The Three Black Crows candlestick pattern is one of the most reliable bearish reversal signals in Forex trading. Although this pattern does not appear frequently on price charts, it is widely respected among professional traders for its strong accuracy and high probability of signaling a market reversal.

For traders who specialize in catching market tops or identifying the beginning of a new downtrend, the Three Black Crows pattern can be an extremely valuable tool. When used correctly with proper confirmation and risk management, it can help traders enter SELL positions at optimal points and maximize profits during bearish market movements.

In this article, you will learn what the Three Black Crows pattern is, how it forms, what it means in market psychology, and how to trade it effectively in Forex.

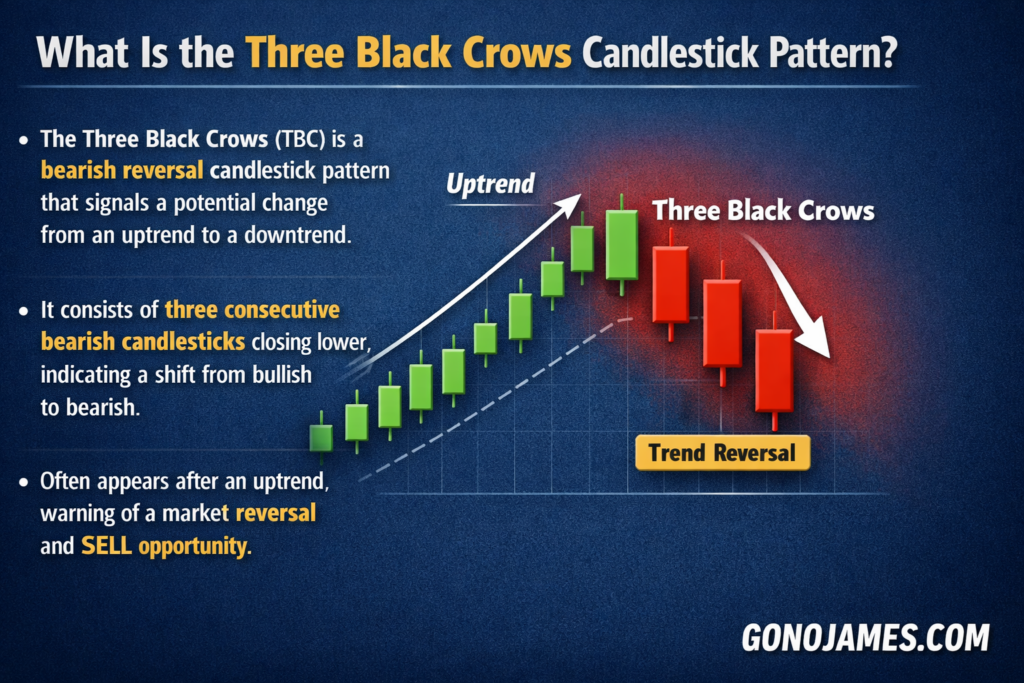

What Is the Three Black Crows Candlestick Pattern?

The Three Black Crows (TBC) is a bearish reversal candlestick pattern that signals a potential change from an uptrend to a downtrend. It typically appears at the top of an uptrend or after a bullish market movement, warning traders that buying momentum is weakening and sellers are taking control.

The pattern consists of three consecutive bearish candlesticks that close progressively lower. These candles reflect strong selling pressure and a gradual shift in market sentiment from bullish to bearish.

When this formation appears after a strong uptrend, it often signals that the market is about to reverse downward. This makes it a powerful pattern for traders looking to identify market tops and open SELL trades.

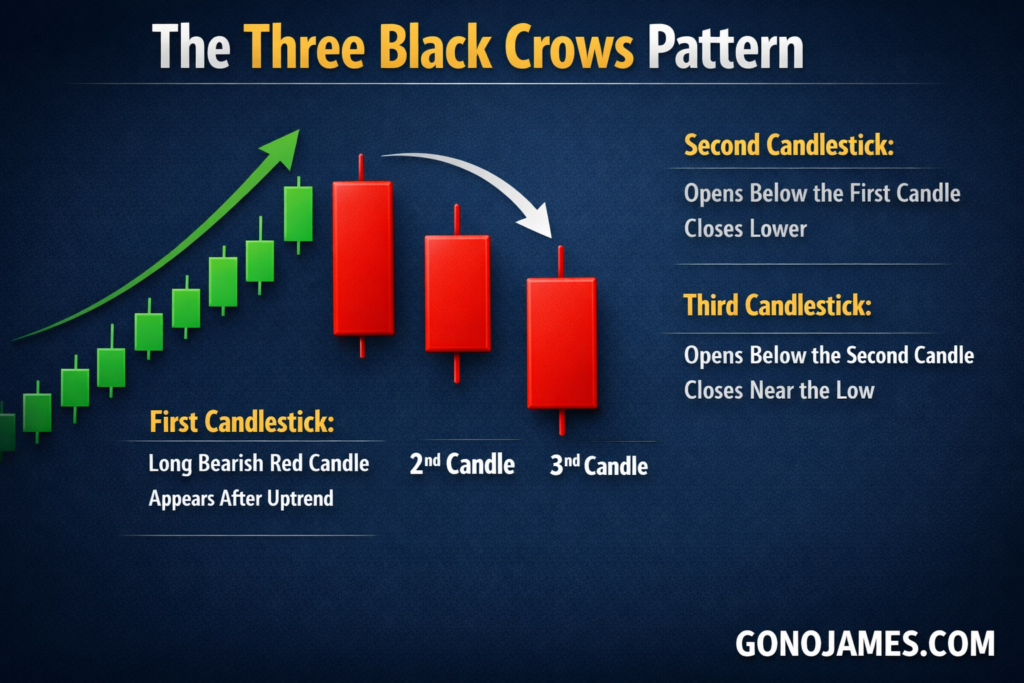

Structure of the Three Black Crows Pattern

Understanding the structure of the Three Black Crows pattern is essential for identifying it accurately and avoiding false signals. The pattern consists of three specific candlesticks that form in sequence.

First Candlestick

The first candle is a long bearish (red) candlestick. It appears after an uptrend and represents the first sign that selling pressure is entering the market. This candle signals that buyers are beginning to lose control.

Second Candlestick

The second candlestick is also bearish. It typically opens within the body of the first candle and closes lower than the first candle’s closing price. It usually has a small upper shadow or no shadow at all, indicating strong selling pressure throughout the session.

Third Candlestick

The third candle is another bearish candlestick. It opens within the body of the second candle and closes near its lowest point. This confirms that sellers are firmly in control and that a bearish trend is likely to follow.

Key Characteristics

- Three consecutive bearish candles

- Each candle closes lower than the previous one

- Small or no upper shadows

- Appears after an uptrend or at market highs

These characteristics together create a strong bearish reversal signal.

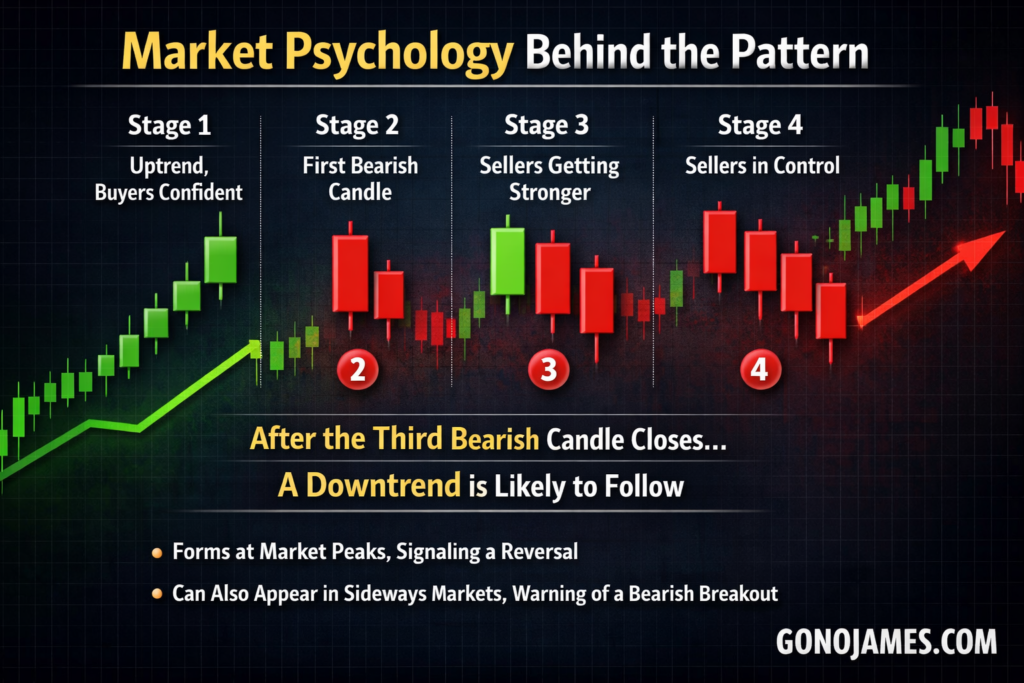

Meaning of the Three Black Crows Pattern

The Three Black Crows pattern reflects a clear shift in market psychology. It shows that buyers who previously dominated the market are losing strength, while sellers are gaining control.

Market Psychology Behind the Pattern

Stage 1: The market is in an uptrend, and buyers are confident.

Stage 2: The first bearish candle appears, showing initial selling pressure.

Stage 3: The second candle confirms that sellers are becoming stronger.

Stage 4: The third candle signals that sellers now dominate the market.

By the time the third bearish candle closes, it is often a strong indication that a downtrend is about to begin.

This pattern commonly forms at price peaks, making it a valuable signal for traders looking to sell near the top of the market. It can also appear during sideways markets, signaling a potential bearish breakout and the start of a downward trend.

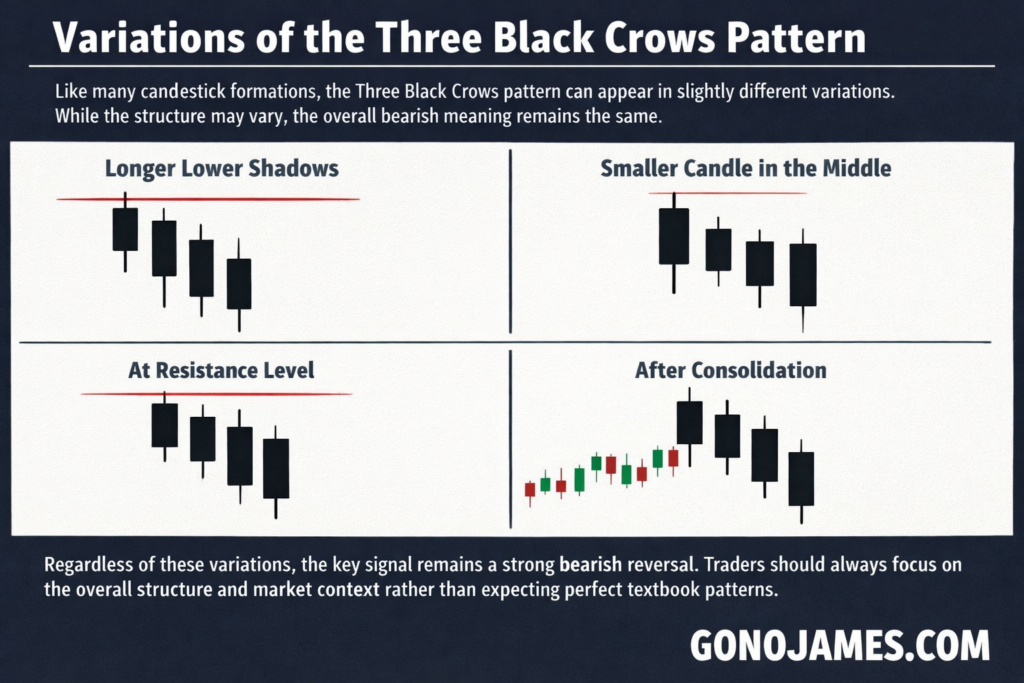

Variations of the Three Black Crows Pattern

Like many candlestick formations, the Three Black Crows pattern can appear in slightly different variations. While the structure may vary, the overall bearish meaning remains the same.

Some common variations include:

- Candles with slightly longer lower shadows

- The second or third candle being slightly smaller

- Formation near resistance levels

- Appearance after a consolidation phase

Regardless of these variations, the key signal remains a strong bearish reversal. Traders should always focus on the overall structure and market context rather than expecting perfect textbook patterns.

How to Trade Forex Effectively Using the Three Black Crows Pattern

Trading the Three Black Crows pattern can be highly effective when combined with proper risk management and confirmation tools. Since this is a bearish reversal pattern, traders should focus on SELL opportunities only.

Entry Point

The best entry point is immediately after the third bearish candle closes. This confirms that the pattern is complete and that selling pressure is dominant.

Some traders prefer to wait for additional confirmation, such as a break below support or a bearish indicator signal, before entering the trade.

Stop-Loss Placement

Place the stop-loss above the highest point before the pattern formed. This is usually above the high of the first candle or the recent swing high.

This placement protects your trade in case the market reverses unexpectedly.

Take-Profit Target

The take-profit level should be placed at key support levels. These may include:

- Previous support zones

- Psychological price levels

- Fibonacci support levels

- Trendline support

You can also use a risk-to-reward ratio of at least 1:2 to maintain consistent profitability.

Tips for Using the Three Black Crows Pattern Successfully

To increase the accuracy of the Three Black Crows pattern, consider combining it with other technical analysis tools:

Use Resistance Levels

The pattern is more reliable when it forms near strong resistance levels. This increases the likelihood of a reversal.

Confirm with Indicators

Use indicators such as RSI, MACD, or moving averages to confirm bearish momentum.

Check Trading Volume

Higher volume during the formation of the pattern strengthens the bearish signal.

Avoid Weak Trends

Do not rely on this pattern in weak or choppy markets. It works best after strong uptrends.

Practice Risk Management

Always use stop-loss orders and proper position sizing to protect your capital.

Conclusion

The Three Black Crows candlestick pattern is one of the most powerful bearish reversal signals in Forex trading. Although it appears rarely, its reliability makes it a favorite among experienced traders who aim to catch market tops and ride strong downtrends.

By understanding its structure, meaning, and trading strategy, you can use this pattern to improve your trading accuracy and identify high-probability SELL opportunities. When combined with technical indicators, support and resistance levels, and solid risk management, the Three Black Crows pattern can become a valuable part of your Forex trading strategy.

Mastering this pattern will help you anticipate market reversals, avoid buying at market tops, and take advantage of profitable bearish movements in the Forex market.