The world of Forex trading is driven by price movement, trader psychology, and technical signals. Among the most reliable and widely used tools in technical analysis are candlestick patterns. These patterns provide valuable insight into market sentiment and potential future price direction.

One of the most powerful bearish reversal patterns every trader should understand is the Evening Star candlestick pattern. This pattern helps traders identify potential market tops and forecast upcoming price declines with high probability.

In this complete guide, you will learn everything about the Evening Star candlestick pattern — what it is, how to recognize it, where it appears, its meaning, variations, and the most effective ways to trade it in Forex.

Whether you are a beginner or an experienced trader, mastering this pattern can significantly improve your trading accuracy and profitability.

What Is the Evening Star Candlestick Pattern?

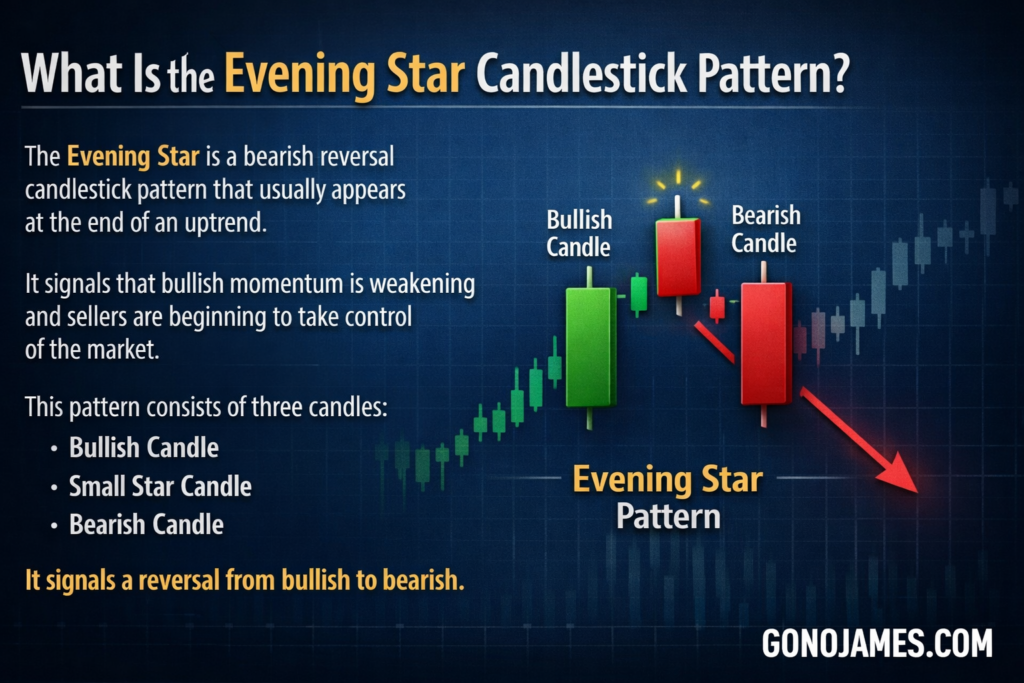

The Evening Star is a bearish reversal candlestick pattern that usually appears at the end of an uptrend. It signals that bullish momentum is weakening and sellers are beginning to take control of the market.

This pattern consists of three candles that form a specific structure. When these candles appear together in the right context, they create a strong signal that the market may soon reverse downward.

The Evening Star is considered one of the most reliable reversal patterns in Forex trading because it clearly shows the transition from bullish to bearish market sentiment.

Structure and Characteristics of the Evening Star Pattern

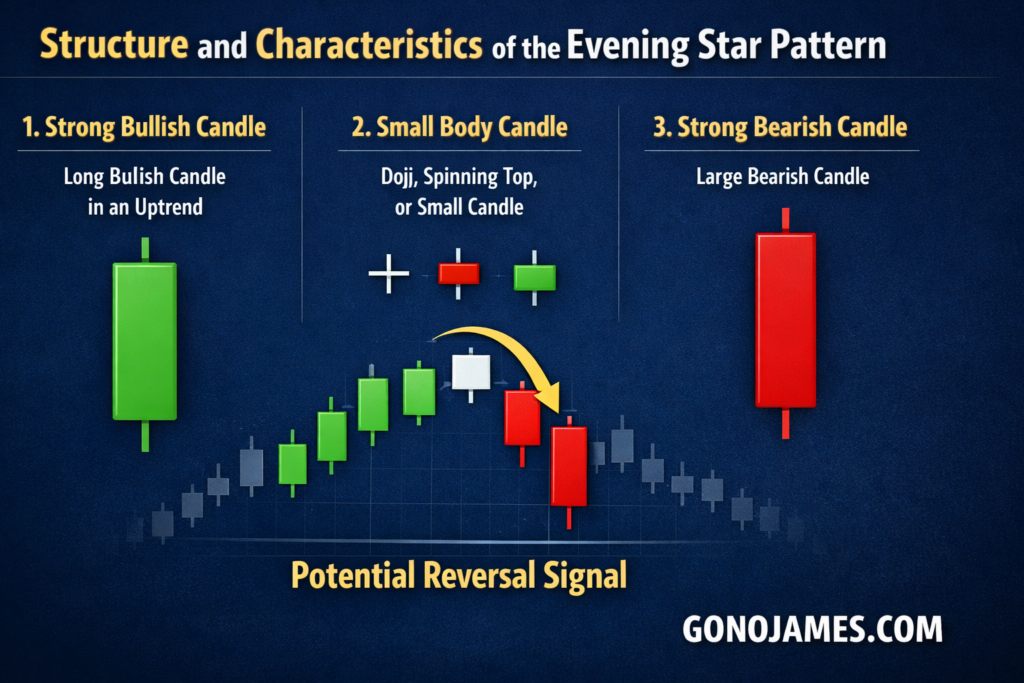

To identify an Evening Star candlestick pattern correctly, traders must understand its three-candle structure.

First Candle – Strong Bullish Candle

The first candle in the pattern is a long bullish candle (green).

This candle represents strong buying pressure and confirms that the market is currently in an uptrend.

Buyers are fully in control during this phase and continue pushing the price higher.

Second Candle – Small Body Candle

The second candle is a small-bodied candle such as a:

- Doji

- Spinning top

- Small bullish or bearish candle

The color of this candle does not matter. What matters is that its body is small.

This candle represents indecision in the market.

Buying pressure begins to weaken and sellers slowly start entering the market.

It signals that the uptrend may be losing strength.

Third Candle – Strong Bearish Candle

The third candle is a strong bearish candle.

Its body should be at least 50% of the first bullish candle.

This candle confirms that sellers have taken control of the market.

It shows strong rejection of higher prices and signals a potential reversal to a downtrend.

Meaning of the Evening Star Pattern

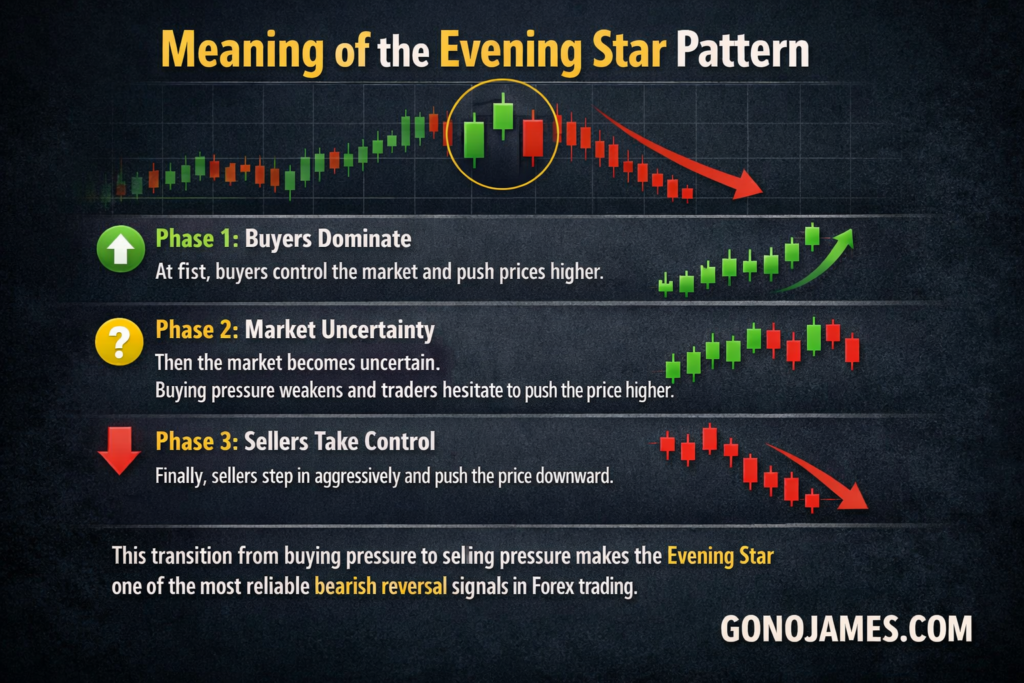

The Evening Star pattern reflects a shift in market psychology from bullish to bearish.

Phase 1: Buyers Dominate

At first, buyers control the market and push prices higher.

Phase 2: Market Uncertainty

Then the market becomes uncertain.

Buying pressure weakens and traders hesitate to push the price higher.

Phase 3: Sellers Take Control

Finally, sellers step in aggressively and push the price downward.

This transition from buying pressure to selling pressure makes the Evening Star one of the most reliable bearish reversal signals in Forex trading.

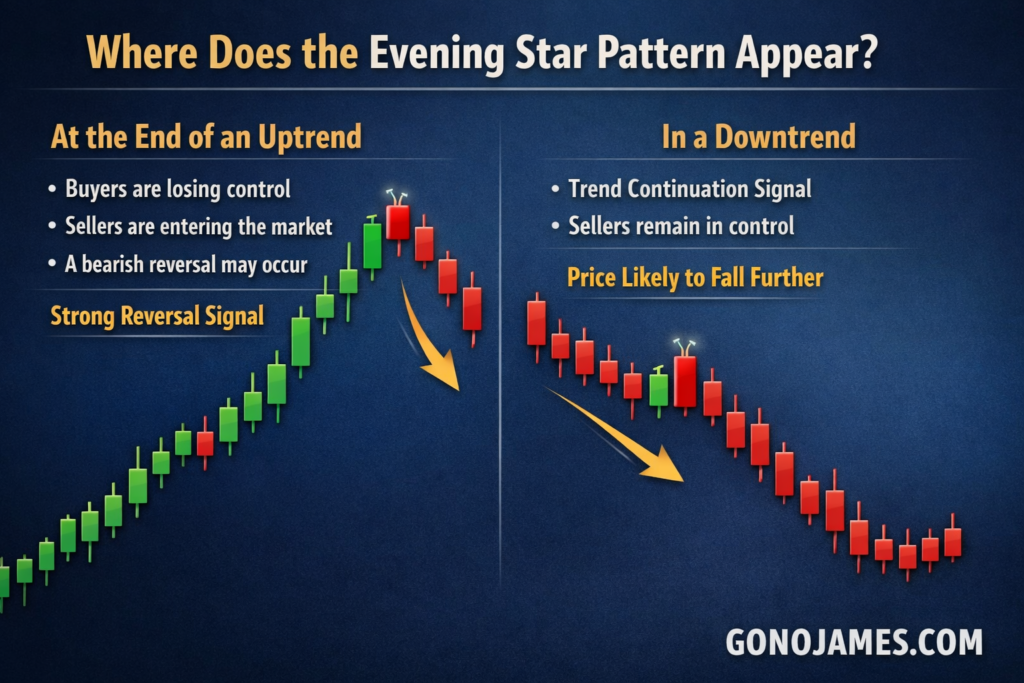

Where Does the Evening Star Pattern Appear?

The Evening Star pattern can appear in different market conditions, but its meaning depends on location.

At the End of an Uptrend

This is the most common and most powerful location.

When the Evening Star appears at the top of an uptrend, it signals:

- Buyers are losing control

- Sellers are entering the market

- A bearish reversal may occur

This is considered a strong signal that the price may soon decline.

In a Downtrend

Sometimes the Evening Star appears during a downtrend.

In this case, it signals trend continuation rather than reversal.

It indicates that sellers remain dominant and the price may continue falling.

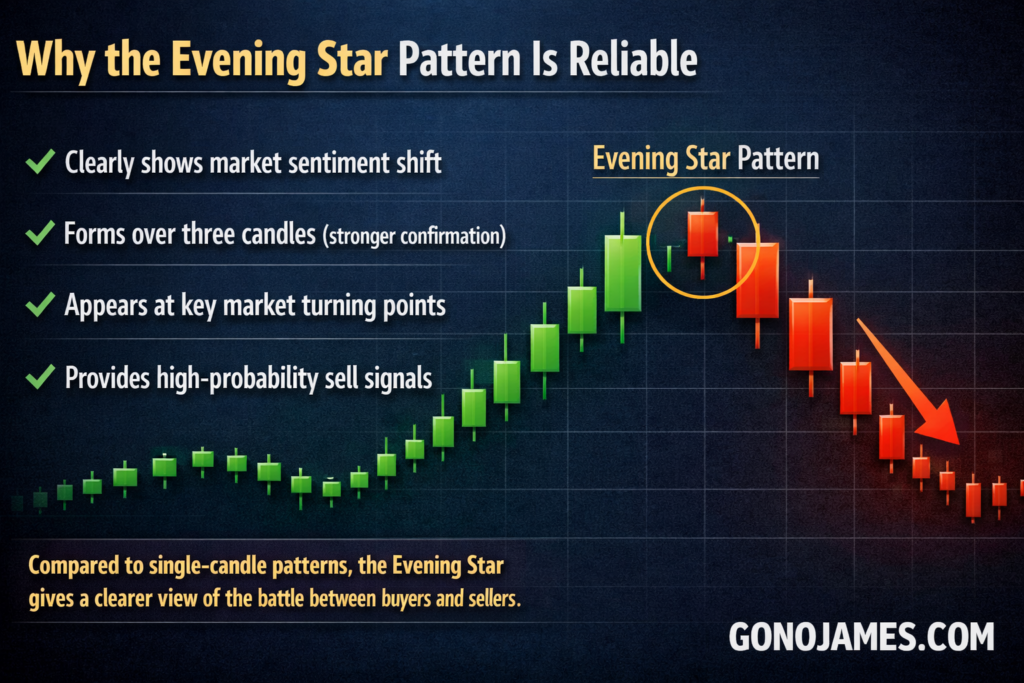

Why the Evening Star Pattern Is Reliable

The Evening Star is trusted by many professional traders because it:

- Clearly shows market sentiment shift

- Forms over three candles (stronger confirmation)

- Appears at key market turning points

- Provides high-probability sell signals

Compared to single-candle patterns, the Evening Star gives a clearer view of the battle between buyers and sellers.

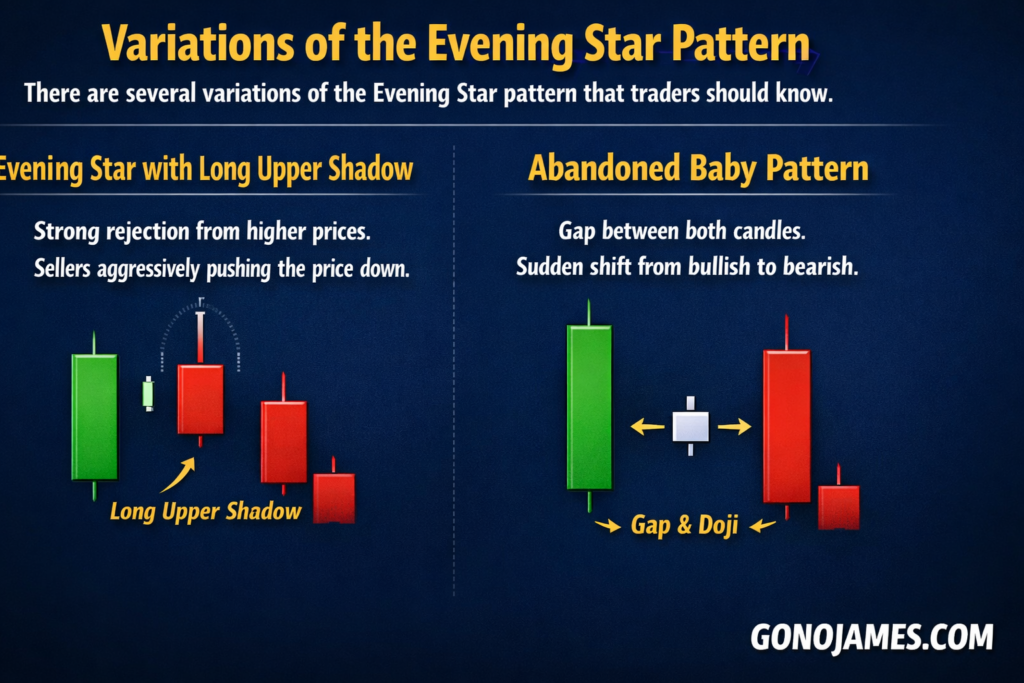

Variations of the Evening Star Pattern

There are several variations of the Evening Star pattern that traders should know.

Evening Star with Long Upper Shadow

If the second candle has a long upper wick, it shows strong rejection from higher prices.

This means sellers are aggressively pushing the price down whenever it rises.

This variation often has higher accuracy.

Abandoned Baby Pattern

When the second candle gaps away from both the first and third candles, the pattern becomes an Abandoned Baby.

This variation is rare but extremely powerful.

It signals a strong and sudden shift from bullish to bearish sentiment.

How to Trade the Evening Star Pattern in Forex

The Evening Star provides a strong bearish signal.

Therefore, traders should only consider SELL trades when this pattern appears.

Never open BUY trades based on the Evening Star pattern.

Below are the most effective trading strategies using the Evening Star.

Strategy 1: Sell at Market Tops

When the Evening Star appears at the top of an uptrend, it often signals a sharp price drop.

This is one of the best opportunities to open a SELL trade.

Entry Point

Open a SELL trade as soon as the third candle closes and completes the pattern.

Stop-Loss

Place stop-loss above the highest point of the pattern.

This protects your trade if the market unexpectedly moves upward.

Take-Profit

Set take-profit at previous support levels.

Price often falls to these levels after a bearish reversal.

Strategy 2: Trade With the Trend

This strategy works best when the overall market trend is already bearish.

You need two confirmations:

- Market is in a downtrend

- Evening Star pattern appears

Entry Point

Enter SELL after the pattern is completed.

Stop-Loss

Place stop-loss at the nearest resistance level.

Take-Profit

Set take-profit at previous support zones.

Trading with the trend increases your probability of success.

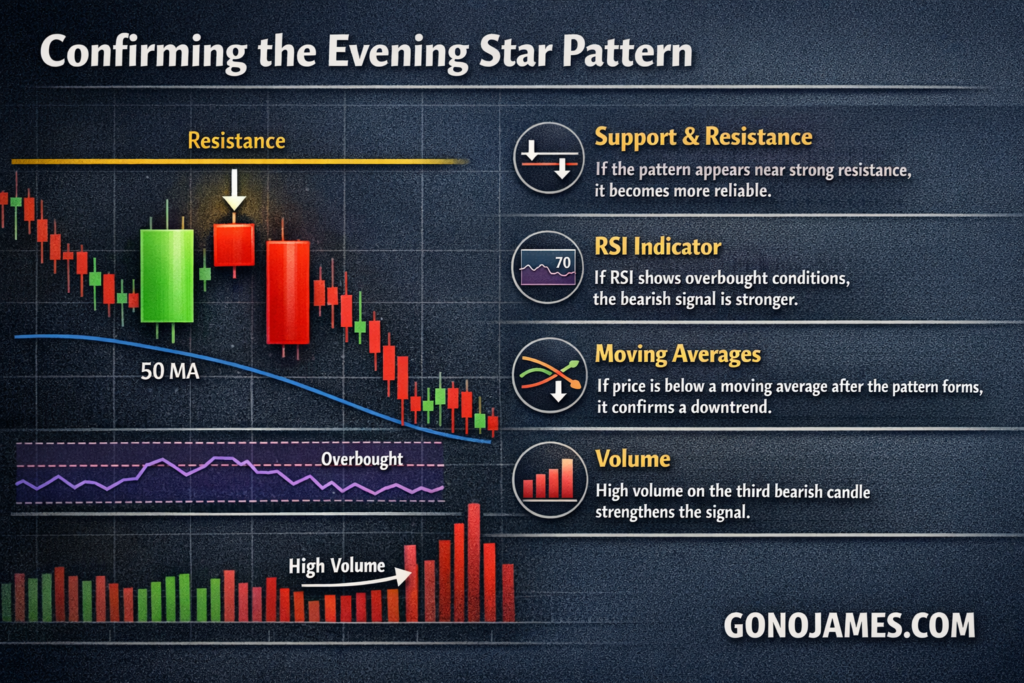

Confirming the Evening Star Pattern

Professional traders rarely rely on a single signal.

They combine the Evening Star pattern with other indicators.

Use Support and Resistance

If the pattern appears near strong resistance, it becomes more reliable.

Use RSI Indicator

If RSI shows overbought conditions, the bearish signal is stronger.

Use Moving Averages

If price is below a moving average after the pattern forms, it confirms a downtrend.

Use Volume

High volume on the third bearish candle strengthens the signal.

Common Mistakes to Avoid

Many traders misuse the Evening Star pattern.

Avoid these mistakes to improve your results.

Trading Without Confirmation

Always wait for the pattern to fully form.

Ignoring Market Context

Do not trade the pattern in random locations.

It works best at resistance or trend tops.

No Stop-Loss

Never trade without stop-loss protection.

Overtrading

Focus only on high-quality setups.

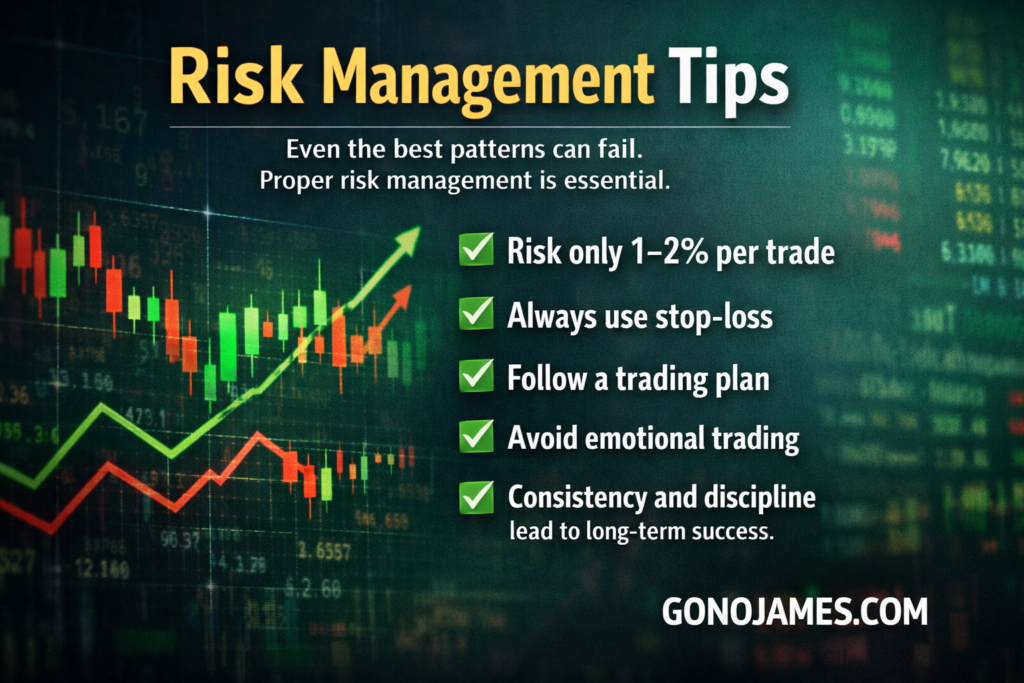

Risk Management Tips

Even the best patterns can fail.

Proper risk management is essential.

- Risk only 1–2% per trade

- Always use stop-loss

- Follow a trading plan

- Avoid emotional trading

Consistency and discipline lead to long-term success.

Why You Should Master the Evening Star Pattern

Learning the Evening Star pattern gives traders several advantages:

- Helps identify market tops

- Provides strong sell signals

- Improves timing of trades

- Works in all timeframes

- Suitable for beginners and professionals

This pattern is a must-know for anyone serious about Forex trading.

Practice on a Demo Account First

Before trading with real money, practice on a demo account.

This allows you to:

- Recognize patterns easily

- Test strategies safely

- Build confidence

- Improve accuracy

Once you master the pattern, you can apply it in live trading.

Final Thoughts

The Evening Star candlestick pattern is one of the most powerful bearish reversal signals in Forex trading. It clearly shows the shift from bullish to bearish market sentiment and helps traders identify high-probability selling opportunities.

By understanding its structure, meaning, and proper trading strategies, you can significantly improve your trading performance.

Remember to always combine the Evening Star with:

- Support and resistance

- Trend analysis

- Technical indicators

- Proper risk management

Mastering this pattern can help you trade more confidently and consistently in the Forex market.

Start practicing today on a demo account and make the Evening Star pattern a powerful weapon in your trading strategy.