In the world of Forex trading, price action remains one of the most powerful and reliable methods for identifying high-probability trade opportunities. Among all candlestick patterns used by professional traders, the Bullish Engulfing candlestick pattern stands out as one of the most effective bullish reversal signals in technical analysis.

This pattern is simple to recognize yet extremely powerful when used correctly. It reflects a strong shift in market sentiment from bearish to bullish and often appears at key turning points in the market.

Whether you are a beginner or an advanced Forex trader, mastering the Bullish Engulfing pattern can significantly improve your trading accuracy, timing, and profitability. In this comprehensive guide, you will learn everything you need to know about the Bullish Engulfing candlestick pattern, including its structure, psychology, best trading strategies, entry and exit rules, and professional tips to maximize profits.

If used properly, this single pattern can transform the way you trade Forex.

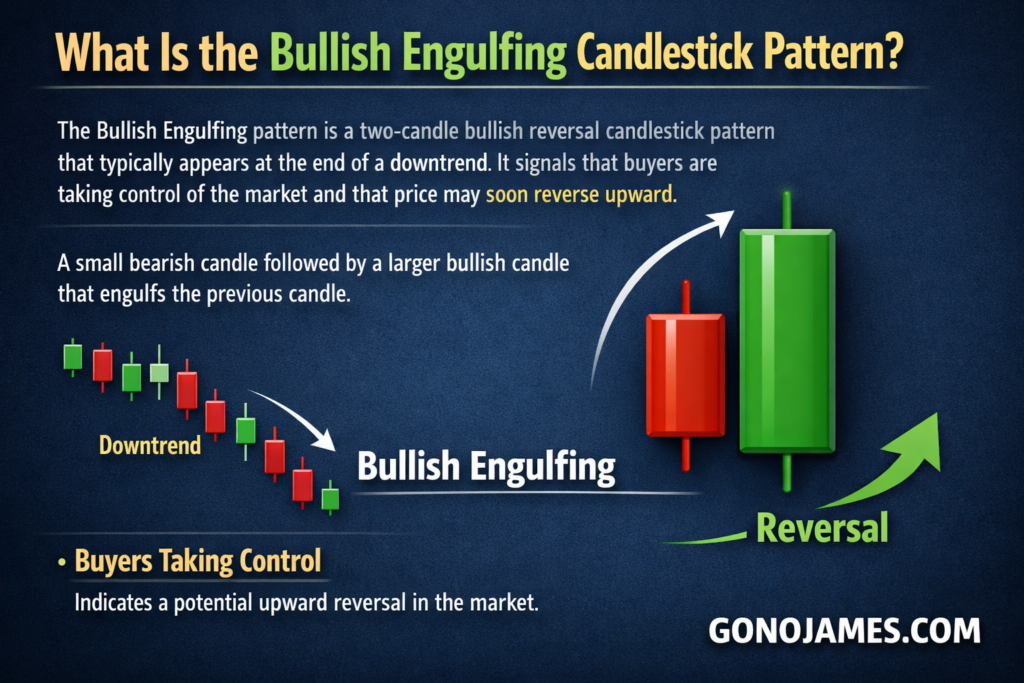

What Is the Bullish Engulfing Candlestick Pattern?

The Bullish Engulfing pattern is a two-candle bullish reversal candlestick pattern that typically appears at the end of a downtrend. It signals that buyers are taking control of the market and that price may soon reverse upward.

This pattern forms when a small bearish candle is immediately followed by a larger bullish candle that completely engulfs the body of the previous candle.

In simple terms, the second candle “swallows” the first candle, showing strong buying momentum and a shift in market control from sellers to buyers.

When traders see this pattern forming after a downtrend, they often interpret it as a sign that the market is preparing to move upward.

Structure of the Bullish Engulfing Pattern

To trade this pattern successfully, you must first understand its structure and characteristics.

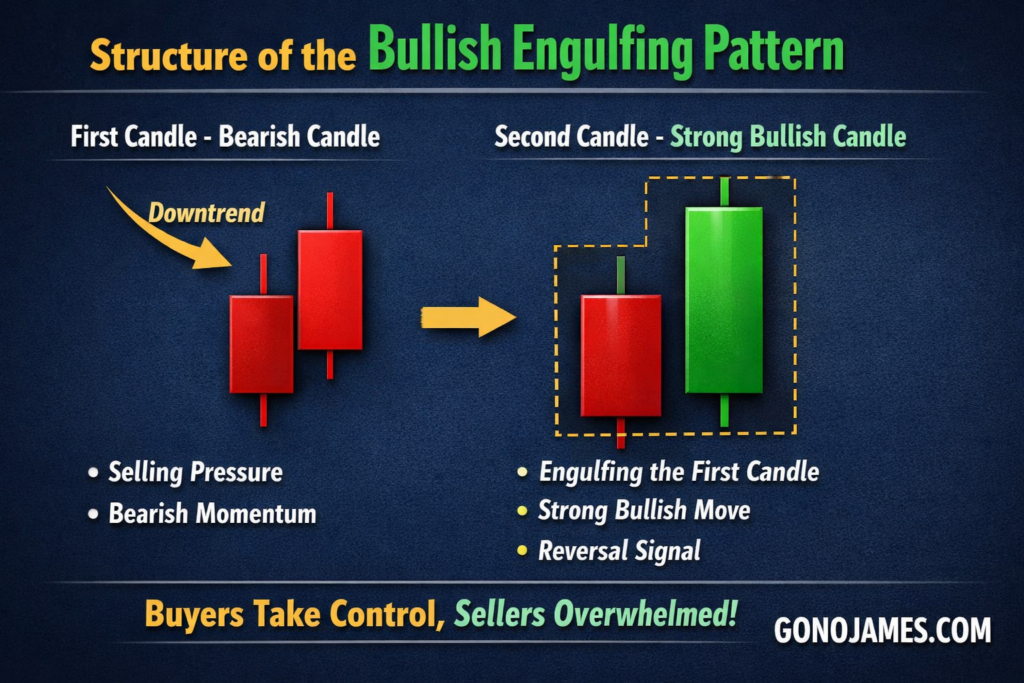

First Candle – Bearish Candle

The first candle in the pattern is a bearish (red) candle.

It represents continued selling pressure and confirms that the market is in a downtrend. Sellers are still in control at this stage, pushing prices lower and maintaining bearish momentum.

However, this candle also sets the stage for a potential reversal.

Second Candle – Strong Bullish Candle

The second candle is a strong bullish (green) candle that completely engulfs the body of the first candle.

This candle opens lower or near the close of the first candle and then moves strongly upward, closing above the previous candle’s open.

This shows that buyers have stepped into the market with strong momentum and have completely overwhelmed the sellers.

The engulfing effect signals a shift in power from sellers to buyers, which is why this pattern is considered a bullish reversal signal.

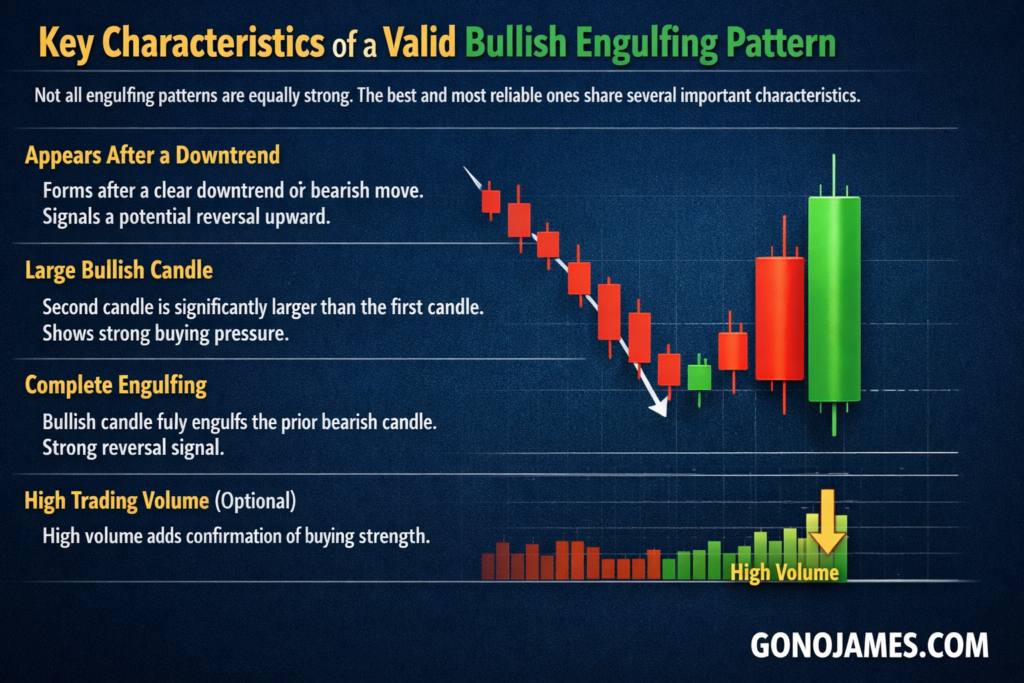

Key Characteristics of a Valid Bullish Engulfing Pattern

Not all engulfing patterns are equally strong. The best and most reliable ones share several important characteristics.

Appears After a Downtrend

The Bullish Engulfing pattern is most powerful when it forms after a clear downtrend or bearish move. This indicates that the market may be ready to reverse upward.

Large Bullish Candle

The second candle should be significantly larger than the first candle. A strong bullish candle indicates aggressive buying pressure and increases the reliability of the signal.

Complete Engulfing

The body of the bullish candle should fully engulf the body of the previous bearish candle. The larger the engulfing candle, the stronger the signal.

High Trading Volume (Optional)

If the Bullish Engulfing pattern forms with high volume, it adds further confirmation that buyers are entering the market strongly.

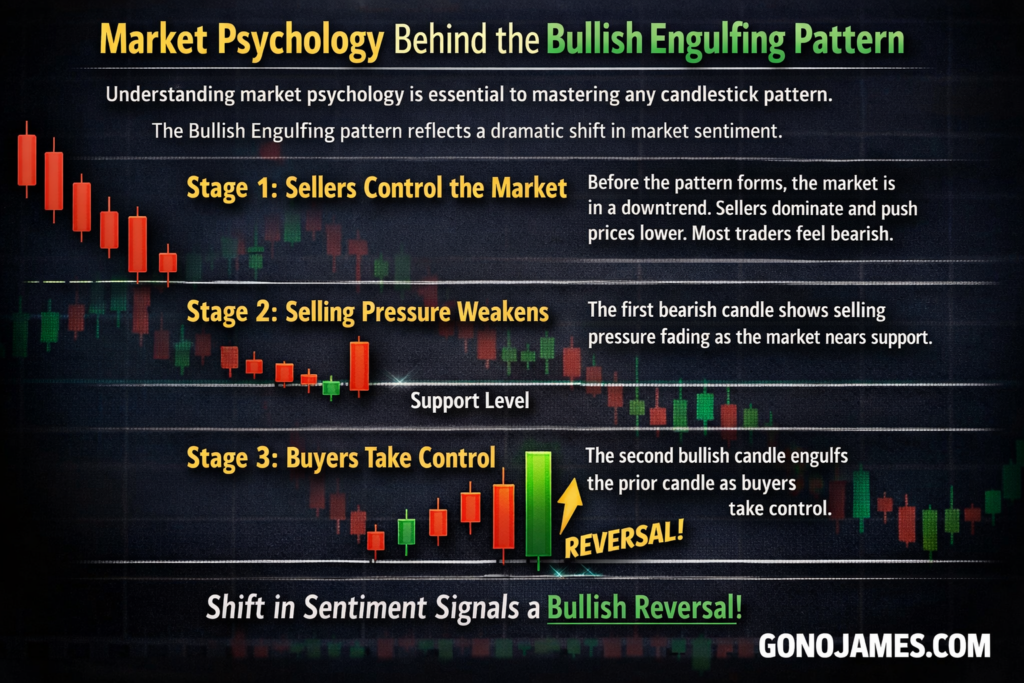

Market Psychology Behind the Bullish Engulfing Pattern

Understanding market psychology is essential to mastering any candlestick pattern.

The Bullish Engulfing pattern reflects a dramatic shift in market sentiment.

Stage 1: Sellers Control the Market

Before the pattern forms, the market is in a downtrend. Sellers dominate and push prices lower. Most traders feel bearish and expect the price to continue falling.

Stage 2: Selling Pressure Weakens

The first bearish candle shows that sellers are still active. However, selling pressure begins to weaken as the market approaches support or a demand zone.

Stage 3: Buyers Take Control

The second bullish candle shows strong buying pressure entering the market. Buyers push the price upward aggressively, completely engulfing the previous candle.

This sudden shift signals that buyers are now in control and that a bullish reversal may begin.

Why the Bullish Engulfing Pattern Is So Powerful

Professional traders rely on the Bullish Engulfing pattern because it provides several advantages:

- Clear and easy to identify

- Strong reversal signal

- Works in all timeframes

- Effective in Forex, stocks, and crypto

- Can be combined with support/resistance

- High probability when confirmed

When used correctly, it can help traders enter trades early in a new uptrend.

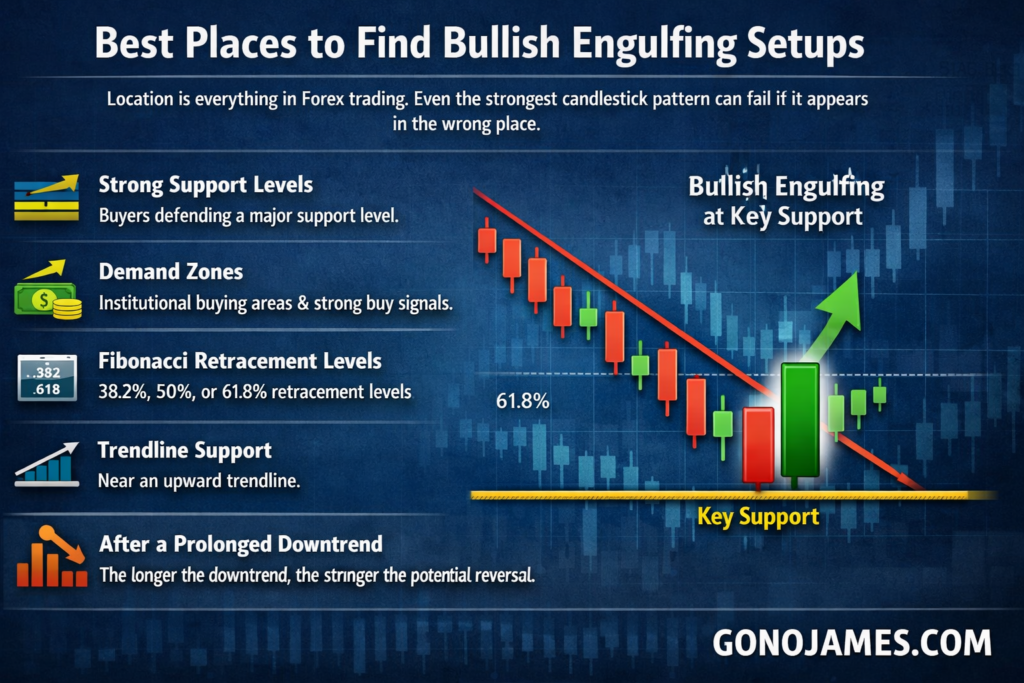

Best Places to Find Bullish Engulfing Setups

Location is everything in Forex trading. Even the strongest candlestick pattern can fail if it appears in the wrong place.

The Bullish Engulfing pattern works best when it forms at key support levels or areas where buyers are likely to step in.

Strong Support Levels

When the pattern forms at a major support level, it indicates that buyers are defending that price zone.

Demand Zones

Demand zones are areas where institutional buyers previously entered the market. A Bullish Engulfing pattern at these levels is a strong buy signal.

Fibonacci Retracement Levels

Look for the pattern around 38.2%, 50%, or 61.8% Fibonacci retracement levels.

Trendline Support

If the pattern forms near an upward trendline, it increases the probability of a bullish move.

After a Prolonged Downtrend

The longer the downtrend, the stronger the potential reversal.

How to Trade the Bullish Engulfing Pattern in Forex

Now let’s discuss how to actually trade this powerful pattern.

Step 1: Identify the Trend

Confirm that the market is in a downtrend or pullback. The Bullish Engulfing pattern works best as a reversal signal.

Step 2: Wait for the Pattern to Form

Look for a bearish candle followed by a strong bullish engulfing candle.

Do not enter the trade before the candle closes. Wait for confirmation.

Step 3: Confirm with Support or Indicator

Use additional confirmation such as:

- Support level

- RSI oversold

- Moving average support

- Fibonacci level

Step 4: Entry Point

Enter a buy trade at the close of the bullish engulfing candle or on the next candle open.

More conservative traders wait for a small pullback before entering.

Step 5: Stop Loss Placement

Place your stop loss below the low of the engulfing candle.

This protects your trade if the pattern fails.

Step 6: Take Profit Targets

You can set take profit at:

- Previous resistance level

- 1:2 or 1:3 risk-to-reward ratio

- Next key supply zone

Always maintain proper risk management.

Bullish Engulfing Trading Strategy (Simple & Effective)

Here is a simple strategy used by many professional traders.

Timeframe

Best timeframes: 15M, 1H, 4H, Daily

Indicators

- Support & resistance

- 50 EMA or 200 EMA

- RSI (optional)

Rules

- Market in downtrend

- Price reaches support

- Bullish Engulfing pattern forms

- RSI oversold (optional)

- Enter buy

- Stop below candle low

- Target next resistance

This strategy works especially well in trending markets.

Common Mistakes to Avoid

Many traders lose money by using the pattern incorrectly.

Trading Without Confirmation

Never trade the pattern alone without support or confluence.

Ignoring Trend Direction

Avoid using it in sideways or choppy markets.

Entering Too Early

Wait for the candle to close before entering.

Poor Risk Management

Always use stop loss and proper lot size.

Trading in the Middle of Nowhere

The pattern is strongest at key levels, not random areas.

Advanced Tips From Professional Traders

If you want to trade like a professional, follow these tips:

Combine With Support and Resistance

This increases win rate significantly.

Use Multiple Timeframe Analysis

Check higher timeframe trend before entering.

Look for Strong Momentum

A large bullish candle with strong momentum is best.

Trade During Active Sessions

London and New York sessions provide best volatility.

Risk Management Is Key

Never risk more than 1–2% per trade.

Bullish Engulfing vs Bearish Engulfing

Understanding the difference helps improve pattern recognition.

Bullish Engulfing: Signals upward reversal

Bearish Engulfing: Signals downward reversal

Both are powerful but must be used in correct market context.

Why Price Action Traders Love This Pattern

Price action traders prefer clean charts without too many indicators. The Bullish Engulfing pattern provides:

- Clear entry signal

- Strong reversal confirmation

- Easy stop loss placement

- High reward potential

This makes it one of the most trusted patterns in Forex trading.

Final Thoughts

The Bullish Engulfing candlestick pattern is one of the most powerful and reliable bullish reversal signals in Forex trading. When used correctly, it can help traders identify high-probability buying opportunities and enter trades at the beginning of new uptrends.

However, like any trading strategy, it should never be used alone. Combining this pattern with support and resistance, trend analysis, and proper risk management will greatly increase your chances of success.

Mastering the Bullish Engulfing pattern takes practice, patience, and discipline. Study charts daily, backtest your strategy, and always follow a trading plan.

With consistency and proper execution, this single candlestick pattern can become one of your most profitable tools in the Forex market.

Start practicing today, and you will soon be able to spot powerful reversal opportunities with confidence.