Welcome to the Professional Value Investing Course, a comprehensive and structured program created for individuals who want to master the timeless principles of value investing and achieve long-term financial success. This course is carefully designed for both beginners who are new to investing and experienced investors who want to refine their strategies, improve portfolio performance, and build sustainable wealth.

Value investing remains one of the most respected and proven investment approaches in the financial world. By focusing on the intrinsic value of companies rather than short-term market fluctuations, value investors aim to identify opportunities where assets are trading below their true worth. This disciplined approach allows investors to make smarter decisions, minimize risk, and achieve consistent long-term returns.

Our Professional Value Investing Course offers a step-by-step pathway to understanding and applying these powerful concepts in real-world markets. Whether your goal is financial independence, professional growth, or portfolio expansion, this course will provide you with the tools and knowledge needed to succeed.

Understanding the Foundations of Value Investing

The course begins with a strong foundation in value investing principles. You will explore the origins of value investing and understand how legendary investors built their wealth using this strategy. The philosophy emphasizes buying high-quality companies at a discount and holding them for long-term growth.

One of the core ideas of value investing is intrinsic value. Intrinsic value represents the true worth of a company based on its financial performance, assets, and future earnings potential. Throughout the course, you will learn how to calculate and evaluate intrinsic value using proven methods and financial models.

Another essential concept is the margin of safety. This principle ensures that investors purchase assets at a price significantly below their intrinsic value, reducing risk and increasing the potential for profit. By mastering these foundational ideas, you will develop a disciplined investment mindset that prioritizes long-term success over short-term speculation.

Mastering Fundamental Analysis

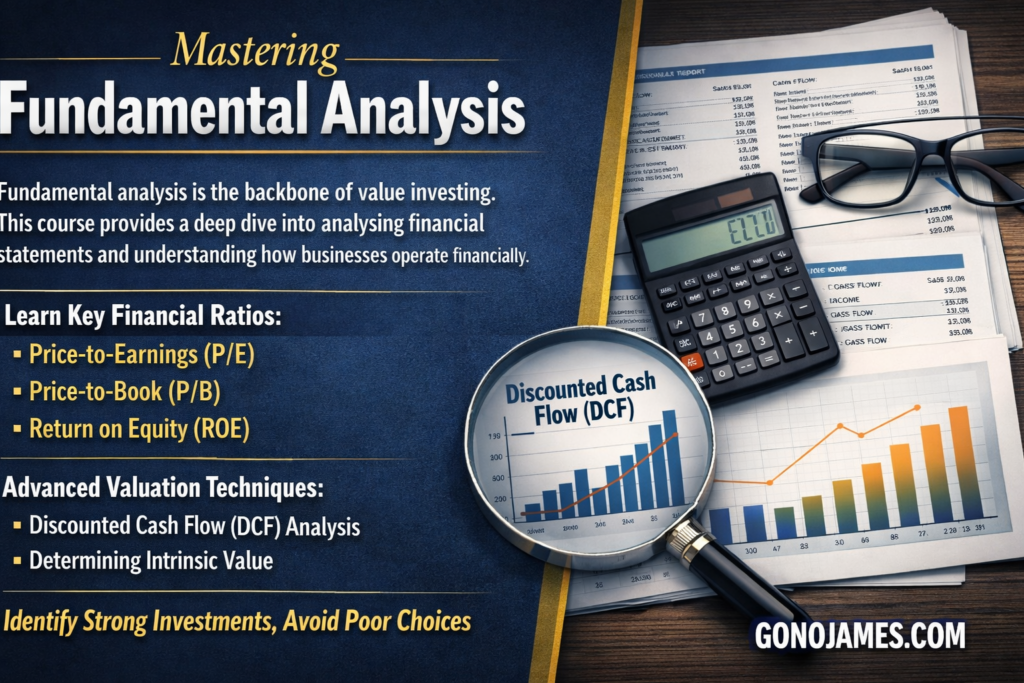

Fundamental analysis is the backbone of value investing. This course provides a deep dive into analyzing financial statements and understanding how businesses operate financially. You will learn how to read and interpret balance sheets, income statements, and cash flow statements to evaluate a company’s financial health.

Understanding key financial metrics is crucial for making informed investment decisions. The course teaches you how to use important ratios such as Price-to-Earnings (P/E), Price-to-Book (P/B), and Return on Equity (ROE) to assess company performance and compare investment opportunities.

In addition to basic metrics, you will explore advanced valuation techniques like Discounted Cash Flow (DCF) analysis. This method allows investors to estimate the future cash flows of a company and determine its present value. By mastering these tools, you will be able to identify strong businesses and avoid poor investments.

Identifying Undervalued Investment Opportunities

Once you have a solid understanding of financial analysis, the course focuses on finding undervalued stocks and assets. You will learn how to identify companies with strong fundamentals, sustainable competitive advantages, and long-term growth potential.

The program teaches you how to evaluate management quality, analyze industry trends, and detect warning signs such as excessive debt or declining revenue. You will also discover how to use stock screening tools to filter thousands of companies and identify those that meet your investment criteria.

Through structured evaluation methods and real-world examples, you will gain confidence in selecting high-quality investments that align with your financial goals.

Market Psychology and Behavioral Finance

Successful investing requires more than just numbers. Understanding market psychology and investor behavior is essential for making rational decisions. This course explores the emotional and psychological factors that influence financial markets.

You will learn about common cognitive biases such as fear, greed, overconfidence, and herd mentality. These biases often lead investors to make poor decisions, especially during market volatility. By recognizing and managing these behaviors, you can maintain discipline and stay focused on long-term strategies.

The course also explains market cycles and how to navigate them effectively. By understanding economic trends and market phases, you will be better prepared to identify opportunities during downturns and avoid overpaying during market peaks.

Building and Managing a Value Portfolio

Creating a successful investment portfolio requires careful planning and strategic management. This course provides a comprehensive guide to building a diversified portfolio that balances risk and return.

You will learn how to allocate assets effectively, diversify across industries, and manage risk through proper position sizing. Regular portfolio reviews and performance evaluations are also covered to ensure your investments remain aligned with your financial objectives.

Risk management strategies are a key component of this module. You will learn how to protect your capital during volatile market conditions and maintain stability in your portfolio. Techniques such as diversification, long-term holding strategies, and disciplined decision-making are emphasized throughout the course.

Real-World Case Studies and Practical Learning

To bridge theory and practice, the course includes real-world case studies and examples of successful value investments. By analyzing historical investment decisions and outcomes, you will gain valuable insights into how professional investors think and act.

Practical exercises and simulations allow you to apply your knowledge in realistic scenarios. You will practice evaluating companies, calculating intrinsic value, and constructing a sample portfolio. This hands-on approach ensures that you develop practical skills that can be used immediately in real markets.

Advanced Value Investing Strategies

For those who want to take their investing skills to a professional level, the course covers advanced strategies such as deep value investing and special situations investing. These strategies focus on finding overlooked opportunities with high potential returns.

You will also explore advanced risk management techniques and learn how experienced investors identify opportunities during market downturns. These insights can help you stay ahead of market trends and maximize returns over time.

Ethical and Responsible Investing

Modern investors must also consider ethical and responsible investing practices. The course discusses the importance of environmental, social, and governance (ESG) factors in evaluating companies. By incorporating ethical considerations into your investment strategy, you can build a portfolio that aligns with both financial and social goals.

Maintaining integrity, transparency, and professionalism is emphasized throughout the course, ensuring that you develop a responsible approach to investing.

Conclusion: Start Your Journey to Financial Success

The Professional Value Investing Course is designed to provide a complete and practical education in value investing. From foundational concepts to advanced strategies, this program equips you with the knowledge, skills, and confidence needed to succeed in today’s financial markets.

By the end of the course, you will be able to identify undervalued opportunities, perform detailed financial analysis, build a strong investment portfolio, and make disciplined decisions based on long-term value. Whether you are just starting your investing journey or looking to enhance your expertise, this course offers the tools and guidance needed to achieve lasting financial success.

Take the next step toward mastering value investing and building long-term wealth with confidence and clarity.