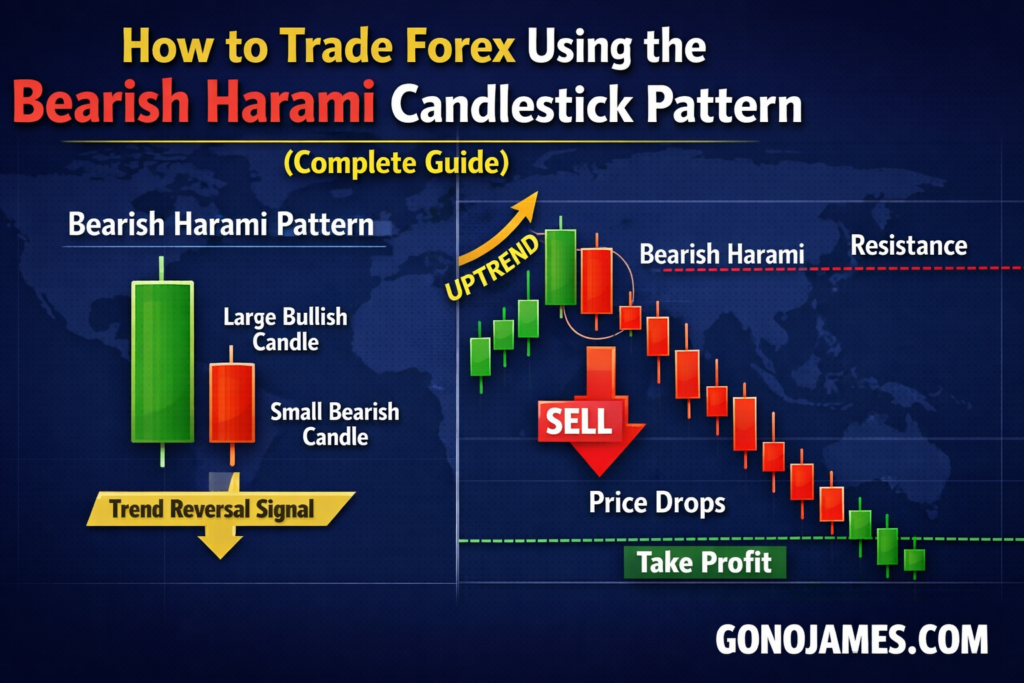

Today, we will explore how to use the Bearish Harami candlestick pattern in Forex trading. This pattern is one of the most powerful price action signals that traders use to identify potential market reversals or trend continuation opportunities. If used correctly, it can help you enter trades at the right time and improve your trading accuracy.

This comprehensive guide will give you everything you need to understand the Bearish Harami pattern, including its structure, meaning, psychology, and effective trading strategies. By the end of this article, you will be able to confidently identify and trade this pattern like a professional Forex trader.

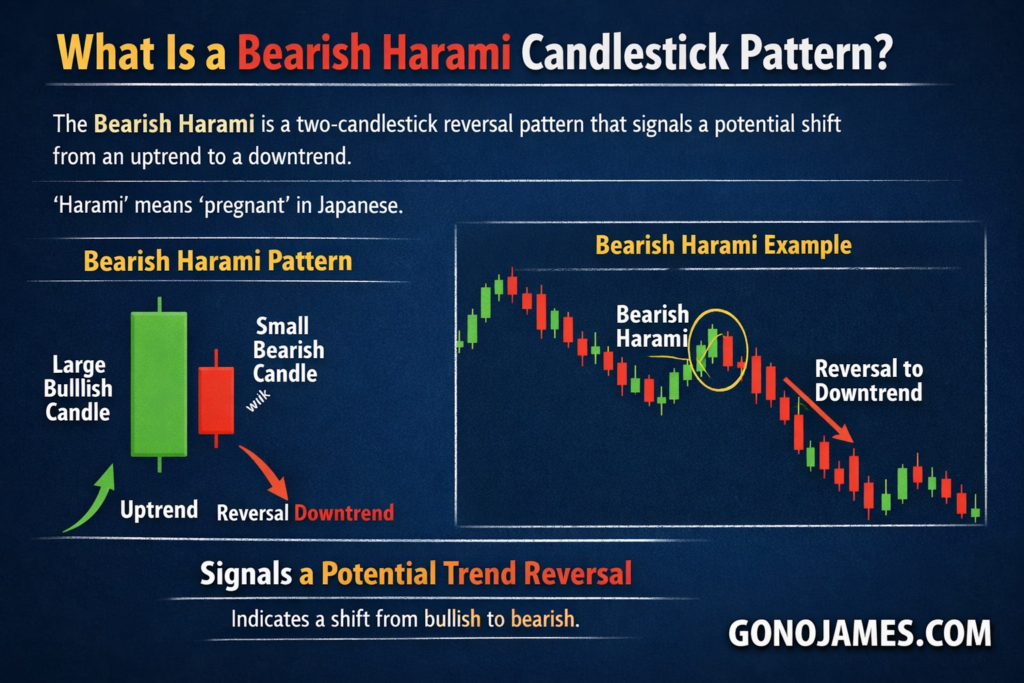

What Is a Bearish Harami Candlestick Pattern?

The Bearish Harami is a popular two-candlestick reversal pattern that signals a potential shift from an uptrend to a downtrend. The word “Harami” comes from Japanese and means “pregnant,” which describes the visual appearance of this pattern. It looks like a small candle inside a larger candle, similar to a baby inside a mother’s body.

There are two main Harami patterns in Forex trading:

- Bullish Harami: Signals a reversal from downtrend to uptrend

- Bearish Harami: Signals a reversal from uptrend to downtrend

Among these two, the Bearish Harami is widely used by traders who want to identify selling opportunities after a bullish market move. When this pattern appears on a price chart, it indicates that buying pressure is weakening and sellers may soon take control.

Professional traders pay close attention to this pattern because it often appears before major price reversals or strong bearish moves.

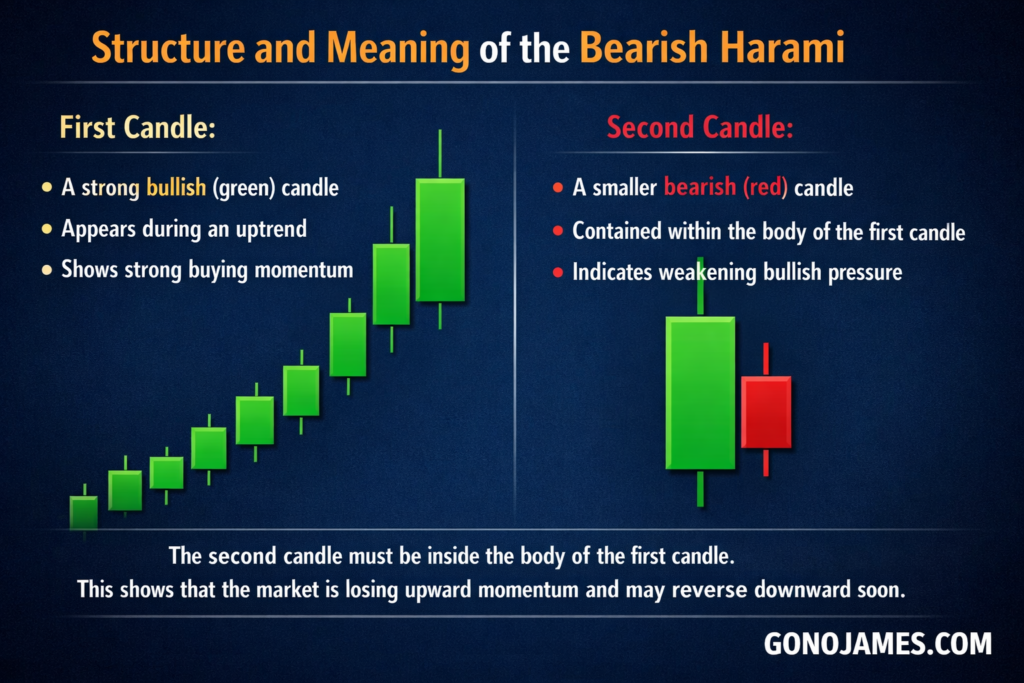

Structure and Meaning of the Bearish Harami

A standard Bearish Harami pattern consists of two candlesticks:

First Candle:

- A strong bullish (green) candle

- Appears during an uptrend

- Shows strong buying momentum

Second Candle:

- A smaller bearish (red) candle

- Completely contained within the body of the first candle

- Indicates weakening bullish pressure

The key feature of this pattern is that the second candle must be inside the body of the first candle. This shows that the market is losing upward momentum and may reverse downward soon.

When you combine the two candles visually, they often resemble a bearish Pin Bar or Shooting Star. These are well-known bearish reversal signals in Forex trading. This similarity explains why the Bearish Harami is considered a reliable signal for a potential market reversal.

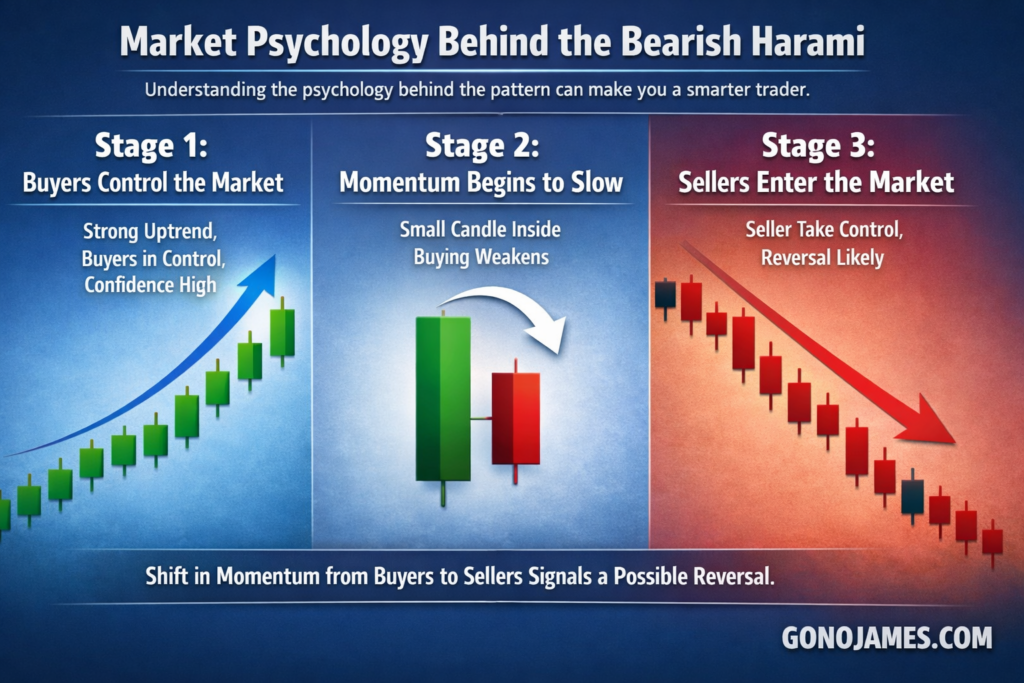

Market Psychology Behind the Bearish Harami

Understanding the psychology behind the pattern can make you a smarter trader.

Stage 1: Buyers Control the Market

Before the Bearish Harami forms, the market is usually in a strong uptrend. Buyers dominate and push prices higher. Confidence in the bullish trend increases.

Stage 2: Momentum Begins to Slow

The second candle forms inside the first candle. This indicates that buyers are losing strength. The market is no longer moving strongly upward.

Stage 3: Sellers Enter the Market

Sellers begin to take control. The market becomes uncertain, and a reversal or strong pullback may occur.

This shift in momentum from buyers to sellers is the core reason why the Bearish Harami is an effective trading signal.

Where the Bearish Harami Appears on the Chart

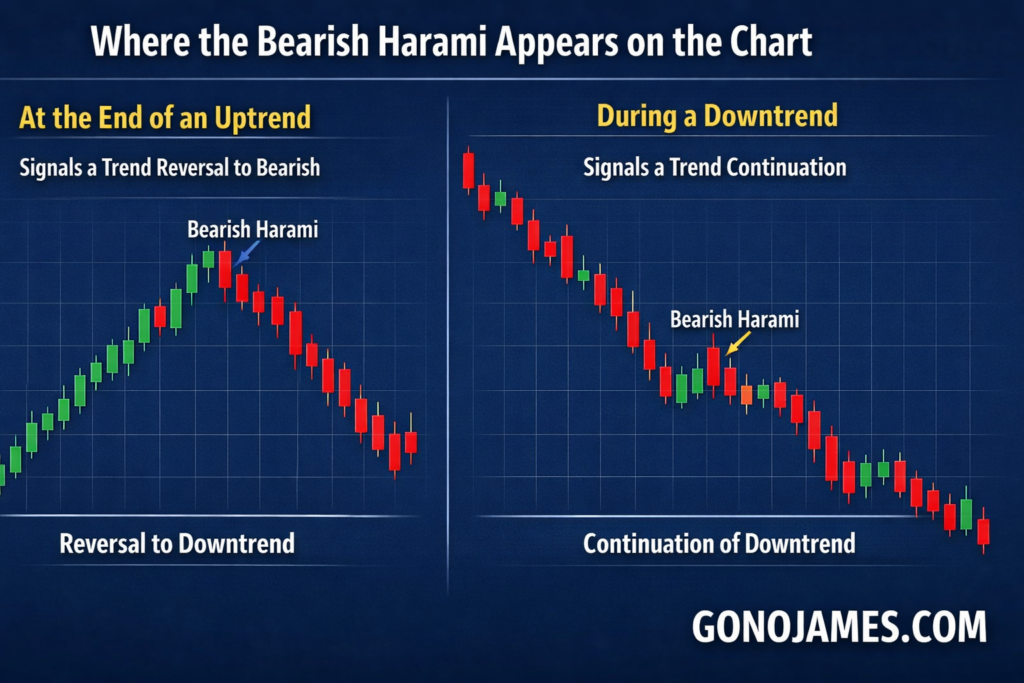

The Bearish Harami pattern usually appears in two key locations:

1. At the End of an Uptrend

This is the most reliable location. When the pattern appears at the top of an uptrend, it signals a possible trend reversal from bullish to bearish.

Traders often use this signal to open SELL trades and catch the beginning of a downtrend.

2. During a Downtrend

Sometimes, the Bearish Harami appears during a downtrend. In this case, it often signals trend continuation rather than reversal. After a small pullback upward, the market may continue moving downward.

Understanding context is important. Always analyze the overall trend before making a trade.

Variations of the Bearish Harami Pattern

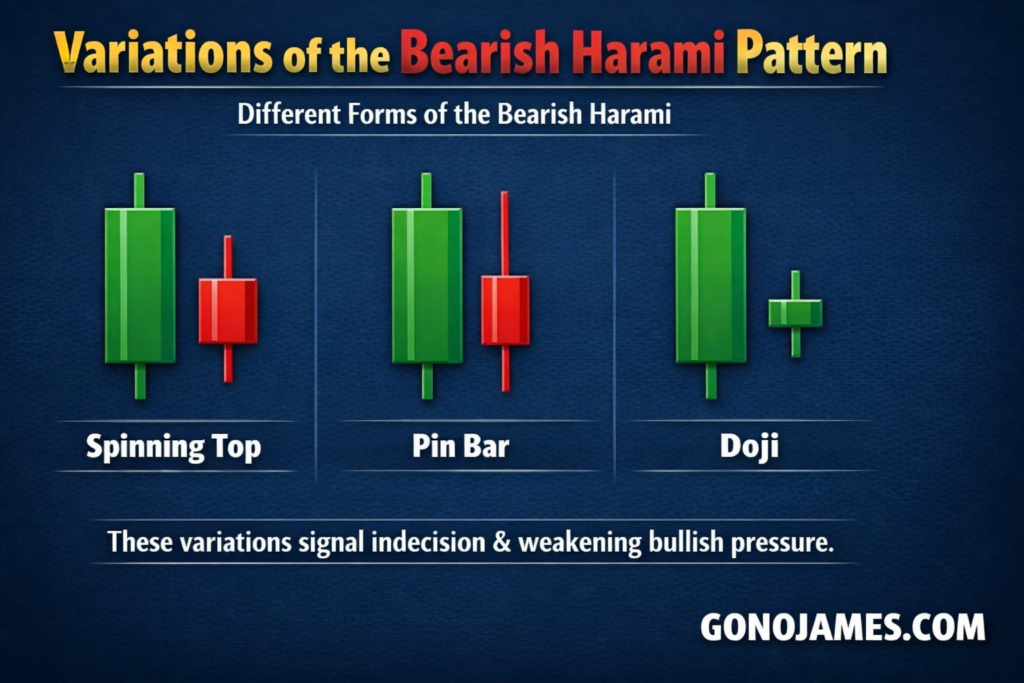

There are several variations of the Bearish Harami pattern. While the standard pattern is the most common, experienced traders also watch for variant structures.

In some cases, the second candle may appear as:

- A Spinning Top

- A Pin Bar

- A Doji

These variations still represent market indecision and weakening bullish pressure. When they appear within the first bullish candle, they still form a valid Bearish Harami signal.

Variant patterns can sometimes provide even stronger reversal signals, especially when combined with resistance levels or technical indicators.

How to Trade Forex Effectively With the Bearish Harami

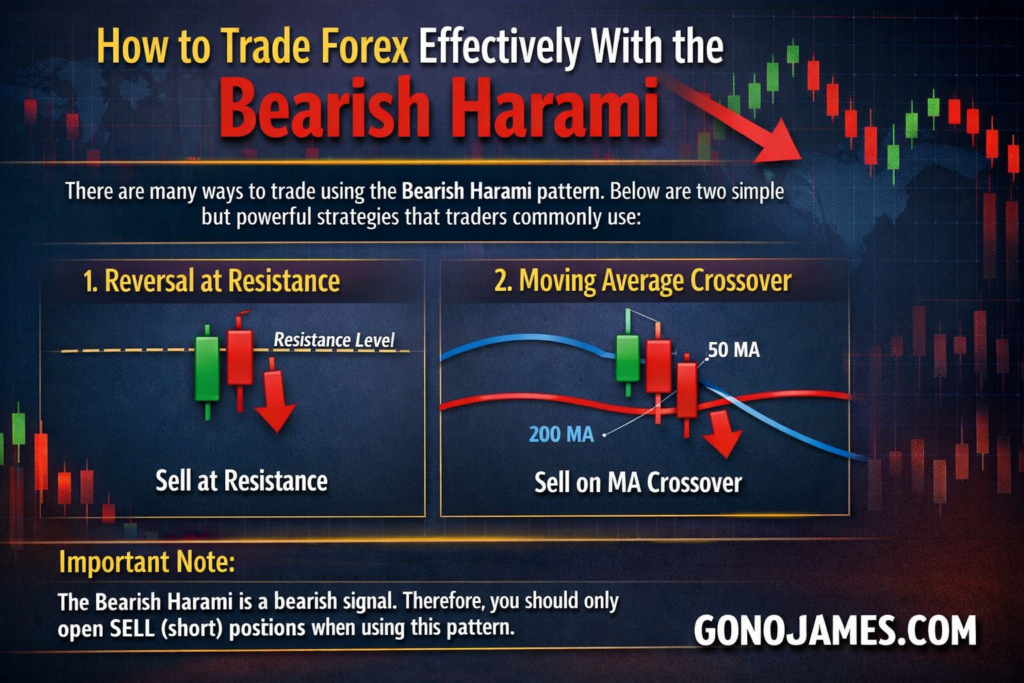

There are many ways to trade using the Bearish Harami pattern. Below are two simple but powerful strategies that traders commonly use.

Important Note:

The Bearish Harami is a bearish signal. Therefore, you should only open SELL (short) positions when using this pattern.

Strategy 1: Place SELL Orders at the Top

This is a simple strategy suitable for traders who want to catch early reversals.

Entry Point:

Open a SELL order immediately after the Bearish Harami pattern is completed.

Stop-Loss:

Place your stop-loss above the high or shadow of the first bullish candle.

Take-Profit:

Set your take-profit at previous support levels or key demand zones.

This strategy can deliver high rewards but also carries higher risk because the reversal is not always guaranteed. To improve accuracy, combine the pattern with resistance levels or indicators like RSI.

Strategy 2: Trade With the Downtrend

This strategy is safer and more reliable.

Conditions:

- The market must already be in a downtrend

- A Bearish Harami appears after a pullback

Entry Point:

Open a SELL order after the pattern is completed.

Stop-Loss:

Place the stop-loss above the first candle’s high.

Take-Profit:

Set the take-profit at previous support levels or follow the trend using a trailing stop.

This method follows the trend, which increases the probability of success. Many professional traders prefer this strategy because trading with the trend is generally safer.

Tips for Higher Accuracy

To improve your trading results with the Bearish Harami pattern, follow these tips:

- Always trade with the trend

- Use support and resistance levels

- Combine with RSI or moving averages

- Avoid trading during low volatility

- Confirm the pattern on higher timeframes

The best timeframes for this pattern include 15-minute, 1-hour, 4-hour, and daily charts.

Conclusion

The Bearish Harami candlestick pattern is a powerful tool for Forex traders who want to identify potential selling opportunities and market reversals. Its simple structure and clear signal make it easy to recognize, even for beginners.

However, like all trading strategies, it should not be used alone. Combine it with trend analysis, support and resistance, and proper risk management for the best results.

Before using this pattern on a live account, practice on a demo account to understand how it works in real market conditions. With patience and consistent practice, the Bearish Harami can become one of your most reliable Forex trading signals.

Stay disciplined, keep learning, and wish you great success in your Forex trading journey.