Exchange Traded Funds (ETFs) have become one of the most popular investment tools in the world. From beginner investors to professional fund managers, ETFs offer a simple, low-cost, and highly diversified way to grow wealth over time. Whether you want to invest in the U.S. stock market, global markets, bonds, commodities, or emerging technologies, ETFs provide an easy path to participate in financial growth.

If your goal is to build long-term wealth with less risk and complexity, understanding ETFs is essential.

What Is an ETF?

An ETF is a basket of assets such as stocks, bonds, or commodities that tracks an underlying index. Instead of buying individual stocks, investors can buy a single ETF that represents a large group of companies or assets.

For example, when you invest in an S&P 500 ETF, you are investing in 500 of the largest companies in the United States. This provides instant diversification and reduces the risk associated with investing in a single company.

Unlike mutual funds, ETFs trade on stock exchanges just like individual stocks. This means investors can buy and sell ETFs throughout the trading day at market prices. ETFs own the underlying assets and divide ownership into shares. When investors purchase ETF shares, they own a portion of the entire portfolio.

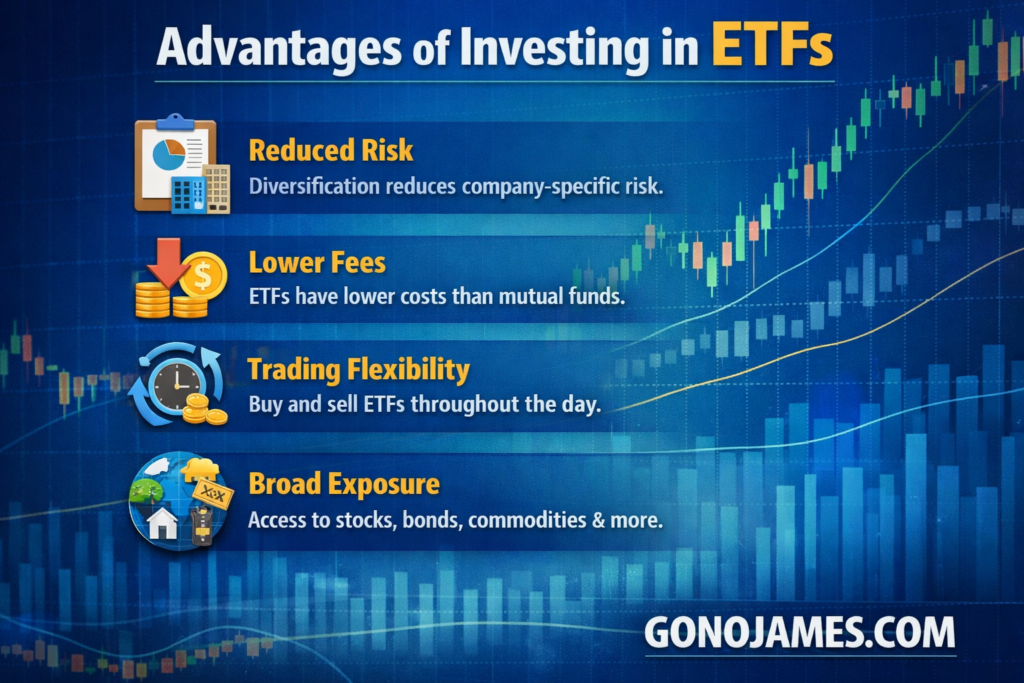

Advantages of Investing in ETFs

ETFs have gained global popularity because they offer several key advantages that make investing simpler and more efficient.

First, ETFs reduce company-specific risk. Because they hold multiple assets, poor performance from one company has less impact on the overall investment. This diversification helps stabilize returns over time.

Second, ETFs generally have lower fees compared to actively managed mutual funds. Many ETFs simply track an index, which reduces management costs and allows investors to keep more of their returns.

Third, ETFs provide flexibility. Investors can trade them throughout the day, just like stocks. They can also be used for both long-term investing and short-term trading strategies.

Fourth, ETFs give access to multiple markets and asset classes. Investors can easily gain exposure to stocks, bonds, real estate, commodities, currencies, and even specific industries such as technology or clean energy.

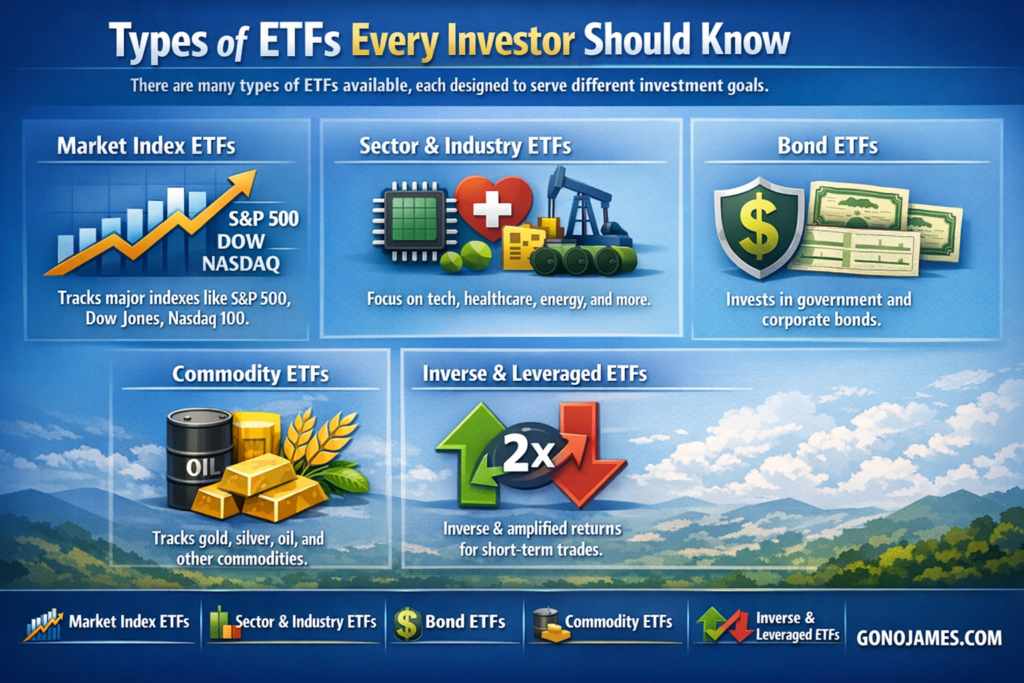

Types of ETFs Every Investor Should Know

There are many types of ETFs available, each designed to serve different investment goals.

Market Index ETFs track major stock market indexes such as the S&P 500, Dow Jones Industrial Average, or Nasdaq 100. These are often considered the foundation of a long-term investment portfolio because they provide broad market exposure and consistent growth over time.

Sector and Industry ETFs focus on specific sectors like technology, healthcare, financials, energy, or consumer goods. These ETFs allow investors to target industries with strong growth potential, such as artificial intelligence, cloud computing, cybersecurity, robotics, and clean energy.

Bond ETFs invest in government or corporate bonds. They provide income and stability, making them useful for investors who want to reduce volatility and generate consistent returns. Bond ETFs often perform differently from stocks, helping balance a portfolio during market fluctuations.

Commodity ETFs track physical commodities such as gold, silver, oil, and agricultural products. These ETFs can help protect against inflation and provide diversification beyond traditional stocks and bonds.

Inverse and Leveraged ETFs are advanced products designed for experienced traders. Inverse ETFs move in the opposite direction of an index, allowing investors to profit when markets decline. Leveraged ETFs aim to amplify returns but also increase risk, making them suitable only for short-term strategies.

How to Choose the Right ETF

With thousands of ETFs available, selecting the right one requires careful analysis. Smart investors evaluate several key factors before investing.

Fund Size and Management Company: Larger ETFs with strong assets under management tend to be more stable and liquid. Reputable fund providers such as Vanguard, BlackRock, and State Street are known for reliability and low fees.

Holdings and Diversification: Review how many companies or assets the ETF holds and how they are weighted. A well-diversified ETF reduces risk and provides balanced exposure.

Expense Ratio: This represents the annual management fee. Lower expense ratios help maximize long-term returns.

Trading Volume: Higher trading volume means better liquidity and easier buying or selling without affecting price.

Performance History: While past performance does not guarantee future results, reviewing long-term trends helps investors understand how an ETF performs during different market conditions.

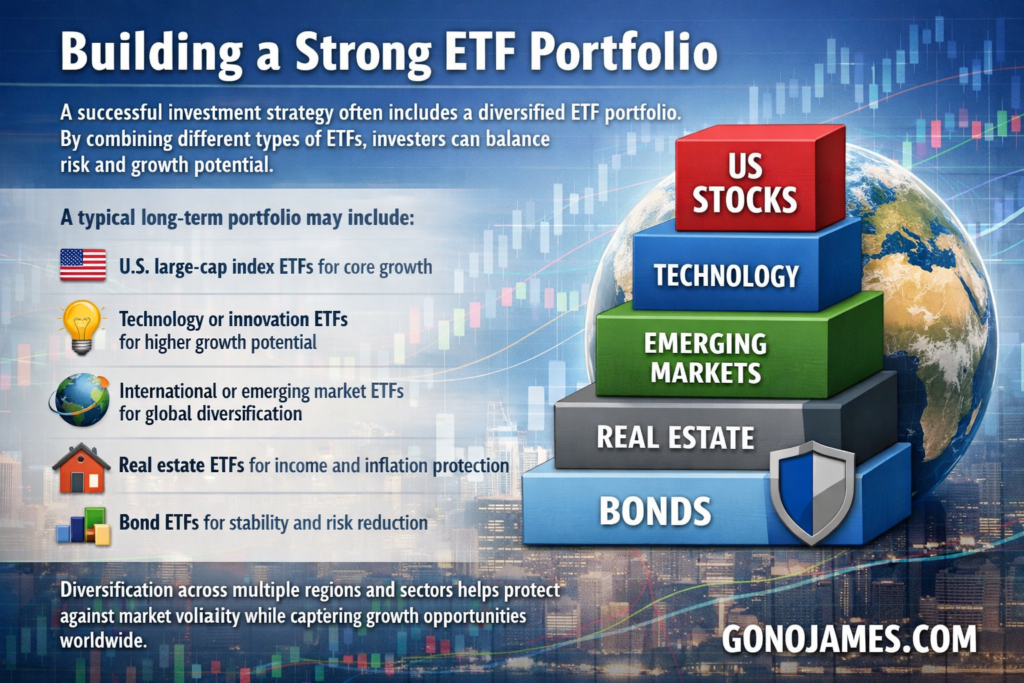

Building a Strong ETF Portfolio

A successful investment strategy often includes a diversified ETF portfolio. By combining different types of ETFs, investors can balance risk and growth potential.

A typical long-term portfolio may include:

- U.S. large-cap index ETFs for core growth

- Technology or innovation ETFs for higher growth potential

- International or emerging market ETFs for global diversification

- Real estate ETFs for income and inflation protection

- Bond ETFs for stability and risk reduction

Diversification across multiple regions and sectors helps protect against market volatility while capturing growth opportunities worldwide.

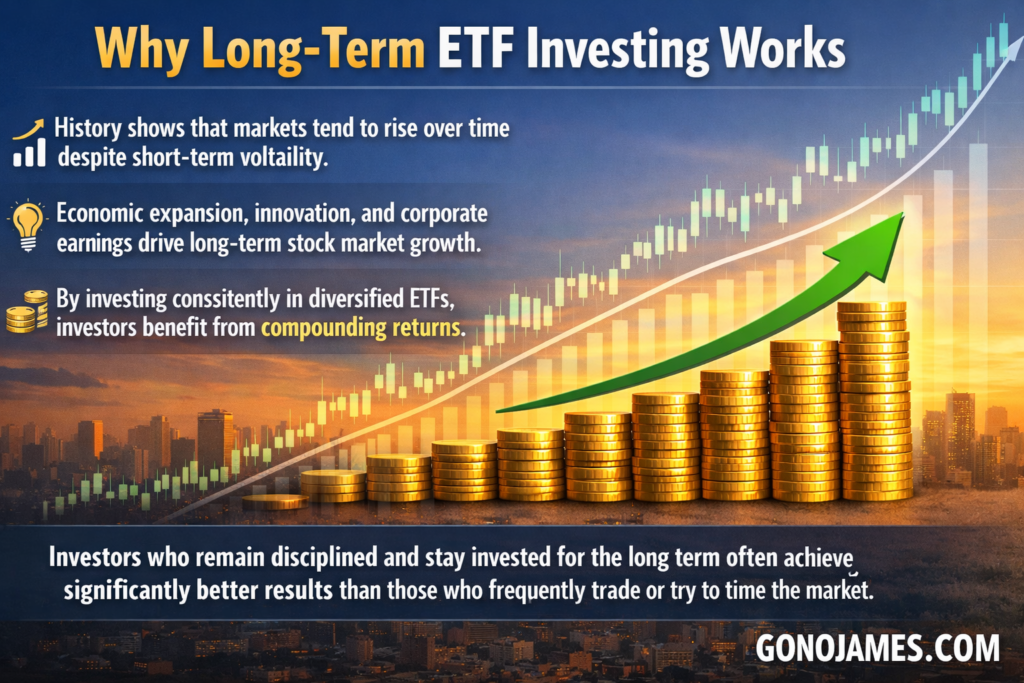

Why Long-Term ETF Investing Works

History shows that markets tend to rise over time despite short-term volatility. Economic expansion, innovation, and corporate earnings drive long-term stock market growth. By investing consistently in diversified ETFs, investors benefit from compounding returns.

Compounding allows investment earnings to generate additional earnings over time. This snowball effect is one of the most powerful forces in wealth building. Investors who remain disciplined and stay invested for the long term often achieve significantly better results than those who frequently trade or try to time the market.

Final Thoughts

ETFs have transformed the investment landscape by making it easier than ever to build a diversified portfolio. They offer simplicity, transparency, flexibility, and cost efficiency, making them ideal for both beginners and experienced investors.

Whether your goal is long-term wealth creation, passive income, or portfolio diversification, ETFs provide a powerful solution. By choosing the right ETFs and maintaining a disciplined investment strategy, investors can participate in global market growth and build financial security over time.

For smart investors looking to grow wealth consistently, ETFs remain one of the best and simplest ways to invest in today’s financial markets.