The Three Inside Down candlestick pattern is one of the most reliable bearish reversal patterns used in Forex trading. This pattern consists of three candlesticks that signal a shift in market momentum from bullish to bearish. For traders looking to identify potential market tops and place accurate sell orders, understanding this pattern can provide a significant advantage.

Japanese candlestick patterns have long been used by professional traders to analyze price movements and market psychology. Among these patterns, the Three Inside Down stands out as a powerful warning sign that an uptrend may be coming to an end. In this article, we will explore the structure, meaning, variants, and trading strategies associated with the Three Inside Down candlestick pattern so you can use it effectively in your Forex trading.

What Is the Three Inside Down Candlestick Pattern?

The Three Inside Down candlestick pattern is a bearish reversal pattern that typically appears at the top of an uptrend. It consists of three candles that together indicate a shift in control from buyers to sellers. When this pattern forms, it suggests that the bullish momentum is weakening and that a potential downward trend may soon begin.

This pattern is considered a strong signal because it reflects a gradual change in market sentiment. At first, buyers are in control and pushing prices higher. However, as the pattern develops, sellers begin to take over, eventually leading to a bearish reversal.

In Forex trading, recognizing this pattern early can help traders open precise sell positions at the top of the market. This allows them to maximize profits while minimizing risk.

Structure of the Three Inside Down Pattern

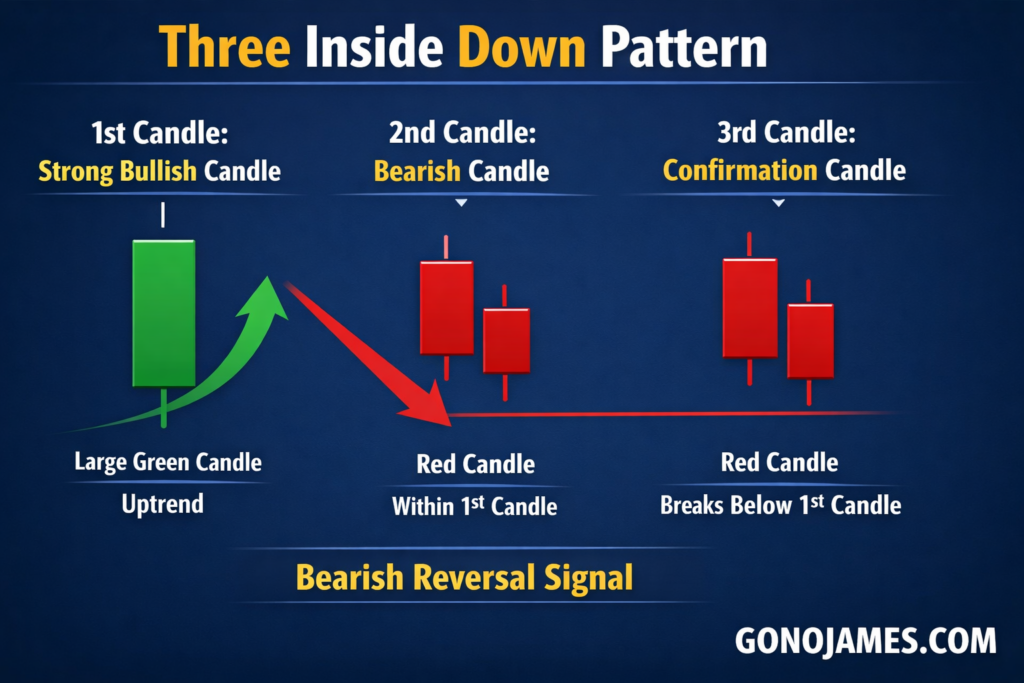

To identify the Three Inside Down pattern correctly, traders must understand its structure. A standard Three Inside Down pattern consists of three specific candlesticks that appear in sequence.

First Candlestick: Strong Bullish Candle

The first candle is a large green (bullish) candlestick that appears during an uptrend. This candle reflects strong buying pressure and confirms that buyers are still in control of the market.

Second Candlestick: Bearish Candle

The second candle is a red (bearish) candlestick that forms within the body of the first candle. Ideally, it should retrace at least half of the first candle’s length. This candle indicates that selling pressure has begun to appear and that the bullish momentum is weakening.

Third Candlestick: Confirmation Candle

The third candle is another red bearish candle. Its closing price must be lower than the opening price of the first candle. This confirms that sellers have taken control and that a bearish reversal is likely to occur.

When these three candles form together, they create a clear signal that the market may reverse from an uptrend to a downtrend.

Variations of the Three Inside Down Pattern

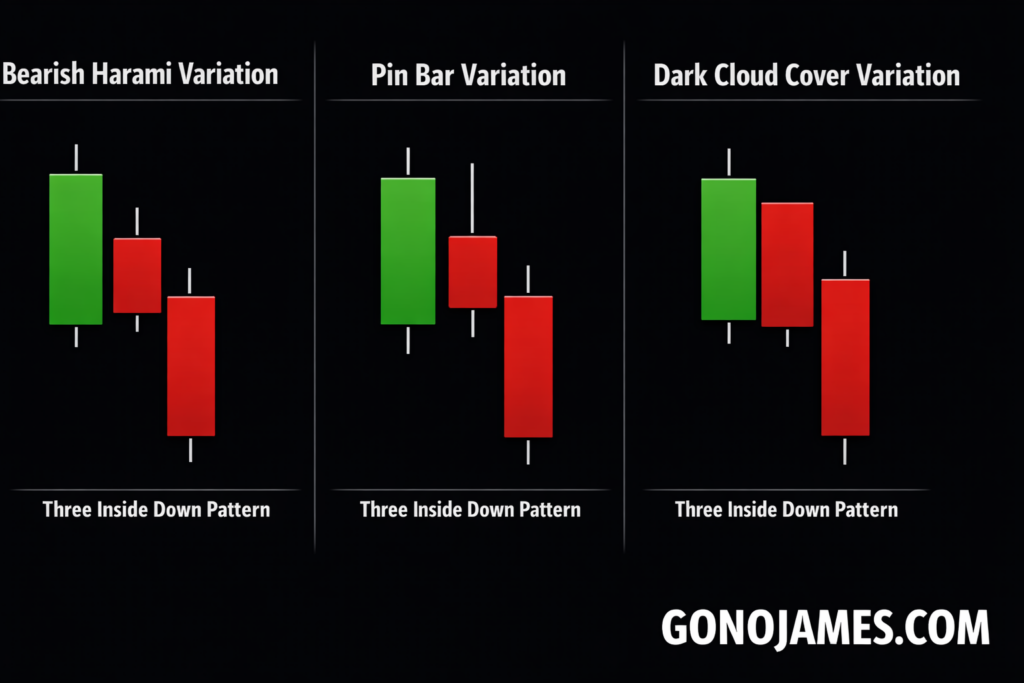

Like many Japanese candlestick patterns, the Three Inside Down can appear in different variations. These variations still carry bearish signals but may have slight structural differences.

Bearish Harami Variation

In this variation, the first two candles form a Bearish Harami pattern. The second candle is smaller and contained within the first candle’s body. The third candle then confirms the bearish reversal by closing lower.

Pin Bar Variation

Sometimes, the second candle appears as a Pin Bar with a long upper wick. This indicates strong rejection at higher prices and suggests that sellers are stepping in. When followed by a bearish third candle, the pattern becomes a reliable sell signal.

Dark Cloud Cover Variation

Another variation occurs when the first two candles form a Dark Cloud Cover pattern. In this case, the second candle closes deep into the first candle’s body, signaling strong selling pressure. The third candle then confirms the bearish trend.

Each of these variations reflects the same underlying principle: buyers are losing control and sellers are taking over.

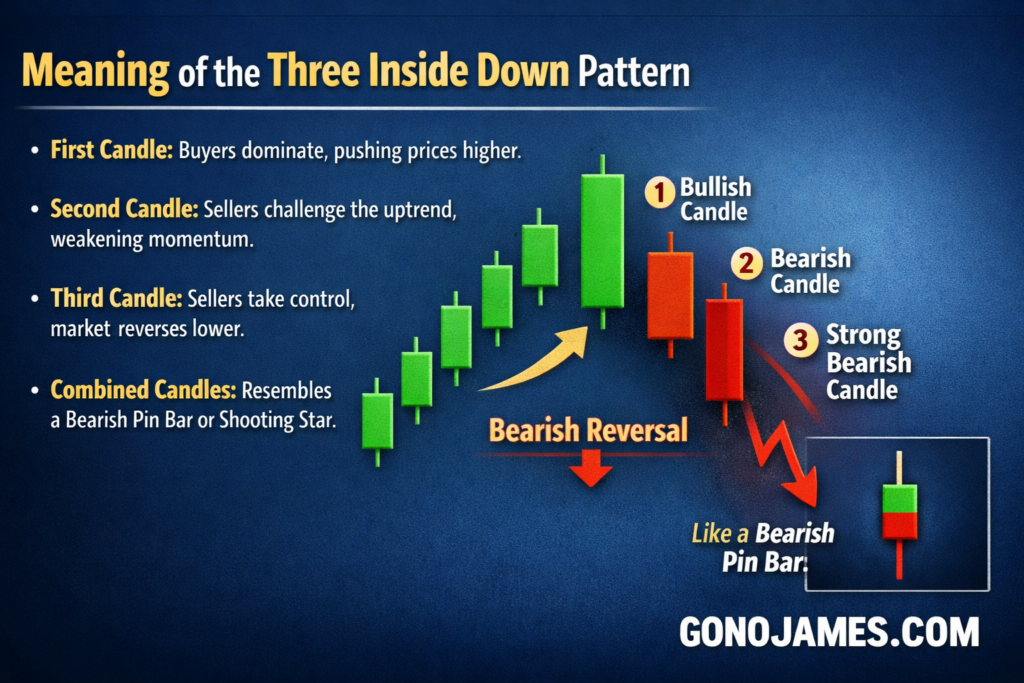

Meaning of the Three Inside Down Pattern

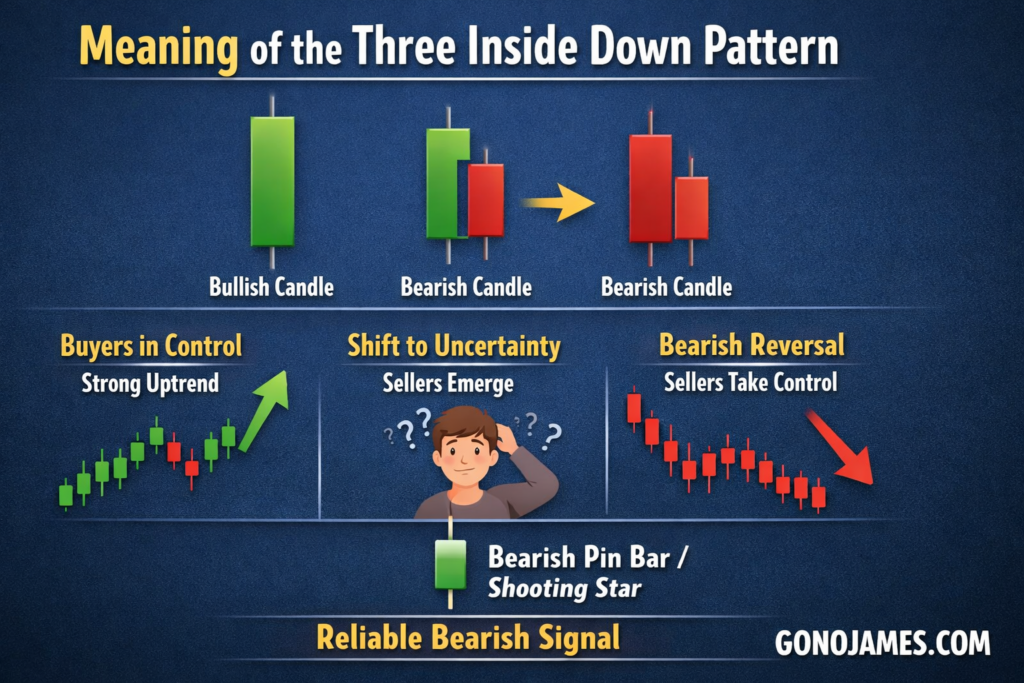

The Three Inside Down pattern represents a shift in market psychology. It shows the transition from bullish dominance to bearish control. Understanding this psychological shift can help traders make better decisions.

During the first candle, buyers dominate the market and push prices higher. Confidence among buyers remains strong. However, during the second candle, sellers begin to challenge the uptrend. This creates uncertainty and weakens bullish momentum.

By the time the third candle forms, sellers have taken full control. The market confirms the bearish reversal as prices close lower. This sequence of events explains why the Three Inside Down is considered a reliable bearish signal.

When combining the three candles of this pattern, traders often notice that it resembles a bearish pin bar or shooting star pattern. This further reinforces its reliability as a bearish reversal signal.

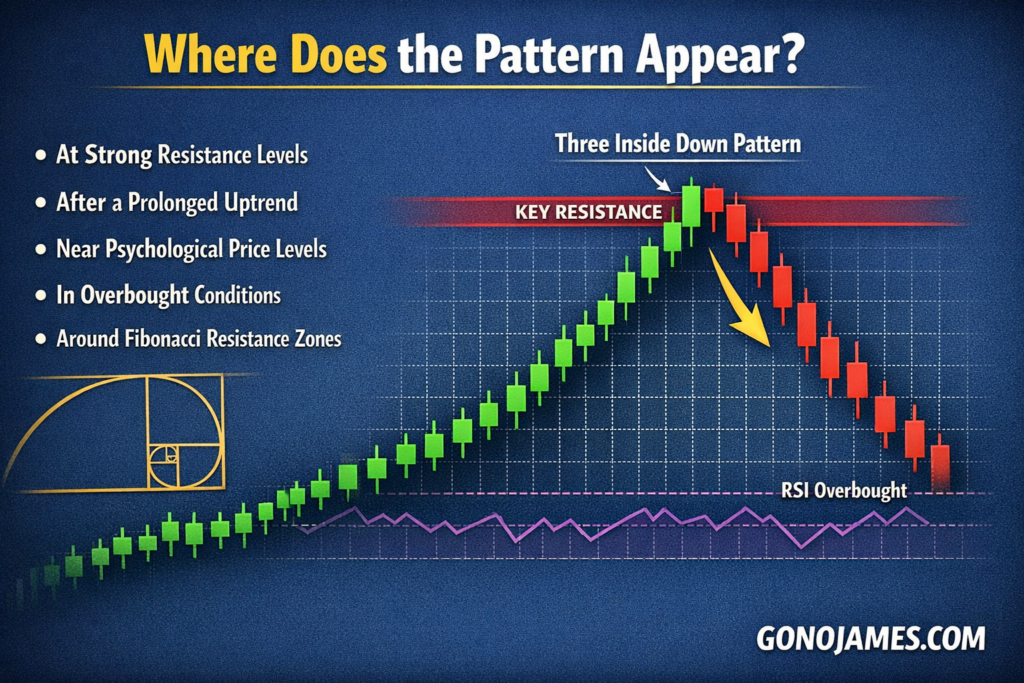

Where Does the Pattern Appear?

The Three Inside Down pattern usually appears at the top of an uptrend or after a prolonged bullish movement. It is most effective when it forms at key resistance levels or in overbought market conditions.

Traders should pay close attention when this pattern appears in the following areas:

- At strong resistance levels

- After a prolonged uptrend

- Near psychological price levels

- In overbought market conditions

- Around Fibonacci resistance zones

When the pattern forms in these areas, the probability of a successful bearish reversal increases significantly.

How to Trade Forex with the Three Inside Down Pattern

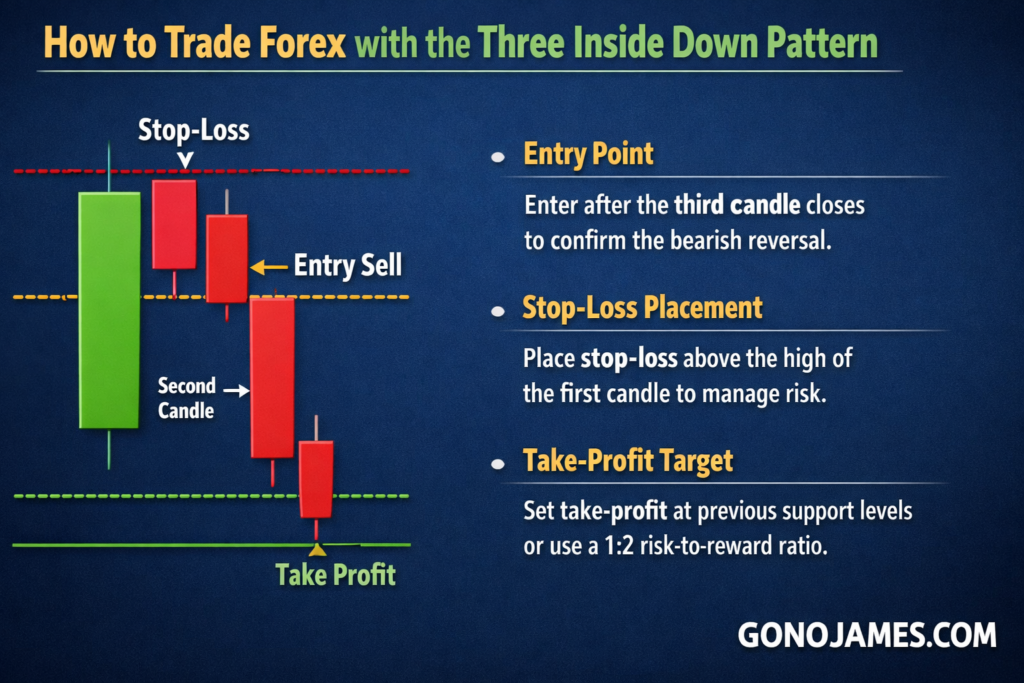

Trading with the Three Inside Down pattern can be highly effective if done correctly. Since this is a bearish reversal signal, traders should focus only on sell opportunities when the pattern appears.

Entry Point

The best entry point is immediately after the third candle closes. This confirms that the pattern has formed completely and that the bearish reversal is likely underway.

Stop-Loss Placement

Place the stop-loss at the highest price level before the market turns down and forms the pattern. This is usually above the high of the first candle. Setting a proper stop-loss helps manage risk and protect your trading capital.

Take-Profit Target

The take-profit level should be placed at previous support levels. These are areas where price has historically reversed or consolidated. You can also use a risk-to-reward ratio of at least 1:2 to ensure consistent profitability.

Tips for Better Trading Results

To improve accuracy when trading the Three Inside Down pattern, consider combining it with other technical indicators and tools:

- Support and resistance levels

- Moving averages

- RSI (Relative Strength Index)

- MACD indicator

- Trendlines

Using multiple confirmations helps filter out false signals and increases the probability of successful trades.

Conclusion

The Three Inside Down candlestick pattern is a powerful bearish reversal signal that every Forex trader should understand. This three-candle formation clearly reflects a shift in market control from buyers to sellers and often appears at the top of an uptrend.

By learning how to identify its structure, recognize its variations, and apply proper trading strategies, traders can use this pattern to place precise sell orders and improve overall trading performance.

Mastering the Three Inside Down pattern will not only enhance your technical analysis skills but also help you make smarter trading decisions in the Forex market. With practice and proper risk management, this pattern can become a valuable tool in your trading strategy.