The stock market is one of the most powerful wealth-building tools ever created. However, many new investors misunderstand how markets move and often make emotional decisions based on short-term price changes. To succeed in investing, it is essential to understand one simple truth: stock prices move in cycles.

These cycles include bull markets, bear markets, and temporary corrections. Smart investors do not fear these movements — they use them as opportunities to build long-term wealth. By understanding how market trends work, you can position yourself to benefit from both rising and falling markets.

Stock Prices Move in Trends

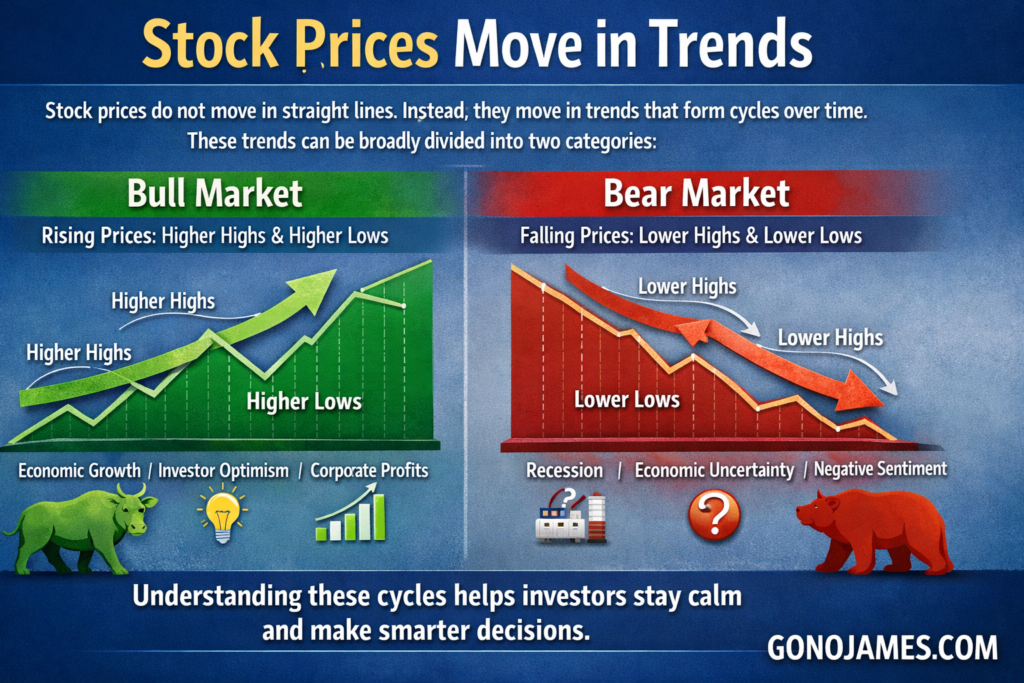

Stock prices do not move in straight lines. Instead, they move in trends that form cycles over time. These trends can be broadly divided into two categories:

Bull markets and bear markets.

A bull market occurs when stock prices are rising over time. During a bull market, prices form higher highs and higher lows. This means that even when prices temporarily fall, they eventually recover and move higher. Bull markets are usually driven by economic growth, corporate profits, innovation, and investor optimism.

A bear market is the opposite. It occurs when stock prices decline over time and form lower highs and lower lows. Bear markets are often associated with recessions, economic uncertainty, and negative investor sentiment. While they can be stressful, they are a natural part of the investing cycle and do not last forever.

Understanding these cycles helps investors stay calm and make smarter decisions rather than reacting emotionally to short-term market movements.

Bull Markets Create Opportunities

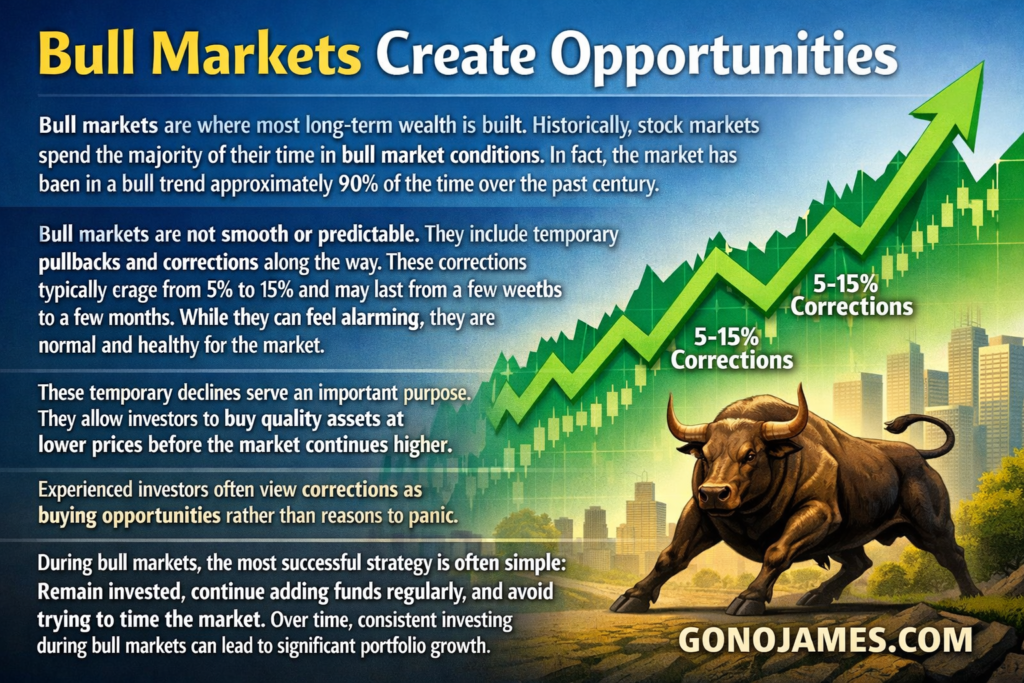

Bull markets are where most long-term wealth is built. Historically, stock markets spend the majority of their time in bull market conditions. In fact, the market has been in a bull trend approximately 90% of the time over the past century.

Bull markets are not smooth or predictable. They include temporary pullbacks and corrections along the way. These corrections typically range from 5% to 15% and may last from a few weeks to a few months. While they can feel alarming, they are normal and healthy for the market.

These temporary declines serve an important purpose. They allow investors to buy quality assets at lower prices before the market continues higher. Experienced investors often view corrections as buying opportunities rather than reasons to panic.

During bull markets, the most successful strategy is often simple: remain invested, continue adding funds regularly, and avoid trying to time the market. Over time, consistent investing during bull markets can lead to significant portfolio growth.

Bear Markets Are Bigger Opportunities

Although bear markets can be uncomfortable, they often provide the greatest opportunities for long-term investors. Historically, bear markets occur every 6 to 8 years and typically last between 6 months and 18 months.

During a bear market, stock prices can decline significantly. On average, markets may fall around 30% to 40%, and in severe cases, declines can reach 50% or more. These declines can create fear and cause many investors to sell at the worst possible time.

However, history shows that bear markets never last forever. Every bear market in modern history has eventually been followed by a new bull market. When markets recover, they often reach new highs over time.

For long-term investors, bear markets present rare opportunities to buy high-quality assets at discounted prices. Investors who continue investing during downturns often benefit the most when markets recover. This is why many experienced investors view bear markets not as threats, but as opportunities.

The History of Bull and Bear Markets

Looking at market history since the 1930s reveals a powerful pattern. Bull markets have lasted far longer than bear markets and have produced significantly larger gains. While bear markets are sharp and noticeable, they are relatively short compared to the long periods of growth that follow.

Over decades, markets have consistently trended upward despite recessions, wars, political changes, and global crises. This long-term upward trend is driven by innovation, population growth, productivity, and the expansion of global economies.

Investors who focus on long-term trends rather than short-term volatility are more likely to succeed. Instead of trying to predict every market movement, successful investors stay invested and allow time and compounding to work in their favor.

Key Learning Points for Investors

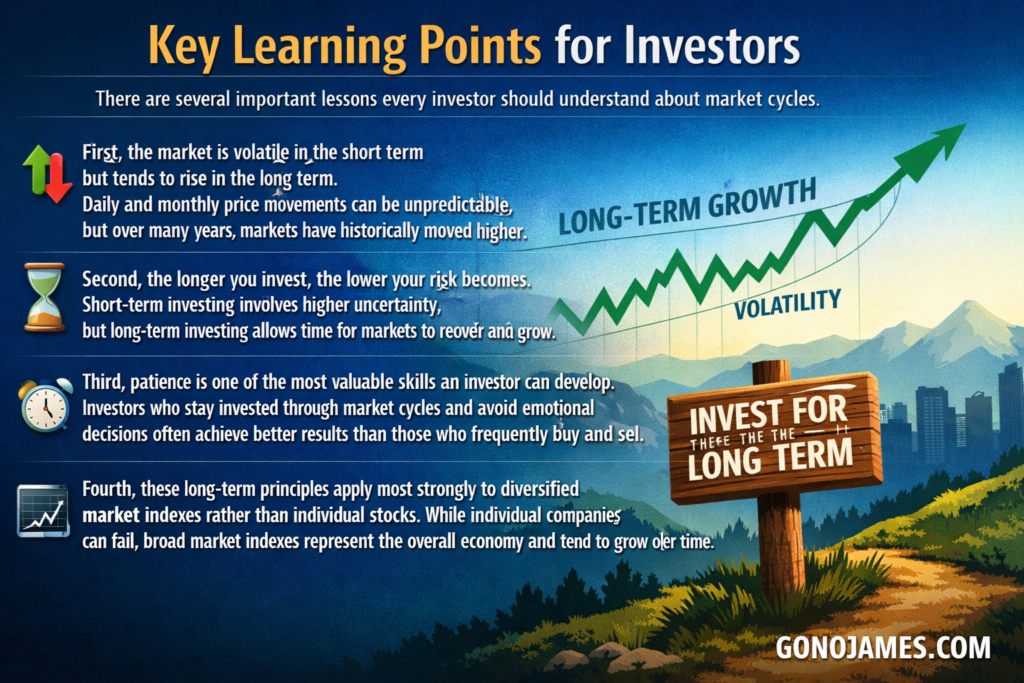

There are several important lessons every investor should understand about market cycles.

First, the market is volatile in the short term but tends to rise in the long term. Daily and monthly price movements can be unpredictable, but over many years, markets have historically moved higher.

Second, the longer you invest, the lower your risk becomes. Short-term investing involves higher uncertainty, but long-term investing allows time for markets to recover and grow.

Third, patience is one of the most valuable skills an investor can develop. Investors who stay invested through market cycles and avoid emotional decisions often achieve better results than those who frequently buy and sell.

Fourth, these long-term principles apply most strongly to diversified market indexes rather than individual stocks. While individual companies can fail, broad market indexes represent the overall economy and tend to grow over time.

Why Index Investing and ETFs Make Sense

One of the simplest and most effective strategies for long-term investors is investing in exchange-traded funds (ETFs) that track major market indexes. ETFs provide diversification by holding many companies in a single investment. This reduces risk compared to investing in individual stocks.

Index ETFs track major benchmarks such as the S&P 500 or global stock markets. Because they reflect the performance of many companies, they tend to grow over time as economies expand and businesses innovate.

By consistently investing in index-tracking ETFs, investors can participate in the long-term growth of the market without needing to pick individual winners. This strategy also reduces emotional decision-making and encourages disciplined investing.

Final Thoughts

The stock market operates in cycles, but the long-term trend has historically been upward. Bull markets create growth opportunities, while bear markets create buying opportunities. Investors who understand these cycles can remain calm and confident regardless of short-term market conditions.

Success in investing does not come from predicting every market move. It comes from understanding market behavior, staying disciplined, and maintaining a long-term perspective. By focusing on consistent investing and broad market exposure through index ETFs, anyone can participate in the wealth-building power of the stock market.

The key is simple: stay patient, stay invested, and let time work in your favor.