Investing in the stock market is one of the most powerful ways to build long-term wealth. However, one of the biggest questions investors ask is simple: When should I enter and exit the market?

Understanding how and when to invest can make a significant difference in long-term returns. Professional investors typically rely on proven strategies rather than emotions or headlines. In this guide, we will explore three powerful investment approaches used by smart investors: Dollar Cost Averaging, Trend Following, and the Hybrid Approach. We will also examine how market cycles and investor behavior impact returns.

Understanding the Challenge of Market Timing

Many retail investors try to predict market highs and lows, but timing the market perfectly is extremely difficult. News headlines, economic fears, and market volatility often cause investors to make emotional decisions.

Professional investors, on the other hand, focus on disciplined strategies that remove emotion and rely on data, trends, and long-term consistency. The key is not predicting every move but following a structured investment plan.

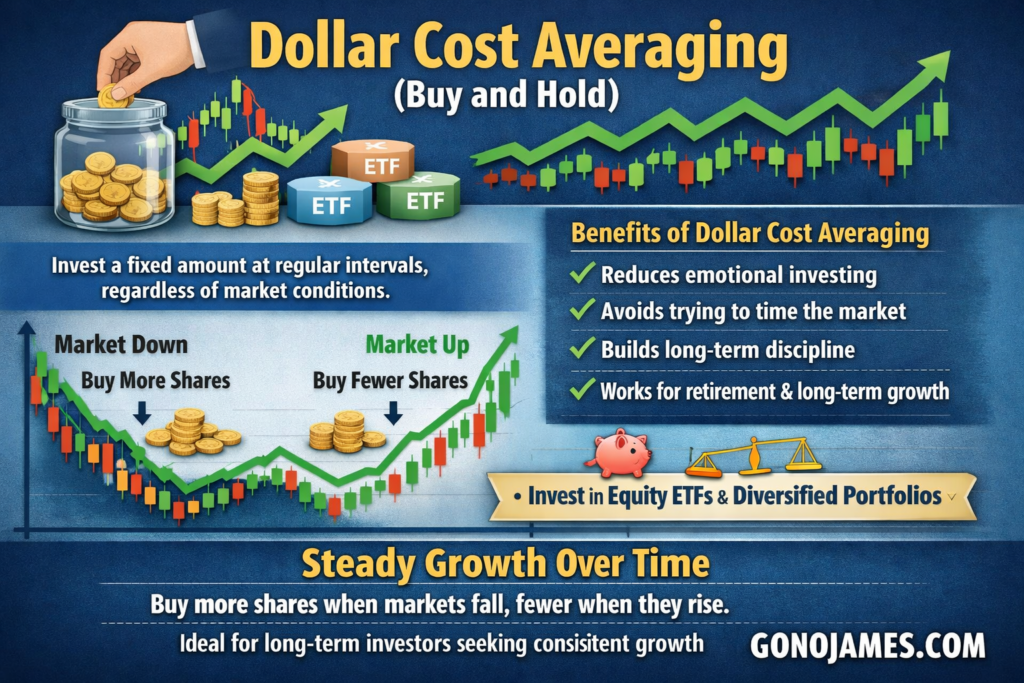

Strategy 1: Dollar Cost Averaging (Buy and Hold)

Dollar Cost Averaging (DCA) is one of the simplest and most effective investment strategies. It involves investing a fixed amount of money at regular intervals, regardless of market conditions.

For example, an investor might invest monthly, quarterly, or annually into a diversified portfolio of ETFs or index funds. Over time, this approach reduces the impact of market volatility.

Benefits of Dollar Cost Averaging

- Reduces emotional investing

- Avoids trying to time the market

- Builds long-term discipline

- Works well for retirement and long-term portfolios

When markets fall, your fixed investment buys more shares. When markets rise, you buy fewer shares. Over time, this helps average out the cost of your investments.

Many successful investors use dollar cost averaging with equity ETFs or multi-asset portfolios. This approach is particularly effective for long-term investors who want steady growth without constant monitoring.

Strategy 2: Trend Following

Trend following is a more active strategy used by professional investors and hedge funds. Instead of investing blindly at fixed intervals, trend investors analyze price movements and market direction.

How Trend Following Works

Trend investors use tools such as moving averages and price action to identify whether the market is in an uptrend or downtrend.

- Buy when the market enters an uptrend or dips during an uptrend

- Sell when the market shows signs of a downtrend

- Avoid investing heavily during strong downtrends

This strategy aims to capture major market gains while avoiding significant losses during bear markets.

Example: SPY Buy & Hold vs Trend Following

Historical data comparing buy-and-hold investing with trend following shows interesting results. Over a 26-year period, buy-and-hold strategies generated strong returns. However, trend-following strategies sometimes delivered even higher returns while reducing large drawdowns.

Trend following helps investors stay invested during bull markets and exit during major downturns. This reduces emotional stress and can improve long-term performance.

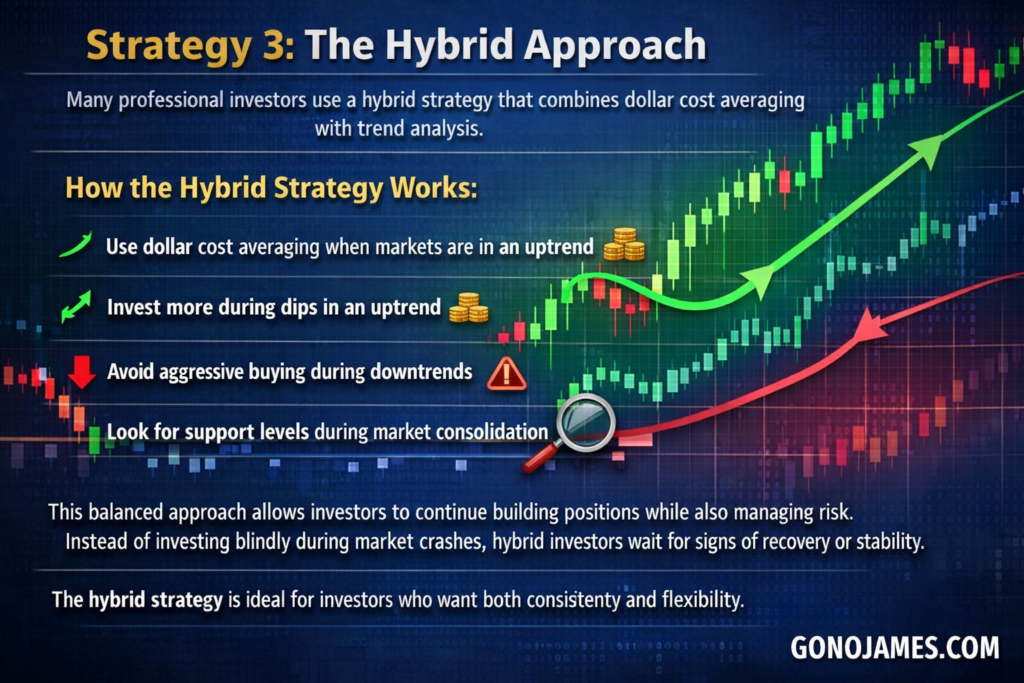

Strategy 3: The Hybrid Approach

Many professional investors use a hybrid strategy that combines dollar cost averaging with trend analysis.

How the Hybrid Strategy Works

- Use dollar cost averaging when markets are in an uptrend

- Invest more during dips in an uptrend

- Avoid aggressive buying during downtrends

- Look for support levels during market consolidation

This balanced approach allows investors to continue building positions while also managing risk. Instead of investing blindly during market crashes, hybrid investors wait for signs of recovery or stability.

The hybrid strategy is ideal for investors who want both consistency and flexibility.

Economic Cycles vs Stock Market Cycles

To invest effectively, it is important to understand that the stock market often moves ahead of the economy. Markets typically recover before economic data improves and decline before recessions officially begin.

Typical Market Cycle

- Market bottom during recession

- Bull market begins during early recovery

- Market peaks during strong economic growth

- Bear market starts before recession

Professional investors monitor economic indicators such as interest rates, consumer confidence, and industrial production. However, price trends often provide the earliest signals.

Understanding cycles helps investors avoid panic selling and recognize opportunities during downturns.

What Retail Investors Do vs Professional Investors

During market crashes, retail investors often panic and sell at the worst possible time. Negative news headlines increase fear and uncertainty, causing many to exit the market near the bottom.

Professional investors usually do the opposite. They follow structured strategies and look for opportunities when fear is highest.

For example, during major market declines, headlines often predict economic disaster. Yet historically, some of the best buying opportunities occur when news is most negative.

Key Differences

Retail Investors:

- React emotionally to news

- Buy during hype and sell during fear

- Lack structured strategy

Professional Investors:

- Follow disciplined systems

- Buy during fear and uncertainty

- Focus on long-term trends

Learning to think like a professional investor can dramatically improve investment results.

Key Lessons for Long-Term Investors

- Consistency beats timing. Regular investing builds wealth over time.

- Follow trends, not emotions. Market direction matters more than headlines.

- Diversification reduces risk. ETFs and multi-asset portfolios provide stability.

- Market downturns create opportunities. Long-term investors benefit from volatility.

- Discipline is the key to success. A structured strategy prevents costly mistakes.

Final Thoughts

There is no perfect investment strategy that works in every situation. However, combining proven approaches like dollar cost averaging, trend following, and hybrid investing can significantly improve long-term results.

Successful investors understand that markets move in cycles. Instead of reacting emotionally, they follow disciplined strategies and focus on long-term growth.

Whether you are a beginner or experienced investor, the key is to stay consistent, manage risk, and think like a professional. Over time, smart investing decisions can build powerful portfolios and lasting wealth.

Start with a clear strategy, stay patient, and let the power of compounding work in your favor.