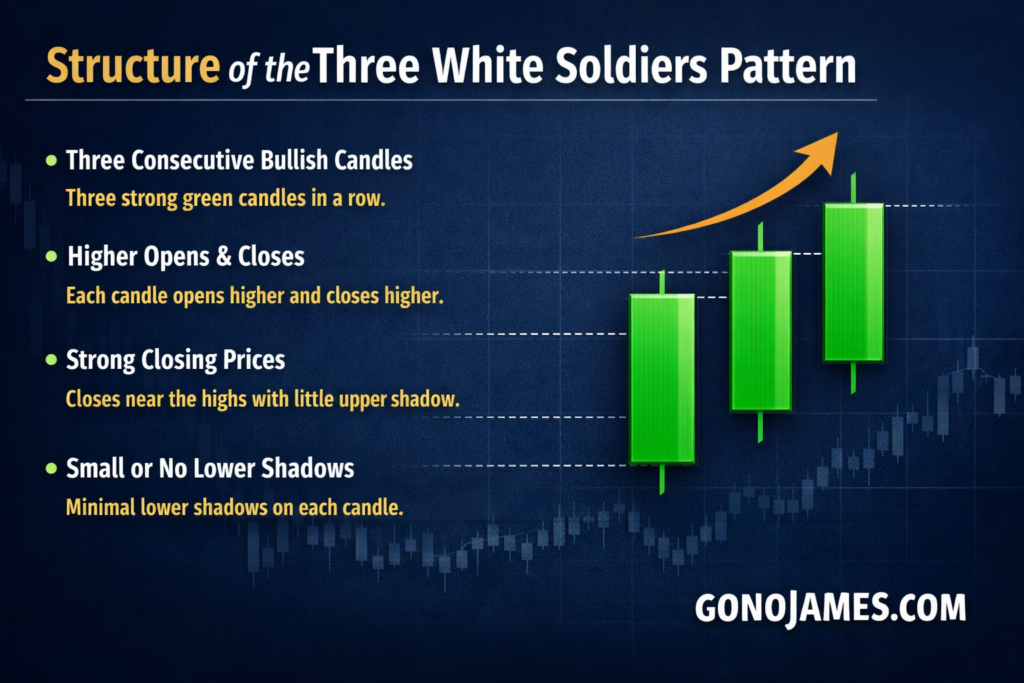

To identify the Three White Soldiers pattern correctly, traders must understand its structure. The pattern consists of three consecutive bullish candles that follow a downtrend or consolidation phase.

For the pattern to be valid, it must meet the following conditions:

1. Three Consecutive Bullish Candles

The pattern is made up of three strong bullish (green) candlesticks that appear one after another. Each candle represents increasing buying pressure and growing market confidence.

2. Higher Opens and Closes

Each new candle should open within the body of the previous candle and close higher than the previous candle’s closing price. This shows steady upward momentum and strong buyer control.

3. Strong Closing Prices

Each candle should close near its high, leaving little or no upper shadow. This indicates that buyers remained in control throughout the trading session and closed the price near the highest level.

4. Small or No Lower Shadows

Ideally, the candles should have small lower shadows. This means sellers were unable to push the price significantly lower during the formation of each candle.

When all these conditions are met, the Three White Soldiers pattern becomes a powerful signal of bullish momentum.

Meaning and Market Psychology

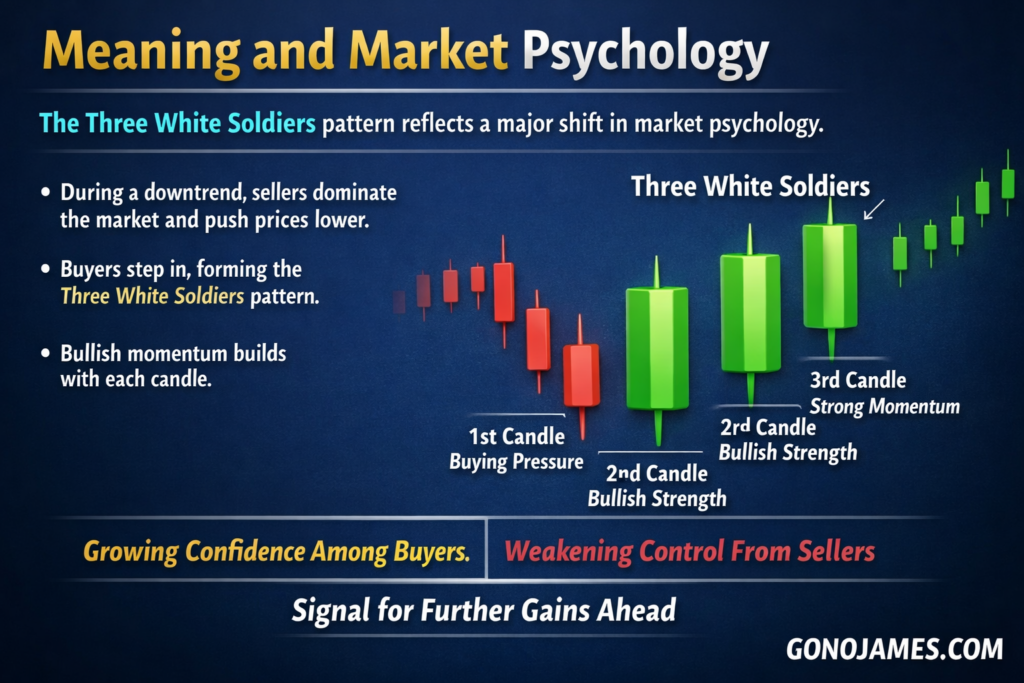

The Three White Soldiers pattern reflects a major shift in market psychology.

During a downtrend, sellers dominate the market and push prices lower. However, when the Three White Soldiers pattern begins to form, buyers gradually step in and gain control.

The first candle shows early signs of buying pressure. The second candle confirms that buyers are gaining strength. By the third candle, bullish momentum becomes strong and consistent.

This sequence demonstrates growing confidence among buyers and weakening control from sellers. As a result, many traders interpret this pattern as a strong signal that prices are likely to continue rising.

The pattern not only shows a reversal but also indicates strong momentum that can drive the market higher for an extended period.

Different Variations of the Pattern

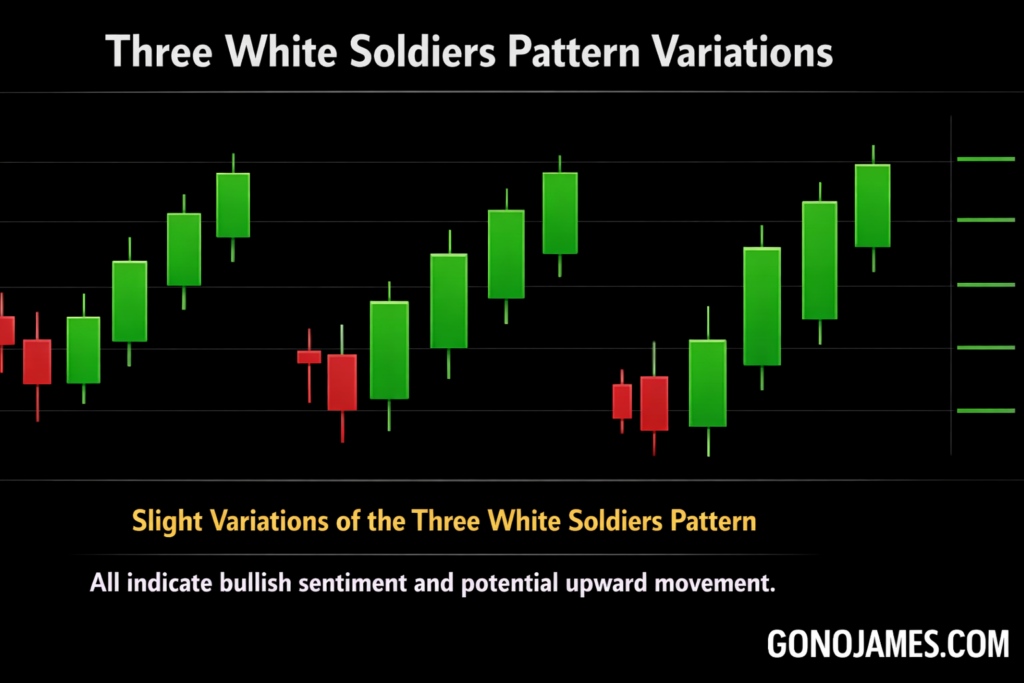

On a candlestick chart, the Three White Soldiers pattern can appear in slightly different forms. Some candles may have slightly longer shadows or varying body sizes. However, as long as the general structure and bullish progression remain intact, the signal is still valid.

All variations of the pattern generally indicate bullish sentiment and potential upward movement. The stronger and more consistent the candles, the more reliable the signal becomes.

Traders should focus on the overall structure and context rather than expecting perfect textbook formations.

Best Position to Find the Pattern

The location of the Three White Soldiers pattern on the chart plays a crucial role in its effectiveness.

At the Bottom of a Downtrend

The most powerful signal occurs when the pattern forms after a prolonged downtrend. This indicates a strong bullish reversal and a potential new uptrend. Many traders use this opportunity to open BUY trades and capture early bullish momentum.

During an Uptrend

Sometimes the pattern appears within an existing uptrend. In this case, it acts as a continuation signal rather than a reversal. It suggests that buyers remain in control and that the uptrend may continue.

Understanding the context of the pattern helps traders make better decisions and avoid false signals.

How to Trade the Three White Soldiers Pattern Effectively

The Three White Soldiers pattern is a strong signal of bullish market conditions. However, like any trading strategy, it should be used with proper risk management and confirmation tools.

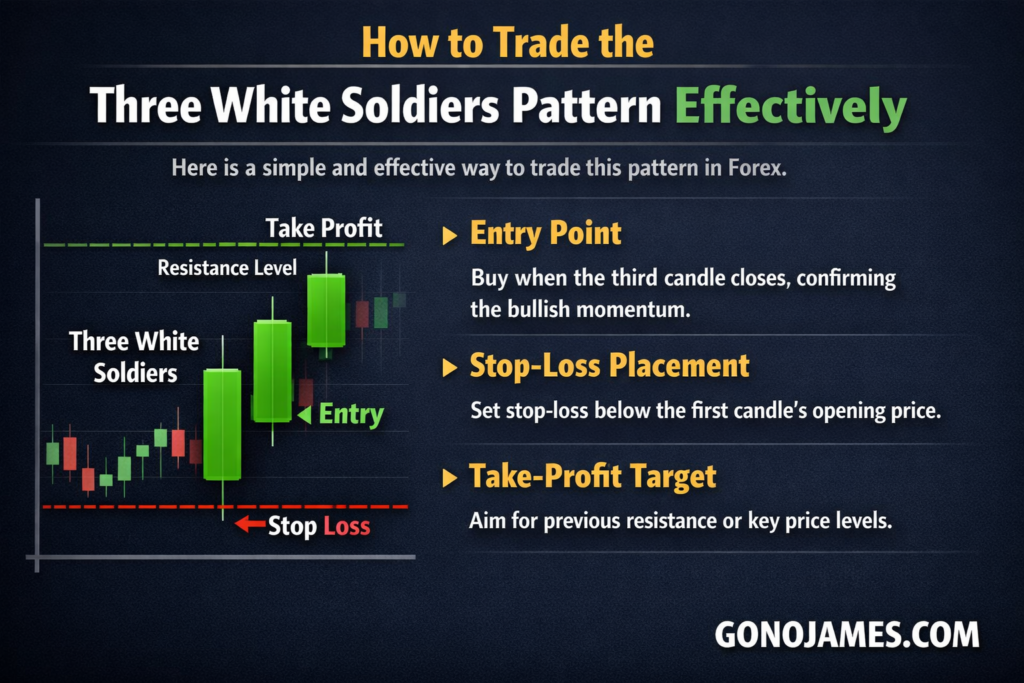

Here is a simple and effective way to trade this pattern in Forex.

Entry Point

Open a BUY order as soon as the third candle closes and the pattern is fully formed. This confirms that bullish momentum is strong and increases the probability of a successful trade.

Some traders prefer waiting for a slight pullback before entering to get a better price, but entering immediately after confirmation is a common strategy.

Stop-Loss Placement

Place the stop-loss below the opening price of the first candle in the pattern. This level represents the point where the bullish setup would be invalidated if price moves below it.

Using a stop-loss protects your trading account from unexpected market reversals and limits potential losses.

Take-Profit Target

Set your take-profit level at previous resistance zones or key price levels where the market has historically reversed. These areas often act as barriers where price may slow down or reverse.

You can also use a risk-to-reward ratio such as 1:2 or 1:3 to ensure long-term profitability.

Tips for Better Trading Results

To improve the accuracy of trades using the Three White Soldiers pattern, consider combining it with other technical tools:

- Support and resistance levels

- Moving averages

- RSI (Relative Strength Index)

- MACD indicator

- Trendlines

Using multiple confirmations helps filter out false signals and increases the probability of successful trades.

Avoid trading the pattern in low-volume or sideways markets, as this can reduce its reliability. Always analyze the overall market trend before making trading decisions.

Conclusion

The Three White Soldiers candlestick pattern is one of the most powerful bullish signals in Forex trading. It represents strong buying pressure and often marks the beginning of a significant uptrend or the continuation of bullish momentum.

By understanding its structure, meaning, and proper trading strategies, traders can use this pattern to identify high-probability BUY opportunities and improve trading performance.

Like all trading tools, the Three White Soldiers pattern works best when combined with proper risk management and additional technical analysis. Mastering this pattern can help you gain confidence, improve accuracy, and achieve more consistent results in the Forex market.

If you want to become a more successful trader, learning to recognize and trade the Three White Soldiers pattern is an essential step in your price action journey.