Exchange-traded funds (ETFs) have become one of the most powerful tools for modern investors. Whether you are a beginner or an experienced investor, ETFs offer diversification, low fees, and flexibility. With the right strategy, ETFs can help you build long-term wealth while managing risk and market volatility.

In this guide, we will explore two of the most effective ETF investment strategies: the All Weather Portfolio, dollar cost averaging, and trend following. These proven approaches are widely used by successful investors and can help you navigate both bull and bear markets with confidence.

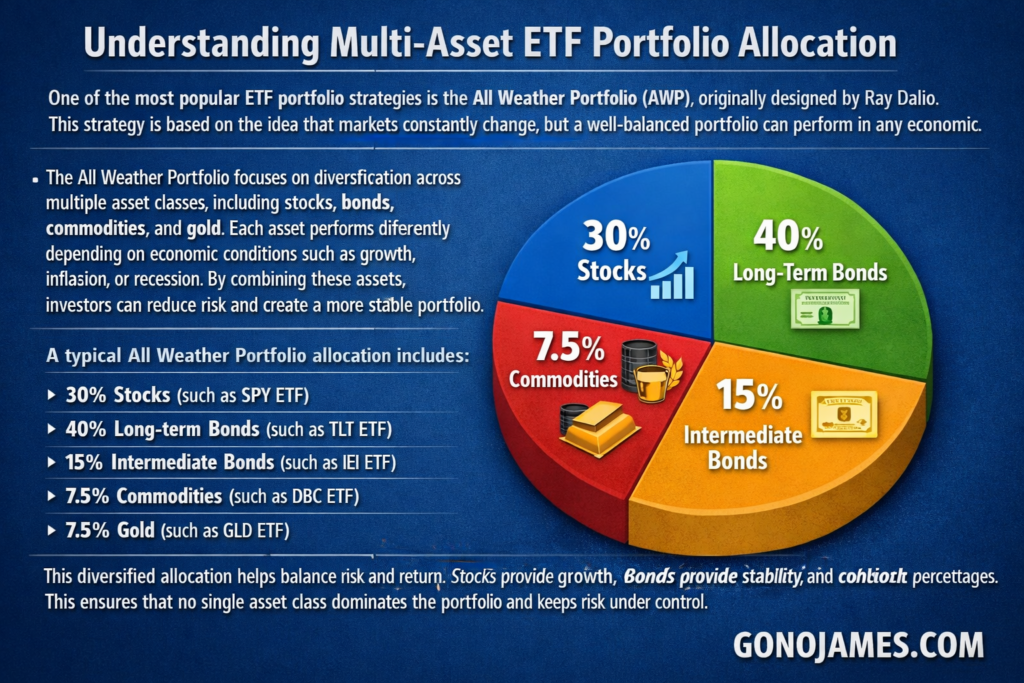

Understanding Multi-Asset ETF Portfolio Allocation

One of the most popular ETF portfolio strategies is the All Weather Portfolio (AWP), originally designed by Ray Dalio. This strategy is based on the idea that markets constantly change, but a well-balanced portfolio can perform in any economic environment.

The All Weather Portfolio focuses on diversification across multiple asset classes, including stocks, bonds, commodities, and gold. Each asset performs differently depending on economic conditions such as growth, inflation, or recession. By combining these assets, investors can reduce risk and create a more stable portfolio.

A typical All Weather Portfolio allocation includes:

- 30% Stocks (such as SPY ETF)

- 40% Long-term bonds (such as TLT ETF)

- 15% Intermediate bonds (such as IEI ETF)

- 7.5% Commodities (such as DBC ETF)

- 7.5% Gold (such as GLD ETF)

This diversified allocation helps balance risk and return. Stocks provide growth, bonds provide stability, and commodities and gold protect against inflation and economic uncertainty.

The key to maintaining this strategy is annual rebalancing. Once a year, investors adjust their portfolio back to the original percentages. This ensures that no single asset class dominates the portfolio and keeps risk under control.

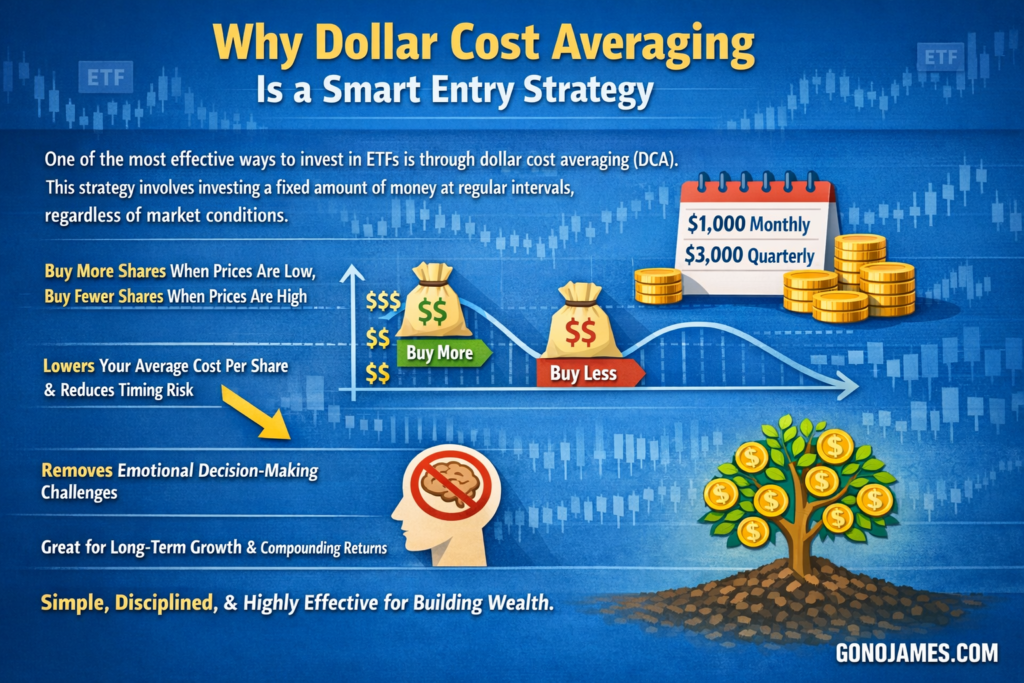

Why Dollar Cost Averaging Is a Smart Entry Strategy

One of the most effective ways to invest in ETFs is through dollar cost averaging (DCA). This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions.

For example, instead of investing $12,000 all at once, you might invest $1,000 every month or $3,000 every quarter. By doing this, you automatically buy more shares when prices are low and fewer shares when prices are high.

Over time, this approach lowers your average cost per share and reduces the risk of investing at the wrong time. It also removes emotional decision-making, which is one of the biggest challenges for investors.

Dollar cost averaging works especially well for long-term investors. By consistently investing over many years, you can take advantage of market growth and compound returns. This strategy is simple, disciplined, and highly effective for building wealth.

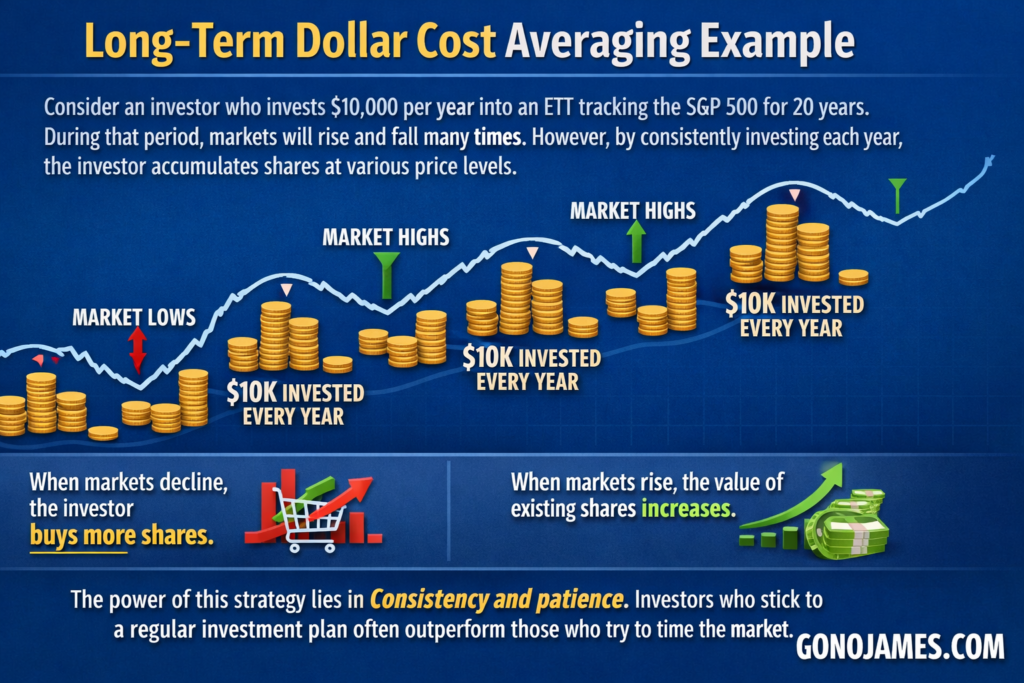

Long-Term Dollar Cost Averaging Example

Consider an investor who invests $10,000 per year into an ETF tracking the S&P 500 for 20 years. During that period, markets will rise and fall many times. However, by consistently investing each year, the investor accumulates shares at various price levels.

When markets decline, the investor buys more shares. When markets rise, the value of existing shares increases. Over time, this creates a balanced average cost and a growing portfolio.

The power of this strategy lies in consistency and patience. Investors who stick to a regular investment plan often outperform those who try to time the market.

Trend Following: A More Active ETF Strategy

While dollar cost averaging focuses on long-term investing, trend following is a more active strategy. This approach involves identifying market trends and making investment decisions based on price movements and technical indicators.

Trend following aims to capture gains during uptrends and reduce losses during downtrends. Instead of holding investments through all market conditions, investors adjust their positions based on market direction.

One common method is using moving averages to identify trends. For example:

- Buy when the market is in an uptrend and above key moving averages

- Sell or reduce exposure when the market enters a downtrend

This strategy helps investors stay invested during strong market growth while avoiding major declines.

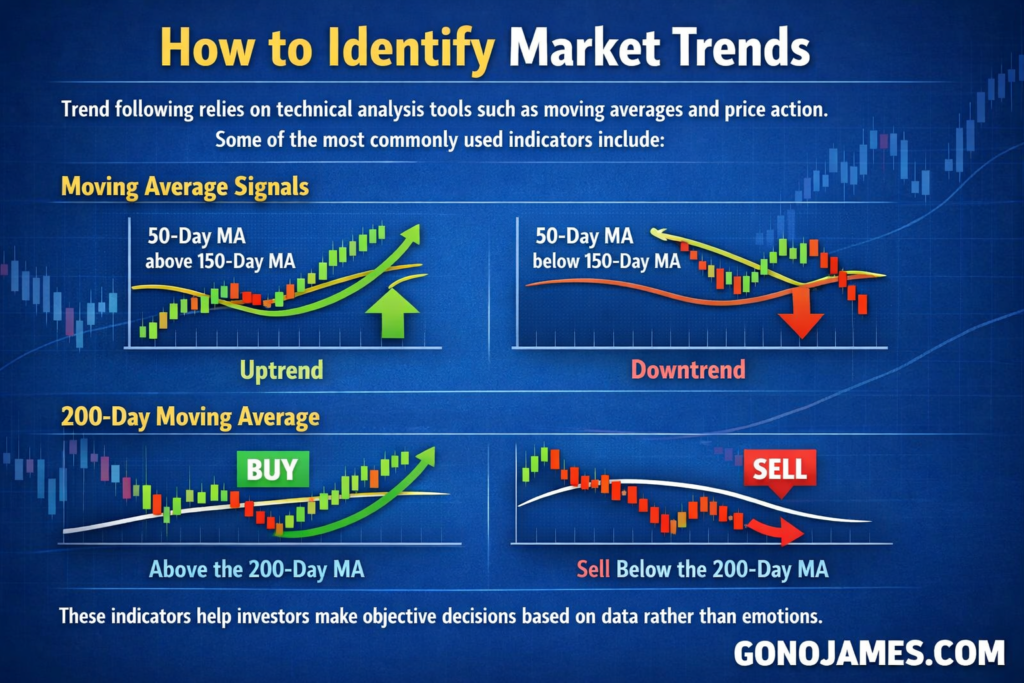

How to Identify Market Trends

Trend following relies on technical analysis tools such as moving averages and price action. Some of the most commonly used indicators include:

Moving Average Signals

- When the 50-day moving average is above the 150-day moving average, it indicates an uptrend

- When the 50-day moving average falls below the 150-day moving average, it signals a potential downtrend

Another widely used signal is the 200-day moving average:

- Buy when price is above the 200-day moving average and trending upward

- Sell when price falls below the 200-day moving average and trends downward

These indicators help investors make objective decisions based on data rather than emotions.

Combining Strategies for Maximum Results

The most successful ETF investors often combine multiple strategies. For example:

- Use dollar cost averaging to build long-term positions

- Use trend following to manage risk and adjust exposure

- Maintain a diversified multi-asset portfolio

This balanced approach allows investors to benefit from long-term market growth while protecting against major downturns.

A diversified ETF portfolio combined with disciplined investing can deliver consistent returns over time. It also reduces stress by removing the need to predict short-term market movements.

Key Principles for Successful ETF Investing

To achieve long-term success with ETFs, investors should follow several key principles:

1. Stay Consistent

Invest regularly and avoid trying to time the market. Consistency is more important than perfect timing.

2. Diversify Across Assets

A multi-asset portfolio reduces risk and improves stability during market volatility.

3. Rebalance Periodically

Review your portfolio once a year and rebalance to maintain your target allocation.

4. Control Emotions

Market fluctuations are normal. Avoid panic selling during downturns and stay focused on long-term goals.

5. Think Long Term

Wealth is built over years, not days. Patience and discipline are essential for investment success.

Final Thoughts

ETF investing offers one of the simplest and most effective ways to build wealth over time. By using strategies such as dollar cost averaging, trend following, and diversified portfolio allocation, investors can create a powerful system for long-term growth.

The key is to stay disciplined, remain consistent, and focus on long-term objectives. Markets will always experience ups and downs, but a well-structured ETF strategy can help you navigate any environment with confidence.

Whether you are just starting your investment journey or looking to improve your current strategy, ETFs provide a flexible and low-cost solution for achieving financial freedom.