The Forex market is full of opportunities, but success often depends on your ability to read price action and identify strong trading signals. One of the most reliable bullish reversal patterns used by professional traders is the Three Inside Up candlestick pattern. This pattern provides early signs that a downtrend may be ending and a new uptrend is about to begin.

In this comprehensive guide, you will learn everything you need to know about the Three Inside Up pattern, including its structure, meaning, variations, and how to trade it effectively. By mastering this powerful candlestick formation, you can improve your trading accuracy and increase your confidence in identifying profitable opportunities in the Forex market.

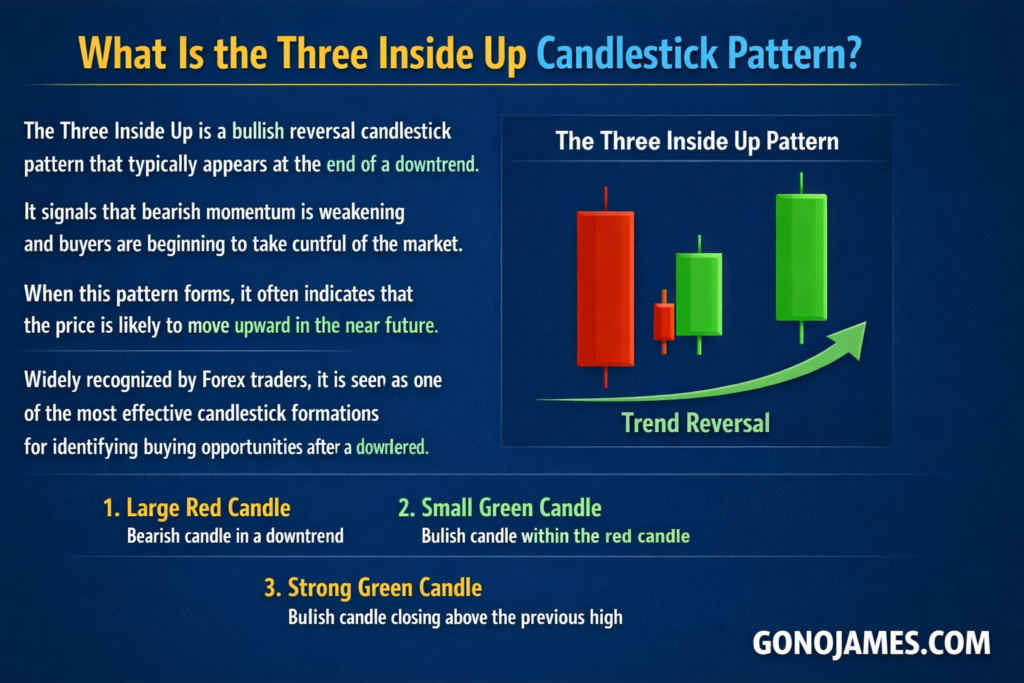

What Is the Three Inside Up Candlestick Pattern?

The Three Inside Up is a bullish reversal candlestick pattern that typically appears at the end of a downtrend. It signals that bearish momentum is weakening and buyers are beginning to take control of the market. When this pattern forms, it often indicates that the price is likely to move upward in the near future.

This pattern is widely recognized by Forex traders because it provides a strong and reliable signal of a trend reversal. Many professional traders consider it one of the most effective candlestick formations for identifying buying opportunities after a downtrend.

The Three Inside Up pattern is formed by three consecutive candles that together reveal a shift in market sentiment from bearish to bullish. Each candle plays a crucial role in confirming the potential reversal.

Structure of the Three Inside Up Pattern

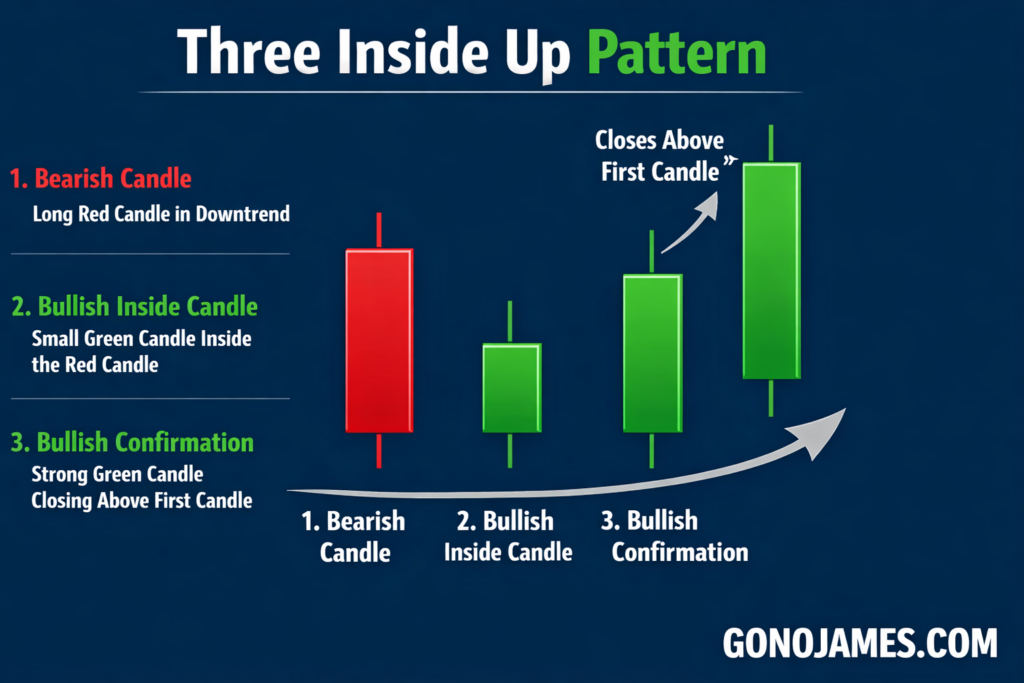

A standard Three Inside Up candlestick pattern consists of three specific candles that form in sequence. Understanding the structure is essential for identifying the pattern correctly and avoiding false signals.

First Candlestick: Bearish Candle

The first candle is a long bearish candlestick that appears during a downtrend. It reflects strong selling pressure and confirms that sellers are still dominating the market at this stage. This candle usually has a large body, indicating strong momentum in the downward direction.

Second Candlestick: Bullish Inside Candle

The second candle is a bullish candlestick that forms within the body of the first bearish candle. Ideally, this candle retraces at least 50% of the previous candle’s body. This indicates that buyers are starting to step into the market and challenge the dominance of sellers.

The second candle is called the “inside candle” because it forms within the range of the first candle. It represents the first sign of a potential reversal.

Third Candlestick: Strong Bullish Confirmation

The third candle is another bullish candlestick with a strong body. This candle closes above the opening price of the first bearish candle, confirming the bullish reversal. It shows that buyers have taken control and the market sentiment has shifted from bearish to bullish.

Once this third candle closes, the Three Inside Up pattern is considered complete and confirmed.

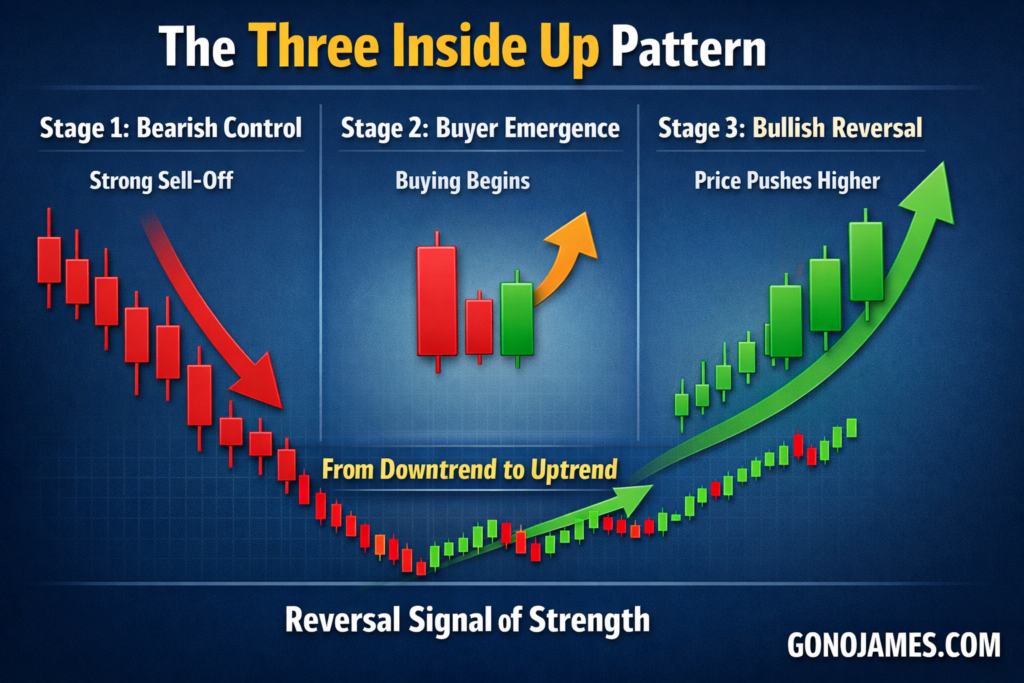

Meaning of the Three Inside Up Pattern

The Three Inside Up pattern reflects a clear change in market psychology. At first, sellers dominate the market and push prices lower. However, as the pattern develops, buyers gradually gain strength and eventually take control.

Here is the psychological progression behind the pattern:

- Stage 1: Sellers control the market with strong bearish momentum.

- Stage 2: Buyers begin to enter, reducing selling pressure.

- Stage 3: Buyers gain dominance and push the price upward.

This transition from bearish to bullish sentiment is what makes the Three Inside Up pattern such a powerful reversal signal. When it appears at the end of a downtrend, it often marks the beginning of a new upward movement.

Compared to single-candle reversal signals, the Three Inside Up pattern provides stronger confirmation because it uses three candles to confirm the shift in momentum. This makes it more reliable and less prone to false signals.

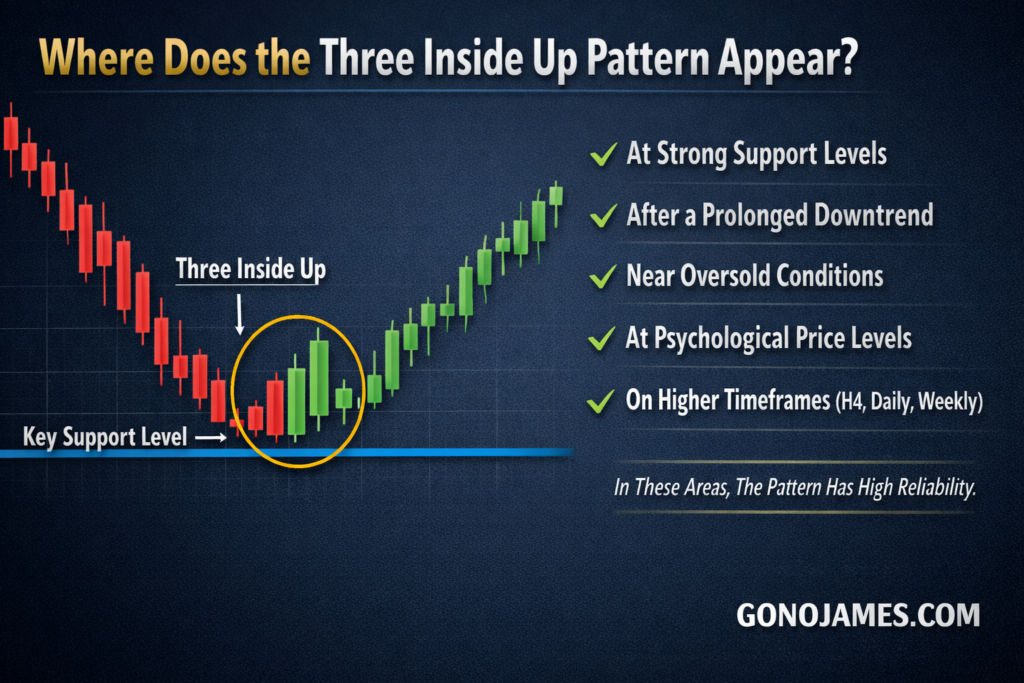

Where Does the Three Inside Up Pattern Appear?

The Three Inside Up pattern usually appears at the end of a downtrend or during a market correction. It is most effective when it forms at key support levels or after a prolonged bearish movement.

Traders should look for this pattern in the following areas:

- At strong support levels

- After a prolonged downtrend

- Near oversold conditions

- At psychological price levels

- On higher timeframes such as H4, daily, or weekly charts

When the pattern appears in these locations, its reliability increases significantly. Combining it with support and resistance analysis can further improve trading accuracy.

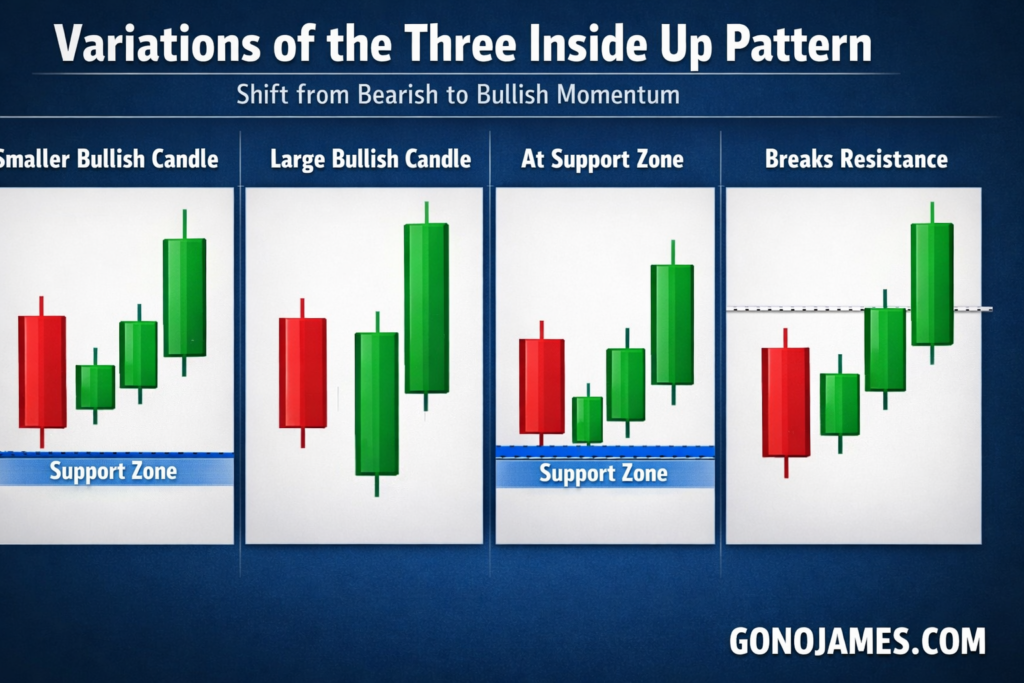

Variations of the Three Inside Up Pattern

Like many candlestick patterns, the Three Inside Up can appear in different variations. Although the structure may vary slightly, these variations still provide reliable bullish signals.

Some common variations include:

- The second candle may be smaller but still bullish.

- The third candle may be very strong and large.

- The pattern may form near a support zone.

- The third candle may break above a resistance level.

Regardless of the variation, the key characteristic remains the same: a shift from bearish to bullish momentum confirmed by three candles.

Traders should focus on the overall structure and confirmation rather than expecting a perfect textbook formation every time.

How to Trade the Three Inside Up Pattern in Forex

Trading with the Three Inside Up pattern can be highly effective if done correctly. Since this is a bullish reversal signal, traders should focus on finding BUY opportunities when the pattern appears.

Entry Point

The best entry point is immediately after the third bullish candle closes. This confirms that the pattern is complete and that buyers are in control. Some traders prefer to wait for a small pullback before entering to get a better price.

Stop-Loss Placement

The stop-loss should be placed below the lowest point of the pattern. This helps protect your account if the market moves against your position. Proper risk management is essential in Forex trading, so always use a stop-loss.

Take-Profit Target

The take-profit level can be set at the nearest resistance level or previous price high. Traders can also use a risk-to-reward ratio of at least 1:2 to ensure profitable trading over time.

Additional Confirmation Tools

To increase accuracy, combine the Three Inside Up pattern with technical indicators such as:

- Support and resistance levels

- Moving averages

- RSI (Relative Strength Index)

- MACD indicator

- Trendlines

Using multiple confirmations can help filter out false signals and improve overall trading performance.

Important Notes for Beginners

If you are new to Forex trading, it is important to practice before using real money. The Three Inside Up pattern is powerful, but like all trading strategies, it requires experience and discipline.

Start by using this pattern on a demo account to understand how it behaves in different market conditions. Practice identifying the pattern, setting entry points, and managing risk. Once you feel confident, you can gradually apply it to live trading.

Remember, no candlestick pattern guarantees success. Always combine technical analysis with proper risk management and trading discipline.

Conclusion

The Three Inside Up candlestick pattern is one of the most reliable bullish reversal signals in Forex trading. It provides clear confirmation that a downtrend may be ending and an uptrend is beginning. By understanding its structure, meaning, and trading strategy, traders can use this pattern to identify profitable buying opportunities.

Whether you are a beginner or an experienced trader, mastering the Three Inside Up pattern can significantly improve your trading skills. Practice regularly, combine it with other technical tools, and always manage your risk carefully.

In future guides, we will explore advanced strategies using this powerful candlestick pattern to help you trade the Forex market more effectively. Stay tuned and continue learning to become a successful trader.