The Bearish Engulfing candlestick pattern is one of the most powerful and reliable reversal patterns in Forex trading. Many professional traders rely on this pattern to identify potential market tops and enter high-probability sell trades. If you want to improve your price action trading skills and spot strong reversal signals, mastering the Bearish Engulfing pattern is essential.

In this comprehensive guide, you will learn what the Bearish Engulfing pattern is, how it works, where it appears, and how to trade it successfully in the Forex market.

What Is the Bearish Engulfing Candlestick Pattern?

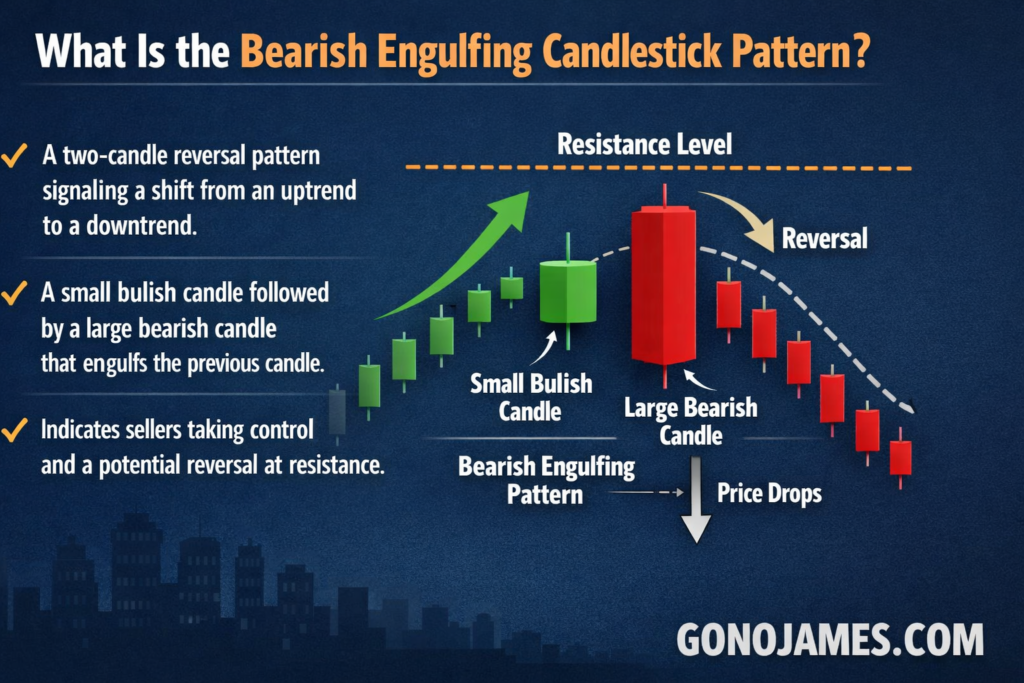

The Bearish Engulfing pattern is a two-candle reversal pattern that signals a potential shift from an uptrend to a downtrend. It typically appears at the top of an uptrend and indicates that sellers are gaining control of the market.

This pattern forms when a smaller bullish candle is followed by a larger bearish candle that completely engulfs the previous candle’s body. The second candle shows strong selling pressure and suggests that buyers are losing momentum.

When this pattern forms at key resistance levels or after a strong uptrend, it can signal a high-probability bearish reversal.

Structure of the Bearish Engulfing Pattern

To properly identify a Bearish Engulfing candlestick pattern, you must understand its structure:

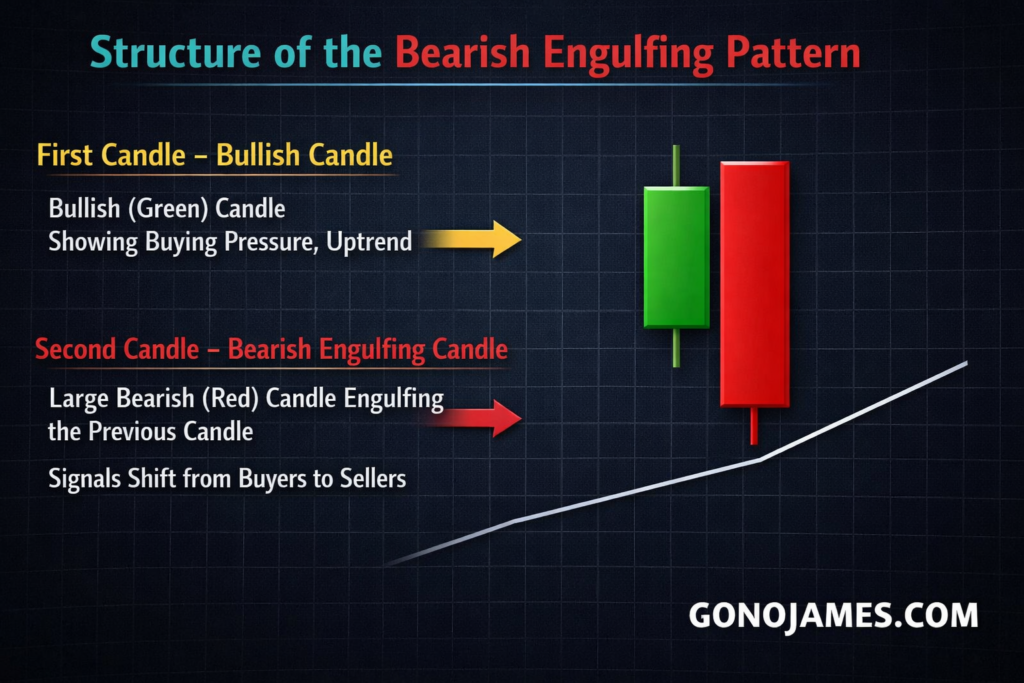

First Candle – Bullish Candle

The first candle is a bullish (green) candle that reflects buying pressure. It confirms that the market is in an uptrend and buyers are currently in control.

Second Candle – Bearish Engulfing Candle

The second candle is a strong bearish (red) candle that completely engulfs the body of the previous bullish candle. This candle opens higher or near the previous close and then closes significantly lower.

The large bearish candle signals a sudden shift in momentum from buyers to sellers.

Market Psychology Behind the Pattern

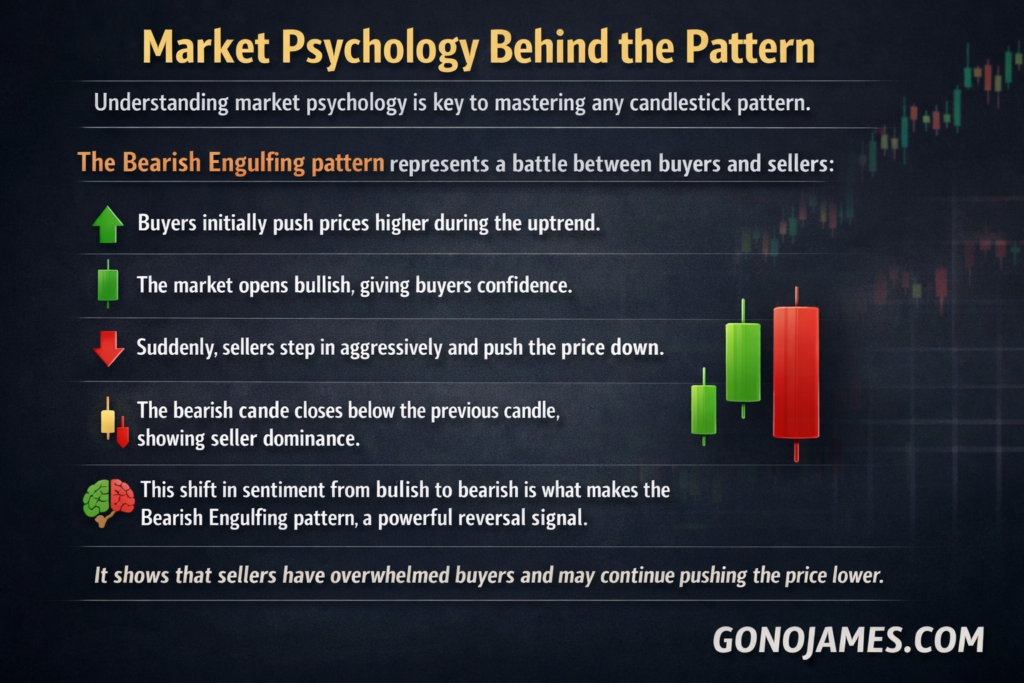

Understanding market psychology is key to mastering any candlestick pattern.

The Bearish Engulfing pattern represents a battle between buyers and sellers:

- Buyers initially push prices higher during the uptrend.

- The market opens bullish, giving buyers confidence.

- Suddenly, sellers step in aggressively and push the price down.

- The bearish candle closes below the previous candle, showing seller dominance.

This shift in sentiment from bullish to bearish is what makes the Bearish Engulfing pattern a powerful reversal signal.

It shows that sellers have overwhelmed buyers and may continue pushing the price lower.

Where the Bearish Engulfing Pattern Works Best

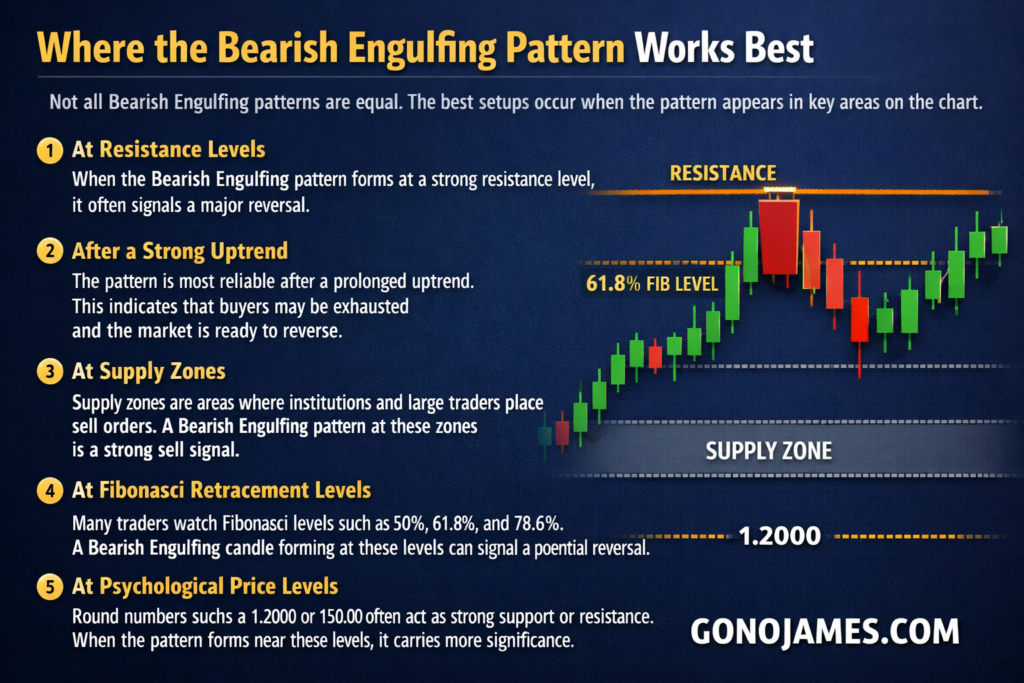

Not all Bearish Engulfing patterns are equal. The best setups occur when the pattern appears in key areas on the chart.

1. At Resistance Levels

When the Bearish Engulfing pattern forms at a strong resistance level, it often signals a major reversal. Resistance is where sellers typically enter the market.

2. After a Strong Uptrend

The pattern is most reliable after a prolonged uptrend. This indicates that buyers may be exhausted and the market is ready to reverse.

3. At Supply Zones

Supply zones are areas where institutions and large traders place sell orders. A Bearish Engulfing pattern at these zones is a strong sell signal.

4. At Fibonacci Retracement Levels

Many traders watch Fibonacci levels such as 50%, 61.8%, and 78.6%. A Bearish Engulfing candle forming at these levels can signal a potential reversal.

5. At Psychological Price Levels

Round numbers such as 1.2000 or 150.00 often act as strong support or resistance. When the pattern forms near these levels, it carries more significance.

How to Trade the Bearish Engulfing Pattern

Trading the Bearish Engulfing pattern requires patience, discipline, and confirmation.

Step 1: Identify the Trend

Look for an existing uptrend. The Bearish Engulfing pattern is a reversal pattern, so it is most effective at the top of an uptrend.

Step 2: Locate Key Resistance

Mark important resistance levels, supply zones, or Fibonacci retracement levels. Wait for price to reach these areas.

Step 3: Wait for the Bearish Engulfing Formation

Once price reaches a key level, watch for the Bearish Engulfing pattern to form. Make sure the bearish candle fully engulfs the previous bullish candle.

Step 4: Confirm the Signal

Do not rush into a trade immediately. Wait for confirmation such as:

- A break below support

- Strong bearish momentum

- High trading volume

- Rejection wicks at resistance

Confirmation increases the probability of a successful trade.

Step 5: Enter the Trade

Enter a sell trade after the bearish candle closes or on a slight pullback. Conservative traders often wait for additional confirmation before entering.

Step 6: Set Stop Loss

Place your stop loss above the high of the Bearish Engulfing candle. This protects your capital if the trade goes against you.

Step 7: Set Take Profit

Your take profit can be placed at:

- Previous support levels

- Risk-to-reward ratio (1:2 or 1:3)

- Next demand zone

Always aim for a favorable risk-to-reward ratio.

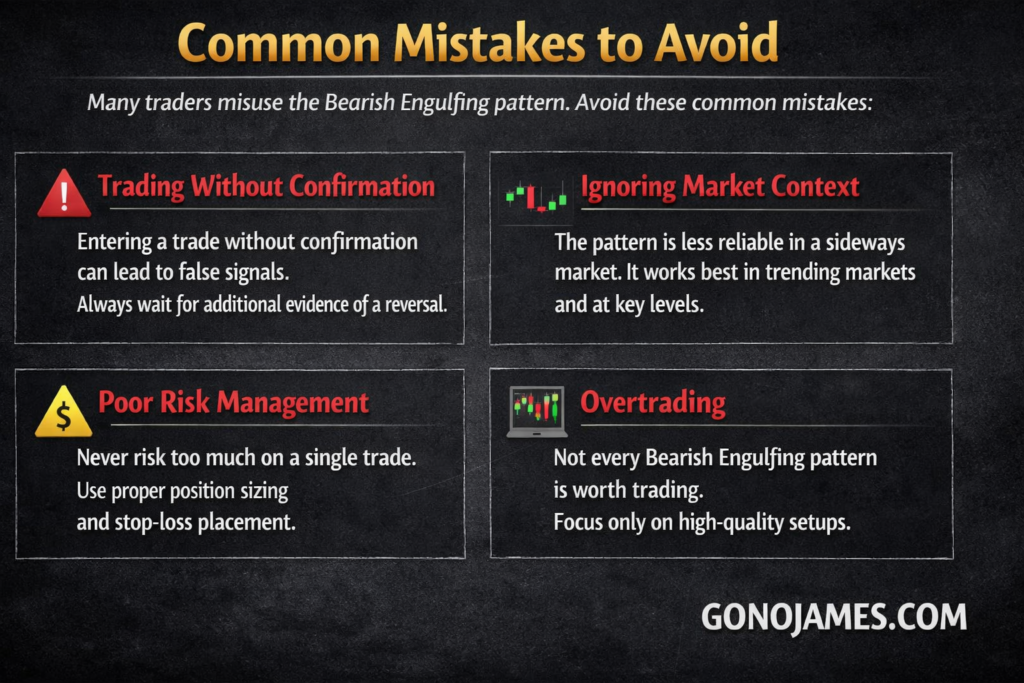

Common Mistakes to Avoid

Many traders misuse the Bearish Engulfing pattern. Avoid these common mistakes:

Trading Without Confirmation

Entering a trade without confirmation can lead to false signals. Always wait for additional evidence of a reversal.

Ignoring Market Context

The pattern is less reliable in a sideways market. It works best in trending markets and at key levels.

Poor Risk Management

Never risk too much on a single trade. Use proper position sizing and stop-loss placement.

Overtrading

Not every Bearish Engulfing pattern is worth trading. Focus only on high-quality setups.

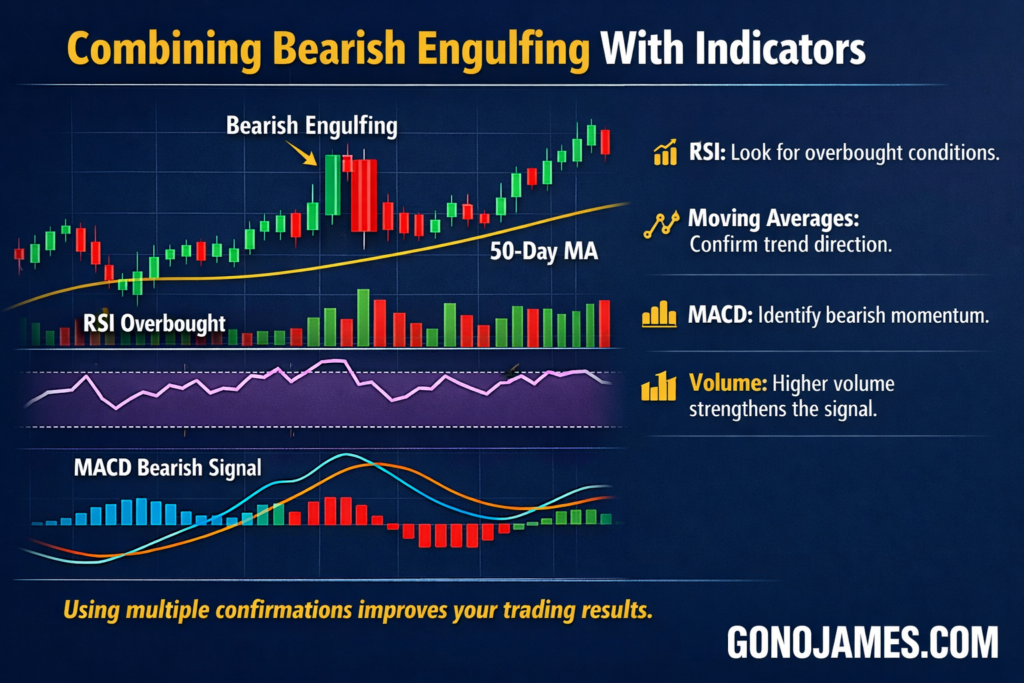

Combining Bearish Engulfing With Indicators

You can increase accuracy by combining the Bearish Engulfing pattern with technical indicators:

- RSI: Look for overbought conditions.

- Moving Averages: Confirm trend direction.

- MACD: Identify bearish momentum.

- Volume: Higher volume strengthens the signal.

Using multiple confirmations improves your trading results.

Final Thoughts

The Bearish Engulfing candlestick pattern is a powerful tool for Forex traders who want to identify market reversals and enter high-probability sell trades. When used correctly, it can help you improve your timing, reduce risk, and increase profitability.

However, like any trading strategy, success comes from practice, discipline, and proper risk management. Always combine the Bearish Engulfing pattern with support and resistance analysis, market structure, and confirmation signals.

By mastering this pattern and applying it consistently, you can significantly improve your Forex trading performance and make smarter trading decisions.

Start practicing on demo charts, refine your strategy, and soon you will be able to trade the Bearish Engulfing pattern with confidence and precision.